Capital One 2007 Annual Report Download - page 82

Download and view the complete annual report

Please find page 82 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

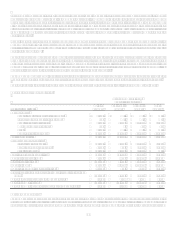

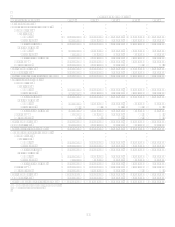

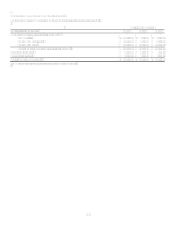

TABLE HSUMMARY OF ALLOWANCE FOR LOAN AND LEASE LOSSES

Table H sets forth activity in the allowance for loan and lease losses for the periods indicated.

Year Ended December 31

(Dollars In Thousands) 2007 2006 2005 2004 2003

Balance at beginning of year $ 2,180,000 $ 1,790,000 $ 1,505,000 $ 1,595,000 $ 1,720,000

Provision for loan and lease losses from

continuing operations:

Domestic 2,487,694 1,235,984 1,327,968 1,085,467 1,388,463

International 148,808 240,454 163,104 135,385 129,034

Total provision for loan and lease

losses from continuing

operations 2,636,502 1,476,438 1,491,072 1,220,852 1,517,497

Provision for loan and lease losses from

discontinued operations 80,151

Acquisitions 225,890 224,144

Other 26,888 72,821 (12,731) (15,284) 3,863

Charge-offs:

Consumer loans:

Domestic (2,076,794) (1,547,746) (1,532,499) (1,473,103) (1,722,348)

International (252,444) (249,332) (193,360) (135,198) (146,152)

Total consumer loans (2,329,238) (1,797,078) (1,725,859) (1,608,301) (1,868,500)

Commercial loans (250,981) (135,375) (139,977) (140,972) (135,828)

Total charge-offs (2,580,219) (1,932,453) (1,865,836) (1,749,273) (2,004,328)

Principal recoveries:

Consumer loans

Domestic 503,618 451,781 384,266 388,573 304,003

International 71,868 68,280 43,560 43,212 37,619

Total consumer loans 575,486 520,061 427,826 431,785 341,622

Commercial loans 44,192 27,243 20,525 21,920 16,346

Total principal recoveries 619,678 547,304 448,351 453,705 357,968

Net charge-offs(1) (1,960,541) (1,385,149) (1,417,485) (1,295,568) (1,646,360)

Balance at end of year $ 2,963,000 $ 2,180,000 $ 1,790,000 $ 1,505,000 $ 1,595,000

Allowance for loan and lease losses to

loans held for investment at end of yea

r

2.91% 2.26% 2.99% 3.94% 4.86%

Allowance for loan and lease losses by

geographic distribution:

Domestic $ 2,754,065 $ 1,949,864 $ 1,639,277 $ 1,354,849 $ 1,477,314

International 208,935 230,136 150,723 150,151 117,686

Allowance for loan and lease losses by

loan category:

Consumer loans:

Domestic $ 2,199,788 $ 1,584,025 $ 1,405,909 $ 1,222,083 $ 1,341,850

International 208,935 230,136 150,723 150,151 117,686

Total consumer loans 2,408,723 1,814,161 1,556,632 1,372,234 1,459,536

Commercial loans 554,277 365,839 221,975 132,766 135,464

Unallocated 11,393

Total loans held for investment $ 2,963,000 $ 2,180,000 $ 1,790,000 $ 1,505,000 $ 1,595,000

(1) Does not include charge-offs of $22.3 million and $29.2 million in 2006 and 2005, respectively, relating to certain loans which have been segregated into pools apart from

the remaining portfolio and accounted for under Statement of Position 03-3, Accounting for Certain Loans or Debt Securities Acquired in a Transfer (SOP 03-3).