Capital One 2007 Annual Report Download - page 86

Download and view the complete annual report

Please find page 86 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

64

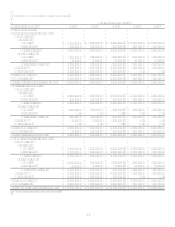

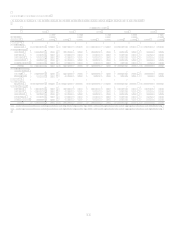

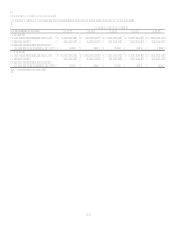

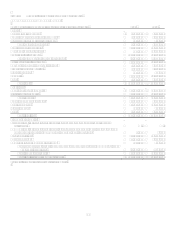

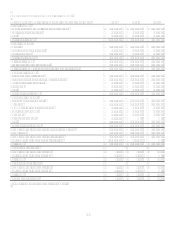

CONSOLIDATED STATEMENTS OF CHANGES IN STOCKHOLDERS EQUITY

Common Stock

(In Thousands, Except Per Share Data) Shares Amount

Paid-In

Capital,

Net

Retained

Earnings

Cumulative Other

Comprehensive

Income (Loss)

Treasury

Stock

Total

Stockholders

Equity

Balance, December 31, 2004 248,354,259 $ 2,484 $ 2,711,327 $ 5,596,372 $ 144,759 $ (66,753) $ 8,388,189

Comprehensive income:

Net income 1,809,147 1,809,147

Other comprehensive income, net of income tax:

Unrealized losses on securities, net of income tax benefit of $31,706 (54,876) (54,876)

Foreign currency translation adjustments (113,189) (113,189)

Unrealized gains in cash flow hedging instruments, net of income taxes of $21,373 29,435 29,435

Other comprehensive income (138,630) (138,630)

Comprehensive income 1,670,517

Cash dividends$.11 per share (27,504) (27,504)

Purchase of treasury stock (40,049) (40,049)

Issuances of common stock and restricted stock, net of forfeitures 11,059,437 110 761,371 761,481

Exercise of stock options and tax benefits of exercises and restricted stock vesting 10,489,976 105 506,897 507,002

Compensation expense for restricted stock awards and stock options 149,496 149,496

Adjustment to issuance of common stock for acquisition 32,882,772 329 2,710,623 2,710,952

Allocation of ESOP shares 8,830 8,830

Balance, December 31, 2005 302,786,444 3,028 6,848,544 7,378,015 6,129 (106,802) 14,128,914

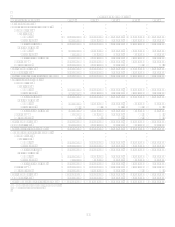

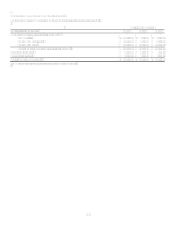

Comprehensive income:

Net income 2,414,493 2,414,493

Other comprehensive income, net of income tax:

Unrealized gains on securities, net of income taxes of $16,635 24,119 24,119

Recognition of additional minimum pension liability, net of income tax benefit of $1,025 (1,903) (1,903)

Foreign currency translation adjustments 246,066 246,066

Unrealized losses on cash flow hedging instruments, net of income tax benefit of $6,750 (13,573) (13,573)

Other comprehensive income 254,709 254.709

Comprehensive income 2,669,202

Adjustment to initially apply FASB Statement No. 158, net of income taxes of $2,876 5,342 5,342

Cash dividends$.11 per share (32,324) (32,324)

Purchase of treasury stock (21,615) (21,615)

Issuances of common stock and restricted stock, net of forfeitures 1,550,117 16 31,395 31,411

Exercise of stock options and tax benefits of exercises and restricted stock vesting 3,934,592 39 261,139 261,178

Compensation expense for restricted stock awards and stock options 180,261 180,261

Adjustment to issuance of common stock for acquisition 103,948,820 1,039 8,006,458 8,007,497

Allocation of ESOP shares 5,340 5,340

Balance, December 31, 2006 412,219,973 4,122 15,333,137 9,760,184 266,180 (128,417) 25,235,206

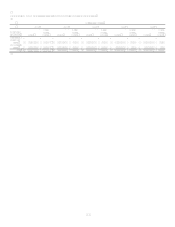

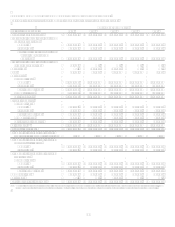

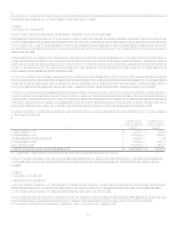

Cumulative effect from adoption of FIN 48 (29,702) (29,702)

Cumulative effect from adoption of FAS 156, net of income taxes of $6,378 8,809 8,809

Comprehensive income:

Net income 1,570,332 1,570,332

Other comprehensive income, net of income tax:

Unrealized gains on securities, net of income tax of $25,780 56,413 56,413

Defined benefit plans, net of income taxes of $17,675 29,407

29,407

Foreign currency translation adjustments 83,499 83,499

Unrealized losses on cash flow hedging instruments, net of income tax benefit of $63,804 (120,251) (120,251)

Other comprehensive income 49,068 49,068

Comprehensive income 1,619,400

Cash dividends$.11 per share (42,055) (42,055)

Purchase of treasury stock (3,024,969) (3,024,969)

Issuances of common stock and restricted stock, net of forfeitures 1,916,402 20 37,182 37,202

Exercise of stock options and tax benefits of exercises and restricted stock vesting 5,225,783 51 301,921 301,972

Compensation Expense for restricted stock awards and stock options 192,422 192,422

Adjustment to issuance of common stock for acquisition (137,258) (1) (10,463) (10,464)

Allocation of ESOP shares 6,291 6,291

Balance, December 31, 2007 419,224,900 $ 4,192 $ 15,860,490 $ 11,267,568 $ 315,248 $ (3,153,386) $ 24,294,112

See Notes to Consolidated Financial Statements.