Capital One 2007 Annual Report Download - page 137

Download and view the complete annual report

Please find page 137 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

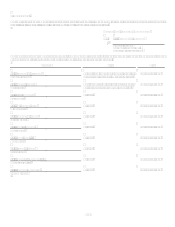

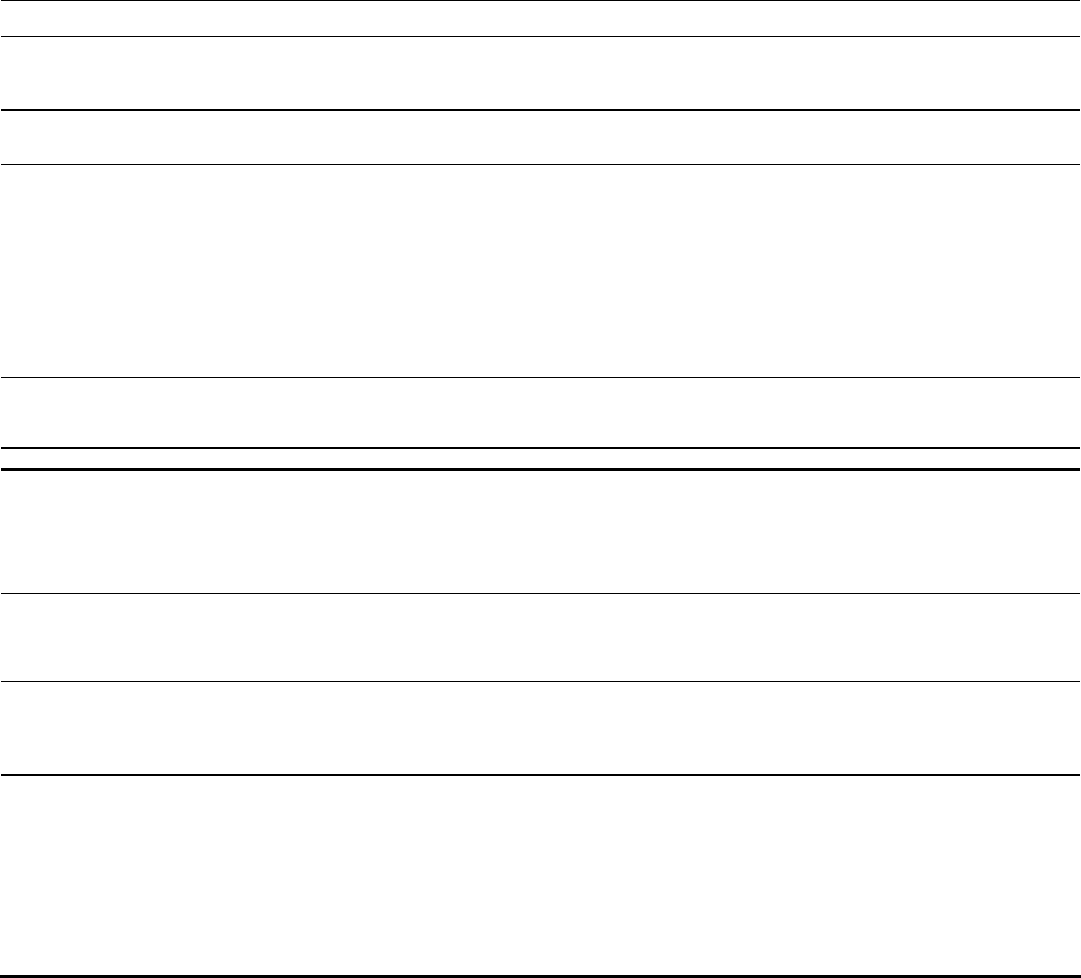

115

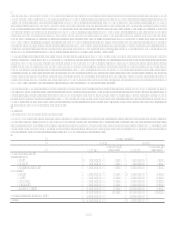

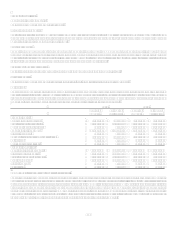

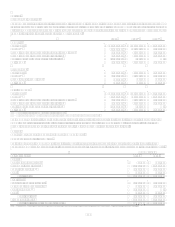

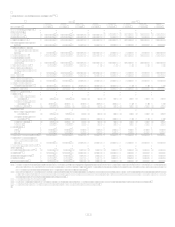

Selected Quarterly Financial Data(1)

2007 2006(5)

(Unaudited) Fourth

Quarter Third

Quarter Second

Quarter First

Quarter Fourth(4)

Quarter Third

Quarter Second

Quarter First

Quarter

Summary of Operations:

(In Thousands)

