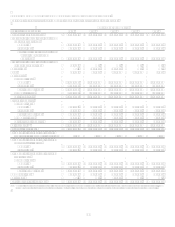

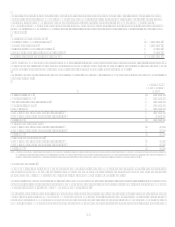

Capital One 2007 Annual Report Download - page 88

Download and view the complete annual report

Please find page 88 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.66

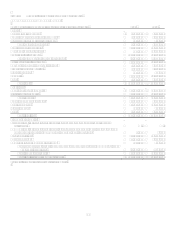

Note 1

Summary of Significant Accounting Policies

Business

Capital One Financial Corporation (the Corporation) is a diversified financial services company whose banking and non-banking

subsidiaries market a variety of financial products and services. The Corporations principal subsidiaries are:

Capital One Bank (COB) which currently offers credit and debit card products, other lending products and deposit

products.

Capital One, National Association (CONA) which offers a broad spectrum of banking products and financial services to

consumers, small businesses and commercial clients.

Another subsidiary of the Corporation, Superior Savings of New England, N.A. (Superior) focuses on telephonic and media-based

generation of deposits.

As of January 1, 2008, Capital One Auto Finance (COAF) moved from a principal subsidiary of the Corporation to become a direct

operating subsidiary of CONA. COAF offers automobile and other motor vehicle financing products.

During 2007, Capital One F.S.B. and North Fork Bank merged with and into CONA.

In the third quarter of 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint Mortgage (GreenPoint), an operating subsidiary of CONA. Additional information can be found din Item 8 Financial

Statements and Supplementary DataNotes to the Consolidated Financial StatementsNote 2Discontinued Operations.

The Corporation and its subsidiaries are hereafter collectively referred to as the Company.

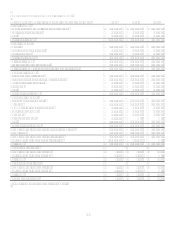

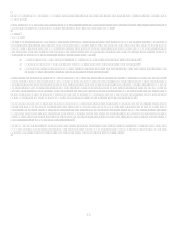

Basis of Presentation

The accompanying Consolidated Financial Statements have been prepared in accordance with accounting principles generally

accepted in the United States (GAAP) that require management to make estimates and assumptions that affect the amounts reported

in the financial statements and accompanying notes. Actual results could differ from these estimates.

The Consolidated Financial Statements include the accounts of the Capital One Financial Corporation and its majority owned

subsidiaries. Investments in unconsolidated entities where we have the ability to exercise significant influence over the operations of

the investee are accounted for using the equity method of accounting. This includes interests in variable interest entities (VIEs)

where we are not the primary beneficiary. Investments not meeting the criteria for equity method accounting are accounted for using

the cost method of accounting. Investments in unconsolidated entities are included in other assets, and our share of income or loss is

recorded in other non-interest income. All significant intercompany balances and transactions have been eliminated. Certain prior

years amounts have been reclassified to conform to the 2007 presentation. All amounts in the following notes, excluding per share

data, are presented in thousands.

The following is a summary of the significant accounting policies used in preparation of the accompanying Consolidated Financial

Statements.

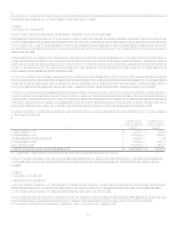

Special Purpose Entities and Variable Interest Entities

Special purpose entities are broadly defined as legal entities structured for a particular purpose. The Company uses special purpose

entities primarily to conduct off-balance sheet securitization activities. Special purpose entities that meet the criteria for Qualifying

Special Purpose Entities (QSPE) as defined in Statement of Financial Accounting Standard No. 140, Accounting for Transfers and

Servicing of Financial Assets and Extinguishments of Liabilities, are not required to be consolidated. Special purpose entities that are

not QSPEs are considered for consolidation in accordance with Financial Accounting Standards Board Interpretation No. 46 (Revised

2003), Consolidation of Variable Interest Entities.

In general, a variable interest entity (VIE) is a special purpose entity formed as a corporation, partnership, limited liability

corporation, or any other legal structure used to conduct activities or hold assets. A VIE often holds financial assets, including loans or

receivables, real estate or other property.

The Company consolidates a VIE if the Company is considered to be its primary beneficiary. The primary beneficiary is subject to

absorbing the majority of the expected losses from the VIEs activities, is entitled to receive a majority of the entities residual returns,

or both. See Note 9 for additional detail related to non-consolidated VIEs.