Capital One 2007 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.24

The amount of finance charges and fees suppressed were $1.1 billion and $0.9 billion for the years ended December 31, 2007 and

2006, respectively.

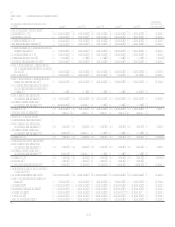

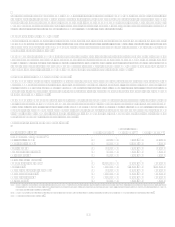

Nonperforming Assets

Nonperforming Assets include nonaccrual loans, impaired loans, certain restructured loans on which interest rates or terms of

repayment have been materially revised, foreclosed and repossessed assets.

Commercial loans, consumer real estate and auto loans are placed in nonaccrual status at 90 days past due or sooner if, in

managements opinion, there is doubt concerning full collectibility of both principal and interest. All other consumer loans and small

business credit card loans are not placed in nonaccrual status prior to charge-off.

At the time a loan is placed on nonaccrual status, interest and fees accrued but not collected through the end of the previous quarter are

systematically reversed and charged against income. Interest payments received on nonaccrual loans are applied to principal if there is

doubt as to the collectibility of the principal; otherwise, these receipts are recorded as interest income. A loan remains in nonaccrual

status until it is current as to principal and interest and the borrower demonstrates the ability to fulfill the contractual obligation.

Upon foreclosure or repossession, loans are adjusted, if necessary, to the estimated fair value of the underlying collateral and

transferred to other assets, net of a valuation allowance for selling costs. We estimate market values primarily based on appraisals

when available or quoted market prices on liquid assets.

Valuation of Mortgage Servicing Rights

Mortgage Servicing Rights (MSRs), are recognized when mortgage loans are sold in the secondary market and the right to service

these loans are retained for a fee, and are carried at fair value; changes in fair value are recognized in mortgage servicing and other

income. The Company continues to operate the mortgage servicing business and to report the changes in the fair value of MSRs in

continuing operations. To evaluate and measure fair value, the underlying loans are stratified based on certain risk characteristics,

including loan type, note rate and investor servicing requirements. Fair value of the MSRs is determined using the present value of the

estimated future cash flows of net servicing income. The Company uses assumptions in the valuation model that market participants

use when estimating future net servicing income, including prepayment speeds, discount rates, default rates, cost to service, escrow

account earnings, contractual servicing fee income, ancillary income and late fees. This model is highly sensitive to changes in certain

assumptions. Different anticipated prepayment speeds, in particular, can result in substantial changes in the estimated fair value of

MSRs. If actual prepayment experience differs from the anticipated rates used in the Companys model, this difference could result in

a material change in MSR value.

As of December 31 2007 and 2006, the MSR balance was $247.6 million and $252.3 million, respectively.

Valuation of Representation and Warranty Reserve

The representation and warranty reserve is available to cover probable losses inherent with the sale of mortgage loans in the secondary

market. In the normal course of business, certain representations and warranties are made to investors at the time of sale, which permit

the investor to return the loan to the seller or require the seller to indemnify the investor for certain losses incurred by the investor

while the loan remains outstanding. The evaluation process for determining the adequacy of the representation and warranty reserve

and the periodic provisioning for estimated losses is performed for each product type on a quarterly basis. Factors considered in the

evaluation process include historical sales volumes, aggregate repurchase and indemnification activity, actual losses incurred.

Quarterly changes to the representation and warranty reserve related to GreenPoint are reported as discontinued operations for all

periods presented.

As of December 31, 2007 and 2006, the representation and warranty reserve was $93.4 million and $156.0 million, respectively.

Valuation of Retained Interests from Securitization Transactions

Loan securitization involves the transfer of a pool of loan receivables to a trust or other special purpose entity. The trust sells an

undivided interest in the pool of loan receivables to third-party investors through the issuance of asset backed securities and distributes

the proceeds to the Company as consideration for the loans transferred. The Company removes loan receivables from the Consolidated

Balance Sheets for securitizations that qualify as sales in accordance with Statement of Financial Accounting Standards No. 140,

Accounting for Transfers and Servicing of Financial Assets and Extinguishment of Liabilitiesa Replacement of FASB Statement

No. 125 (SFAS 140). The trusts are qualified special purpose entities as defined by SFAS 140 and are not subsidiaries of the

Company and are not included in the Companys consolidated financial statements. The gain on sale recorded from off-balance sheet

securitizations is based on the estimated fair value of the assets sold and retained and liabilities incurred, and is recorded at the time of

sale, net of transaction costs. The related receivable is the interest-only strip, which is based on the present value of the estimated

future cash flows from excess finance charges and past-due fees over the sum of the return paid to security holders, estimated