Capital One 2007 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

102

Note 24

Off-Balance Sheet Securitizations

Off-balance sheet securitizations involve the transfer of pools of loan receivables by the Company to one or more third-party trusts or

qualified special purpose entities in transactions that are accounted for as sales in accordance with SFAS 140. Certain undivided

interests in the pool of loan receivables are sold to investors as asset-backed securities in public underwritten offerings or private

placement transactions. The proceeds from off-balance sheet securitizations are distributed by the trusts to the Company as

consideration for the loan receivables transferred. Each new off-balance sheet securitization results in the removal of loan principal

receivables equal to the sold undivided interests in the pool from the Companys consolidated balance sheet (off-balance sheet

loans), the recognition of certain retained residual interests and a gain on the sale. The remaining undivided interests in principal

receivables of the pool, as well as the unpaid billed finance charge and fee receivables related to the Companys undivided interest in

the principal receivables are retained by the Company and recorded as loans on the Consolidated Balance Sheet. The amounts of the

remaining undivided interests fluctuate as the accountholders make principal payments and incur new charges on the selected

accounts. The amount of retained loan receivables, representing, transferors interest was $11.4 billion and $9.9 billion as of

December 31, 2007 and 2006, respectively.

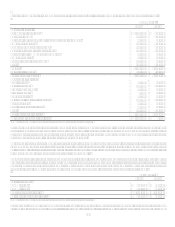

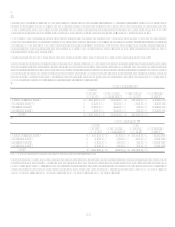

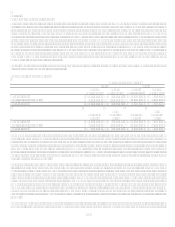

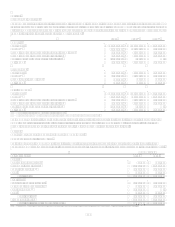

The following table presents the year-end and average balances, as well as the delinquent and net charge-off amounts of the reported,

off-balance sheet and managed loan portfolios.

Supplemental Loan Information

Year Ended December 31

2007 2006

Loans

Outstanding

Loans

Delinquent

Loans

Outstanding

Loans

Delinquent

Managed loans $ 151,362,417 $ 5,863,797 $ 146,151,268 $ 4,414,045

Securitization adjustments (49,557,390) (2,142,353) (49,639,129) (1,765,642)

Reported loans $ 101,805,027 $ 3,721,444 $ 96,512,139 $ 2,648,403

Average

Loans

Net

Charge-

Offs

Average

Loans

Net

Charge-

Offs

Managed loans $ 144,727,007 $ 4,161,995 $ 111,328,595 $ 3,158,080

Securitization adjustments (51,185,182) (2,201,454) (47,751,316) (1,750,591)

Reported loans $ 93,541,825 $ 1,960,541 $ 63,577,279 $ 1,407,489

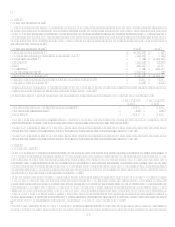

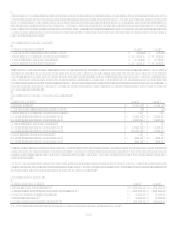

The Companys retained residual interests in the off-balance sheet securitizations are recorded in accounts receivable from

securitizations and are comprised of interest-only strips, retained subordinated undivided interests in the transferred receivables, cash

collateral accounts, cash reserve accounts and unpaid interest and fees on the investors portion of the transferred principal

receivables. The residual interests are recorded at estimated fair value. Retained residual interests totaled $2.3 billion and $2.2 billion

at December 31, 2007 and 2006, respectively. The Companys retained residual interests are generally restricted or subordinated to

investors interests and their value is subject to substantial credit, repayment and interest rate risks on the transferred financial assets.

The investors and the trusts have no recourse to the Companys assets, other than the retained residual interests, if the off-balance

sheet loans are not paid when due.

The gain on sale recorded from off-balance sheet securitizations is based on the estimated fair value of the assets sold and retained and

liabilities incurred, and is recorded at the time of sale, net of transaction costs, in servicing and securitizations income on the

Consolidated Statements of Income. The related receivable is the interest-only strip, which is based on the present value of the

estimated future cash flows from excess finance charges and past-due fees over the sum of the return paid to security holders,

estimated contractual servicing fees and credit losses. The Company periodically reviews the key assumptions and estimates used in

determining the value of the interest-only strip. The Company recognizes all changes in the fair value of the interest-only strip

immediately in servicing and securitizations income on the consolidated statements of income in accordance with the provisions of

SFAS No. 115, Accounting for Certain Investments in Debt and Equity Securities. In accordance with Emerging Issues Task Force 99-

20 (EITF 99-20), Recognition of Interest Income and Impairment of Purchased and Retained Beneficial Interests in Securitized

Financial Assets, the interest component of cash flows attributable to retained interests in securitizations is recorded in other interest

income.

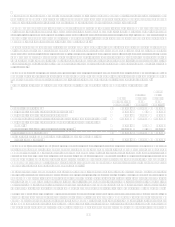

The key assumptions used in determining the fair value of the interest-only strip and other subordinated retained interests resulting

from securitizations of loan receivables completed during the period included the weighted average ranges for charge-off rates,