Capital One 2007 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

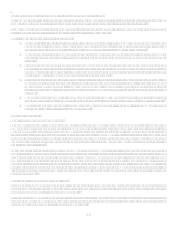

40

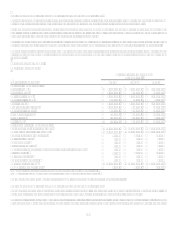

higher percentage of lower yielding loans than the Hibernia portfolio. Net interest margins on deposits are higher in 2007 than in 2006

because of the addition of the lower cost North Fork deposit portfolio to the existing Hibernia and Capital One deposits.

The provision for loan losses increased to $32.1 million in 2007 from $0.4 million in 2006. The increase is primarily the result of the

addition of the North Fork loan portfolios in 2007, offset by a $91.4 million reduction in the allowance for loan losses to conform the

allowance for loan losses methodology of the Local Banking segment to the Companys established methodology. In addition, during

2006, $25.7 million of allowance for loan losses previously established to cover expected losses in the portion of the loan portfolio

impacted by Hurricanes Katrina and Rita was no longer needed and these amounts reduced the overall provision expense in 2006.

Non-interest expenses were $2.2 billion in 2007, compared to $1.2 billion in 2006. The primary reason for the increase is the addition

of North Fork to the Local Banking segment results in 2007. In addition, during 2007 the Local Banking segment continued to incur

costs associated with the integration of Hibernia and North Fork. These activities progressed as planned during the year and all

Hibernia related integration activities were completed. In 2007, the Company opened 39 new banking locations across Louisiana, New

Jersey, New York, Texas and Virginia. The costs of operating these branches, including lease costs, depreciation and personnel, is

included in non-interest expense.

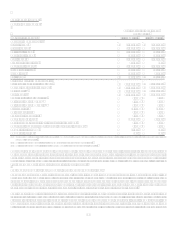

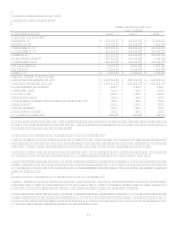

National Lending Segment

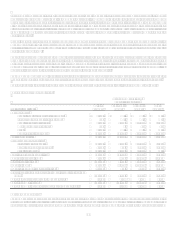

Table 3: National Lending

As of and for the Year Ended

December 31,

(Dollars in thousands) 2007 2006 2005

Earnings (Managed Basis)

Interest income $ 13,703,044 $ 12,088,876 $ 10,891,610

Interest expense 4,848,585 4,182,690 3,267,755

Net interest income 8,854,459 7,906,186 7,623,855

Non-interest income 5,012,099 4,524,152 4,364,164

Total revenue 13,866,558 12,430,338 11,988,019

Provision for loan losses 4,691,779 3,207,849 3,664,399

Non-interest expense 5,545,898 5,631,100 5,359,758

Income before taxes 3,628,881 3,591,389 2,963,862

Income taxes 1,247,073 1,260,518 1,036,415

Net income $ 2,381,808 $ 2,330,871 $ 1,927,447

Selected Metrics (Managed Basis)

Period end loans held for investment $ 106,508,443 $ 102,359,180 $ 89,222,031

Average loans held for investment $ 102,235,384 $ 95,396,391 $ 83,218,086

Total deposits $ 2,050,861 $ 2,383,902 $ 151,498

Net interest margin 8.66% 8.29% 9.16%

Revenue margin 13.56% 13.03% 14.41%

Risk adjusted margin 9.61% 9.79% 10.07%

Non-interest expense as a % of average loans held for investment 5.42% 5.90% 6.44%

Efficiency ratio 39.99% 45.30% 44.71%

Net charge-off rate 3.96% 3.24% 4.34%

30+ day delinquency rate 5.17% 4.09% 3.70%

Number of Total Accounts (000s) 48,537 49,374 48,790

The National Lending segment consists of three sub-segments: U.S. Card, Auto Finance and Global Financial Services. The National

Lending segment contributed $2.4 billion of net income during 2007, compared to $2.3 billion during 2006. At December 31 2007,

loans outstanding in the National Lending segment totaled $106.5 billion while deposits outstanding totaled $2.1 billion. Profits are

primarily generated from net interest income and past-due fees earned and deemed collectible from our loans, income earned on

securities, and non-interest income including the sale and servicing of loans and fee-based services to customers. Total revenue

increased 12% during 2007 primarily due to growth in the average managed loans held for investment portfolio of 7% and selective

pricing and fee changes following conversion of our cardholder system. Provision for loan and lease losses increased $1.5 billion, or

46%, during 2007, compared to 2006 due to normalization of credit following the unusually favorable credit environment in 2006,

selective pricing and fee policy moves in the U.S. Card sub-segment, the significant pull back from prime revolver marketing in the

U.S. Card sub-segment, continued elevated losses in the Auto Finance sub-segment, and from economic weakening consistent with

recently released economic indicators.