Capital One 2007 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.32

Business Outlook

The statements contained in this section are based on our current expectations. Certain statements are forward looking statements

within the meaning of the Private Securities Litigation Reform Act. Actual results could differ materially from those in our forward

looking statements. Factors that could materially influence results are set forth throughout this section and in Item 1A Risk Factors.

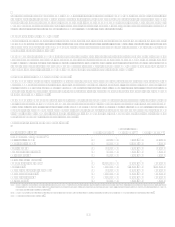

2008 Expectations

Like all banks, Capital One faces continuing cyclical challenges in 2008. The Company believes that its strong balance sheet and

experience in managing through prior economic cycles position the Company to successfully navigate the current challenges.

Expectations for 2008 results include:

Balance sheet growth (loans and deposits) in the low single digits;

Revenue growth in the low single digits, as the positive margin trends in U.S. Card moderate somewhat in 2008;

Continuing operating leverage, with the Companys efficiency ratio declining to the mid 40s, and overall operating

expenses expected to be at least $200 million below their 2007 level;

Continued pressure on delinquencies and charge-offs due to cyclical weakness in the economy;

Tangible common equity (TCE) ratio toward the high end of, or possibly above the announced target range of 5.5% to

6%.

Increase in quarterly dividends per share to $0.375 per quarter, beginning in the first quarter of 2008.

The Company expects that returns in 2008 will likely be pressured by credit headwinds as the economy weakens. The Company

believes that its strong balance sheet, resilient businesses, and actions to navigate the current challenges will position the Company for

a strong rebound when economic and credit cycles turn favorable.

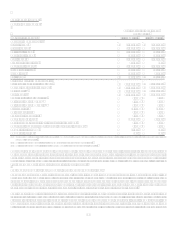

Operating Segments

In the Local Banking segment, the Company expects to maintain caution in underwriting both consumer and commercial loans in the

current economic cycle. The Company also expects the intense competitive environment for deposits to continue in 2008. As a result,

the Company expects loan growth rate and deposit growth rate in the low single digits in its Local Banking segment in 2008.

Planning is complete for North Fork Banks integration into Capital Ones existing technology infrastructure, and we expect to

complete the conversion of the majority of North Forks systems in 2008. The Local Banking business is on track to convert to a

single deposit platform and brand in the first quarter of 2008. While, integration and systems conversions may result in an elevation in

Local Banking operating expense in the first half of 2008, the Company expects that the longer term trend of improving operating

efficiency will resume in the second half of 2008.

In the National Lending businesses, the Company faces several challenges that may pressure results, including weakening consumer

credit and uncertainty regarding the consumer economy.

In the U.S. Card sub-segment, the Company expects the competitive environment to remain challenging. The Company expects U.S.

Card revenue margins to decline from 4th quarter levels in the first quarter of 2008, and to be in the high-teens throughout 2008. There

are several reasons for the expected decline. First, the Company expects to assess fewer fees as customers continue to adjust to pricing

and fee policies implemented in the second half of 2007. Also, the Company plans to implement additional fee policy adjustments in

the first quarter, such as a more generous and targeted fee waiver policy, which will reduce fee revenues somewhat. