Capital One 2007 Annual Report Download - page 90

Download and view the complete annual report

Please find page 90 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.68

the beginning of an entitys first fiscal year that begins after September 15, 2006. The requirements for recognition and initial

measurement of servicing assets and servicing liabilities should be applied prospectively to all transactions after the effective date of

this statement. As of January 1, 2007, the Company has adopted SFAS 156 and elected to measure its servicing assets and servicing

liabilities using the fair value measurement method. The Company has identified mortgage servicing rights (MSRs) relating to

residential mortgage loans as a single class of servicing rights and has elected to apply fair value accounting to these MSRs. Presently,

this class represents all of the Companys material servicing rights. The adoption of SFAS 156 did not have a material impact on the

consolidated earnings or financial position of the Company.

In February 2006, the Financial Accounting Standards Board (FASB) issued Statement of Financial Accounting Standard No. 155,

Accounting for Certain Hybrid Financial Instruments-an amendment of FASB Statements No. 133 and 140, (SFAS 155). SFAS 155

amends FASB Statements No. 133, Accounting for Derivative Instruments and Hedging Activities, (SFAS 133) and No. 140,

Accounting for Transfers and Servicing of Financial Assets and Extinguishments of Liabilities, (SFAS 140). SFAS 155 resolves

issues addressed in SFAS 133 Implementation Issue No. D1, Application of Statement 133 to Beneficial Interests in Securitized

Financial Assets. SFAS 155 permits fair value remeasurement for any hybrid financial instrument that contains an embedded

derivative that otherwise would require bifurcation, clarifies which interest-only strips and principal-only strips are not subject to the

requirements of SFAS 133, establishes a requirement to evaluate interests in securitized financial assets to identify interests that are

freestanding derivatives or that are hybrid financial instruments that contain an embedded derivative requiring bifurcation, clarifies

that concentrations of credit risk in the form of subordination are not embedded derivatives, and amends SFAS 140 to eliminate the

prohibition on a qualifying special-purpose entity from holding a derivative financial instrument that pertains to a beneficial interest

other than another derivative financial instrument. SFAS 155 is effective for all financial instruments acquired or issued after the

beginning of an entitys first fiscal year that begins after September 15, 2006. The adoption of SFAS 155 did not have a material

impact on the consolidated earnings or financial position of the Company.

In May 2005, the FASB issued Statement of Financial Accounting Standard No. 154, Accounting Changes and Error Correctionsa

replacement of APB Opinion No. 20 and FASB Statement No. 3, (SFAS 154). SFAS 154 changes the requirements for the

accounting for and reporting of a change in accounting principle. SFAS 154 applies to all voluntary changes in accounting principle

and to changes required by an accounting pronouncement in the unusual instance that the pronouncement does not include specific

transition provisions. SFAS 154 is effective for accounting changes and corrections of errors made in fiscal years beginning after

December 15, 2005. The Company will apply the provisions of SFAS 154 when applicable in future reporting periods.

Effective January 1, 2006, the Company adopted the fair value recognition provisions of SFAS 123(R) using the modified-

prospective-transition method. Under that transition method, compensation cost recognized during the year ended December 31, 2006

includes: (a) compensation cost for all share-based payments granted prior to, but not yet vested as of January 1, 2006, based on the

grant date fair value estimated in accordance with the original provisions of SFAS 123, and (b) compensation cost for all share-based

payments granted subsequent to January 1, 2006, based on the grant-date fair valued estimated in accordance with the provisions of

SFAS 123(R). The Company voluntarily adopted the expense recognition provisions of Statement of Financial Accounting Standard

No. 123, Accounting for Stock Based Compensation (SFAS 123), prospectively to all awards granted, modified, or settled after

January 1, 2003. Prior to January 1, 2003, the Company applied Accounting Principles Board Opinion No. 25, Accounting for Stock

Issued to Employees and related Interpretations in accounting for its stock based compensation plans. Results for prior periods have

not been restated.

The Company has two active stock-based compensation plans, one employee plan and one non-employee director plan, which are

described more fully in Note 10. Under these plans, the grants to retirement eligible associates continue to vest after the associate

retires. For awards granted prior to the adoption of SFAS 123(R), the Company had been and will continue to recognize the

compensation cost of those awards over the full vesting periods or up to the date of retirement.

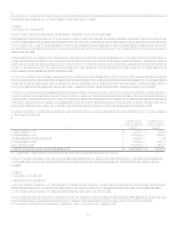

As a result of adopting SFAS 123(R) on January 1, 2006, the Companys income before income taxes and net income for the year

ended December 31, 2006 are $35.3 million and $23.3 million lower, respectively, than if it had continued to account for share-based

compensation under SFAS 123. Basic and diluted earnings per share for 2006 would have been $7.87 and $7.69, respectively, if the

Company had not adopted SFAS 123(R), compared to reported basic and diluted earnings per share of $7.80 and $7.62, respectively.

Prior to the adoption of SFAS 123(R), the Company presented all tax benefits of deductions resulting from the exercise of stock

options as operating cash flows in the Statement of Cash Flows. SFAS 123(R) requires the cash flows resulting from the tax benefits

resulting from tax deductions in excess of the compensation cost recognized for those options (excess tax benefits) to be classified as

financing cash flows.

Significant Accounting Policies

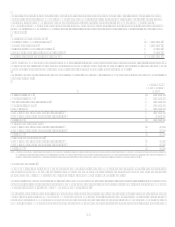

Cash and Cash Equivalents

Cash and cash equivalents includes cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at

other banks. Cash paid for interest for the years ended December 31, 2007, 2006 and 2005 was $4.5 billion, $2.9 billion and $1.9