Capital One 2007 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

The total consideration of $13.2 billion, which includes the value of outstanding stock options, was settled through the issuance of

103.8 million shares of the Companys common stock and payment of $5.2 billion in cash. Under the terms of the transaction, each

share of North Fork common stock was exchanged for $28.14 in cash or 0.3692 shares of the Companys common stock or a

combination of common stock and cash based on the aforementioned conversion rates, based on the average of the closing prices on

the NYSE of the Companys common stock during the five trading days ending the day before the completion of the merger, which

was $76.24.

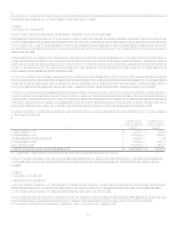

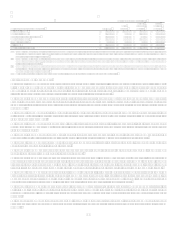

Costs to acquire North Fork:

Capital One common stock issued $ 7,914,463

Cash consideration paid 5,200,500

Fair value of employee stock options 83,633

Investment banking, legal, and consulting fees 31,547

Total consideration paid for North Fork $ 13,230,143

In 2007, the Company recorded certain refinements to its initial estimates of the fair value of the assets and liabilities related to the

North Fork acquisition. These adjustments included goodwill impairment of $650.0 million associated with the shutdown of

GreenPoint, and other adjustments of $140.0 million resulting in a $790.0 million decrease to goodwill.

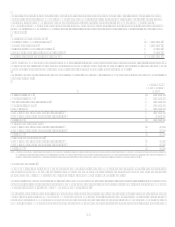

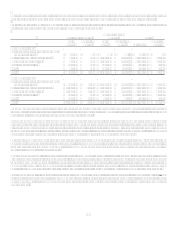

The following unaudited pro forma condensed statements of income assume that the Company and North Fork were combined at the

beginning of 2006.

Year Ended

December 31,

2006

Net interest income $ 6,398,022

Non-interest income 7,122,589

Provision for loan and lease losses 1,513,438

Non-interest expense 7,892,706

Income taxes 1,406,669

Income from continuing operations, net of tax 2,707,798

Income from discontinued operations, net of tax 121,338

Net income $ 2,829,136

Basic earnings per share:

Income from continuing operations, net of tax $ 6.69

Income from discontinued operations, net of tax 0.30

Net income $ 6.99

Diluted earnings per share:

Income from continuing operations, net of tax $ 6.55

Income from discontinued operations, net of tax 0.30

Net income $ 6.85

(1) Pro forma adjustments include the following adjustments: accretion for loan fair value discount, reduction of interest income for amounts used to fund the acquisition,

amortization for interest-bearing deposits fair value premium, accretion for subordinated notes fair value premium, addition of interest expense for borrowings used to fund

the acquisition, and related amortization for intangibles acquired, net of Hibernias and North Forks historical intangible amortization expense.

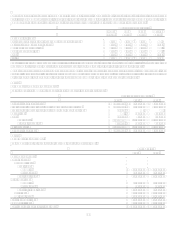

Hibernia Corporation

On November 16, 2005, the Company acquired 100% of the outstanding common stock of Hibernia Corporation (Hibernia), a

financial holding company with operations in Louisiana and Texas. Hibernia offers a variety of banking products and services,

including consumer, commercial and small business loans and demand and term deposit accounts.

The acquisition was accounted for under the purchase method of accounting, and, as such, the assets and liabilities of Hibernia were

recorded at their respective fair values as of November 16, 2005. The results of Hibernias operations were included in the Companys

Consolidated Statement of Income commencing November 16, 2005.

The total consideration of $5.0 billion, which includes the value of outstanding stock options, was settled through the issuance of

32.9 million shares of the Companys common stock and payment of $2.2 billion in cash. Under the terms of the transaction, each

share of Hibernia common stock was exchanged for $30.46 in cash or 0.3792 shares of the Companys common stock or a

combination of common stock and cash based on the aforementioned conversion rates, based on the average of the closing prices on