Capital One 2007 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

78

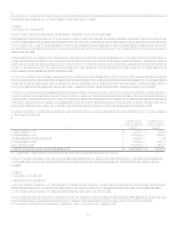

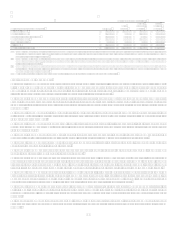

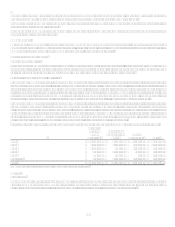

Year Ended December 31, 2005

National Lending sub-segment detail U.S. Card Auto

Finance

Global

Financial

Services

Total

National

Lending

Net interest income $ 4,793,956 $ 1,149,377 $ 1,680,522 $ 7,623,855

Non-interest income 3,321,457 19,951 1,022,756 4,364,164

Provision for loan and lease losses 2,279,109 459,513 925,777 3,664,399

Non-interest expenses 3,356,600 506,480 1,496,678 5,359,758

Income tax provision 870,351 71,268 94,796 1,036,415

Net income $ 1,609,353 $ 132,067 $ 186,027 $ 1,927,447

Loans held for investment $ 49,463,522 $ 16,372,019 $ 23,386,490 $ 89,222,031

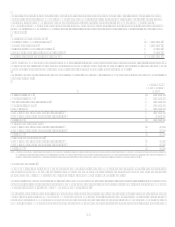

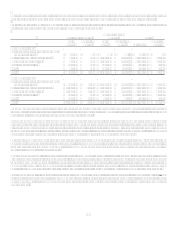

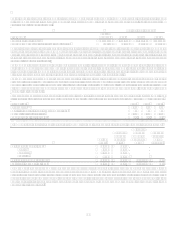

(1) Income statement adjustments for the year ended December 31, 2007 reclassify the net of finance charges of $6,334.8 million, past due fees of $1,004.1 million, other

interest income of $(167.3) million and interest expense of $2,681.7 million; and net charge-offs of $2,201.5 million to non-interest income from net interest income and

provision for loan losses, respectively.

Income statement adjustments for the year ended December 31, 2006 reclassify the net of finance charges of $5,485.0 million, past due fees of $938.6 million, other interest

income of $(239.7) million and interest expense of $2,342.7 million; and net charge-offs of $1,747.5 million to non-interest income from net interest income and provision

for loan losses, respectively.

Income statement adjustments for the year ended December 31, 2005 reclassify the net of finance charges of $5,052.8 million, past due fees of $1,006.1 million, other

interest income of $(196.4) million and interest expense of $1,887.3 million; and net charge-offs of $2,176.5 million to non-interest income from net interest income and

provision for loan losses, respectively.

(2) For 2006, Other category includes North Fork Bank results. For 2005, Other category includes Hibernia Bank results.

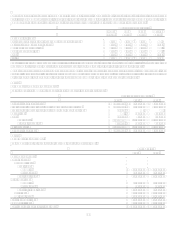

Significant Segment Adjustments

During 2007, the Company recognized a pre-tax charge of $79.8 million for liabilities in connection with the Visa antitrust lawsuit

settlement with American Express. Additionally, the Company recorded a legal reserve of $59.1 million for estimated possible

damages in connection with other pending Visa litigation, reflecting our share of such potential damages as a Visa member. The 2007

litigation charges were recorded in non-interest expense and held in the Other category.

During 2007, the Company completed the sale of its interest in a relationship agreement to develop and market consumer credit

products in Spain and recorded a net gain related to this sale of $31.3 million consisting of a $41.6 million increase in non-interest

income partially offset by a $10.3 million increase in non-interest expense. This gain was recorded in the Global Financial Services

sub-segment.

During 2007, the Company sold its remaining interest in DealerTrack, a leading provider of on-demand software and data solutions

for the automotive retail industry. The sale resulted in a $46.2 million gain, which was recorded in non-interest income and reported in

the Auto Finance sub-segment.

During 2007, the Company recorded $138.2 million of restructuring charges as part of its broad-based initiative to reduce expenses

and improve the Companys competitive cost position. The 2007 restructuring charges were recorded in non-interest expense and held

in the Other category.

During 2006, the Company sold a combination of previously purchased charged-off loan portfolios and the Company originated

charged-off loans resulting in the recognition of $83.8 million of non-interest income recognized in the Other category.

During 2006, the Company sold a number of Treasury and Agency securities realizing a loss of $34.9 million which was reported in

non-interest expense and held in the Other category.

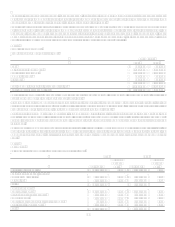

During 2005, the Company sold previously purchased charged-off loan portfolios resulting in a gain of $34.0 million which was

reported in non-interest income and held in the Other category.

During 2005, the Company recognized non-interest expense of $76.3 million for employee termination and facility consolidation

charges related to continued cost reduction initiatives and other less material one-time charges. Of this amount, $41.7 million was

allocated to the U.S. Card sub-segment, $24.9 million was allocated to the Global Financial Services sub-segment, $8.5 million was

allocated to the Auto Finance sub-segment and the remainder was held in the Other category for the year ended December 31, 2005.

During 2005, the Company closed on the sale of its Tampa, Florida facilities. The ultimate sales price was greater than the impaired

value of the held-for-sale property, and as such, the Company reversed $18.8 million of its previously recorded 2004 impairment in

Occupancy expense. Of this amount, $17.4 million was allocated to the U.S. Card sub-segment, $1.3 million was allocated to the

Global Financial Services sub-segment, and the remainder of the balance was held in the Other category.

During 2005, the Company recognized a $20.6 million prepayment penalty for the refinancing of the McLean Headquarters facility.

Of this amount, $16.8 million was allocated to the U.S. Card sub-segment, $2.7 million was allocated to the Global Financial Services

sub-segment, $0.6 million was allocated to the Auto Finance segment, and the remainder of the balance was held in the Other

category.

During 2005, the Company recognized a $28.2 million impairment charge related to the write-off of the Companys insurance

brokerage business. The charge was recorded in non-interest expense and fully allocated to the Global Financial Services sub-

segment.