Interest income $ 2,960,194 $ 2,766,967 $ 2,638,686 $ 2,712,309

$ 2,323,925 $ 2,065,071 $ 1,897,157 $ 1,878,582

Interest expense 1,197,947 1,142,493 1,100,105 1,107,766

930,953 770,556 700,075 671,705

Net interest income 1,762,247 1,624,474 1,538,581 1,604,543

1,392,972 1,294,515 1,197,082 1,206,877

Provision for loan and lease

losses 1,294,210 595,534 396,713 350,045

513,157 430,566 362,445 170,270

Net interest income after

p

rovision for loan and lease

losses 468,037 1,028,940 1,141,868 1,254,498

879,815 863,949 834,637 1,036,607

Non-interest income 2,158,340 2,149,662 1,971,851 1,774,370

1,671,475 1,761,385 1,709,913 1,858,251

Non-interest expense,

excluding restructuring

expenses 2,107,398 1,914,867 1,943,461 1,974,047

1,962,686 1,726,629 1,680,897 1,573,479

Restructuring expenses 27,809 19,354 91,074

Income from continuing

operations before income

taxes 491,170 1,244,381 1,079,184 1,054,821

588,604 898,705 863,653 1,321,379

Income taxes 169,558 428,010 311,572 368,697

185,992 310,866 311,066 438,040

Income from continuing

operations, net of tax 321,612 816,371 767,612 686,124

402,612 587,839 552,587 883,339

Loss from discontinued

operations, net of tax(2) (95,044) (898,029) (17,240) (11,074) (11,884)

Net income (loss) $ 226,568 $ (81,658) $ 750,372 $ 675,050

$ 390,728 $ 587,839 $ 552,587 $ 883,339

Per Common Share:

Basic EPS:

Income from continuing

operations $ 0.85 $ 2.11 $ 1.96 $ 1.68

$ 1.20 $ 1.95 $ 1.84 $ 2.95

Loss from discontinued

operations(2) (0.25) (2.32) (0.04) (0.03) (0.04)

Net Income (loss) $ 0.60 $ (0.21) $ 1.92 $ 1.65

$ 1.16 $ 1.95 $ 1.84 $ 2.95

Diluted EPS:

Income from continuing

operations $ 0.85 $ 2.09 $ 1.93 $ 1.65

$ 1.17 $ 1.89 $ 1.78 $ 2.86

Loss from discontinued

operations(2) (0.25) (2.30) (0.04) (0.03) (0.03)

Net Income (loss) $ 0.60 $ (0.21) $ 1.89 $ 1.62

$ 1.14 $ 1.89 $ 1.78 $ 2.86

Dividends 0.03 0.03 0.03 0.03

0.03 0.03 0.03 0.03

Market prices

High 72.94 78.94 81.85 83.61

82.72 86.17 87.23 89.92

Low 45.66 62.70 70.26 74.37

74.97 69.88 81.10 80.52

Average common shares (000s) 375,566 386,133 390,847 408,709

336,470 301,571 300,829 299,257

Average common shares and

common equivalent shares

(000s) 378,439 390,844 397,473 415,530

343,779 310,386 309,988 309,121

Average Balance Sheet Data:

(In Millions)

Loans held for investment(3) $ 97,785 $ 91,745 $ 91,145 $ 93,466

$ 74,738 $ 62,429 $ 58,833 $ 58,142

Total assets(3) 150,926 143,291 142,690 143,130

111,440 92,295 89,644 88,895

Interest-bearing deposits 72,312 73,555 75,218 74,867

53,735 42,984 42,797 43,357

Total deposits 84,051 84,884 86,719 86,237

60,382 47,196 47,209 47,870

Stockholders equity $ 24,733 $ 25,344 $ 25,128 $ 25,610

$ 18,311 $ 16,310 $ 15,581 $ 14,612

(1) The above schedule is a tabulation of the Companys unaudited quarterly results for the years ended December 31, 2007 and 2006. The Companys common shares are

traded on the New York Stock Exchange under the symbol COF. In addition, shares may be traded in the over-the-counter stock market. There were 18,487 and 19,763

common stockholders of record as of December 31, 2007 and 2006, respectively.

(2) In Q3 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit, GreenPoint Mortgage, realizing an after-tax loss of $898.0

million. The results of the mortgage origination operation of GreenPoint have been accounted for as a discontinued operation and have been removed from the Companys

results of continuing operations for all periods presented.

(3) Based on continuing operations.

(4) On December 1, 2006, the Company acquired 100% of the outstanding common stock of North Fork Bancorporation for total consideration of $13.2 billion.

(5) Certain prior period amounts have been reclassified to conform with current period presentation.