Capital One 2007 Annual Report Download - page 80

Download and view the complete annual report

Please find page 80 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147

|

|

58

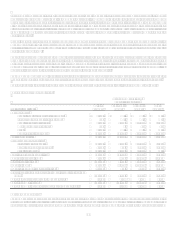

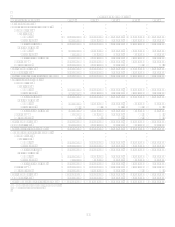

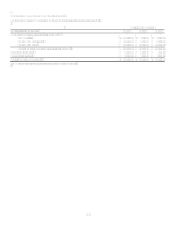

TABLE FNET CHARGE-OFFS

Table F shows the Companys net charge-offs for the periods presented on a reported and managed basis.

Year Ended December 31

(Dollars in thousands) 2007(1) 2006 2005 2004 2003

Reported:

Average loans held for investment $ 93,541,825 $ 63,577,279 $ 40,734,237 $ 34,265,668 $ 28,677,616

Net charge-offs 1,960,541 1,407,489 1,446,649 1,295,568 1,646,360

Net charge-offs as a percentage of

average loans held for investment 2.10% 2.21% 3.55% 3.78% 5.74%

Managed:

Average loans held for investment $ 144,727,007 $ 111,328,595 $ 85,265,023 $ 73,711,673 $ 62,911,953

Net charge-offs 4,161,995 3,158,080 3,623,154 3,251,761 3,683,887

Net charge-offs as a percentage of

average loans held for investment 2.88% 2.84% 4.25% 4.41% 5.86%

(1) Based on continuing operations.