Capital One 2007 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

19

PART II

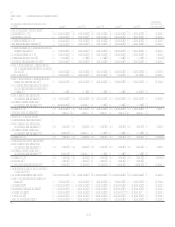

Item 5. Market for Companys Common Equity and Related Stockholder Matters.

(Dollars in thousands,

except per share

information)

Total Number of

Shares Purchased(1)

Average Price

Paid per Share

Total Number of

Shares Purchased

as Part of

Publicly

Announced Plans(1)

Maximum Amount

That May Yet be

Purchased Under

the Plan or

Program(1)

October 1-31, 2007 2,786,160 $ 63.49 2,785,382 $ 594,376

November 1-30, 2007 10,647,881 55.85 10,642,308

December 1-31, 2007 14,899 54.91

Total 13,448,940 13,427,690

(1) Shares purchased represent shares purchased pursuant to our $3.0 billion stock repurchase program and share swaps made in connection with stock option exercises and the

withholding of shares to cover taxes on restricted stock lapses.

The stock repurchase program is intended to comply with Rules 10b5-1(c) (1) (i) and 10b-18 of the Securities Exchange Act of 1934, as amended.

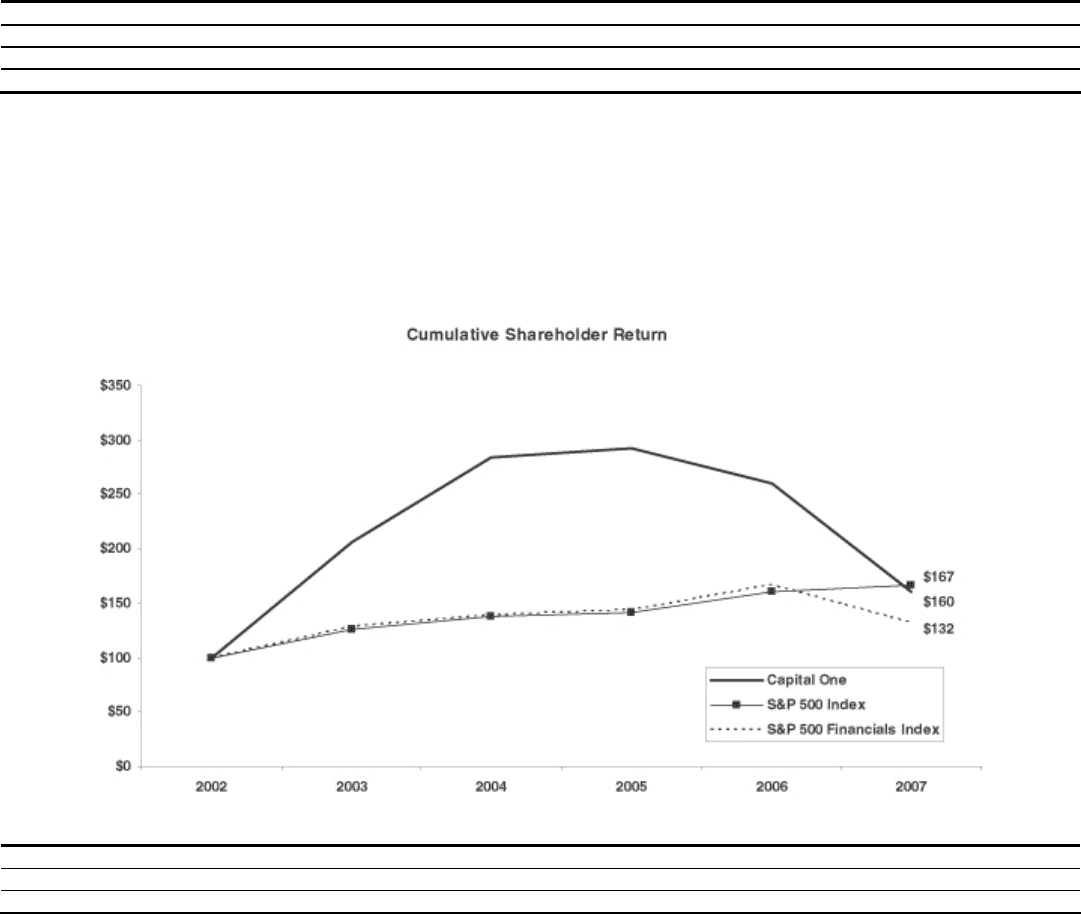

Cumulative Shareholder Return

The following graph compares cumulative total stockholder return on our common stock with the S&P Composite 500 Stock Index

(S&P 500 Index) and an industry index, the S&P Financial Composite Index (S&P 500 Financials Index), for the period from

December 31, 2002 to December 31, 2007. The graph assumes an initial investment of $100 in common stock of the specified

securities. The cumulative returns include stock price appreciation and assume full reinvestment of dividends. The stock price

performance on the graph below is not necessarily indicative of future performance.

2002 2003 2004 2005 2006 2007

Capital One................................................................................................ 100.00 206.74 284.48 292.28 260.22 160.34

S&P 500 Index .......................................................................................... 100.00 126.38 137.75 141.88 161.20 166.89

S&P 500 Financials Index ......................................................................... 100.00 127.93 138.46 143.61 166.82 132.05

The remaining information required by Item 5 is included under the following:

Item 1 BusinessOverview Page 3

Item 1 BusinessSupervision and RegulationDividends and Transfers of Funds

Page

8-9

Item 7 Managements Discussion and Analysis of Financial Condition and Results of

OperationsMarket Risk Management Pages 47-50

Item 7 Managements Discussion and Analysis of Financial Condition and Results of

OperationsCapital Adequacy

Pages

51

Item 7 Managements Discussion and Analysis of Financial Condition and Results of

OperationsDividend Policy Page 66

Item 8 Financial Statements and Supplementary DataNotes to the Consolidated

Financial Statements Pages 62-111

Item 8 Financial Statements and Supplementary DataSelected Quarterly Financial Data Page 115