Capital One 2007 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.111

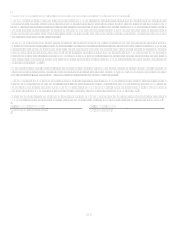

Note 30

Subsequent Events

COAF Reorganization

On January 1, 2008 COAF and its subsidiaries were reorganized into a new legal structure whereby COAF became a direct operating

subsidiary of CONA. Certain assets of COAF and its subsidiaries remained under the Corporation. In connection with this

reorganization, the outstanding balances in the Capital One Auto Loan Facility I and the Capital One Auto Loan Facility II of $4.2

billion and $127.7 million, respectively, were repaid.

Dividend Increase

On January 31, 2008 the Company announced that its Board of Directors approved an increase in its quarterly dividend per share from

$0.027 to $0.375 payable February 20, 2008 to stockholders of record on February 11, 2008.

Share Repurchase Program

On January 31, 2008 the Companys Board of Directors authorized the repurchase of up to $2.0 billion of the Companys Common

Stock. The repurchased shares will be accounted for as treasury shares and may be used for general corporate purposes. The Company

will execute the share repurchases as warranted by market conditions and the Companys continued internal generation of excess

capital. The Company does not expect to begin to repurchase shares before the second half of the year.

Debt Repurchases

During January and February 2008, the Company repurchased $1.0 billion of certain senior unsubordinated debt, recognizing a gain of

approximately $52.0 million recorded in other non-interest income. The Company initiated the repurchases to take advantage of the

current rate environment and replaced the borrowings with lower-rate unsecured funding.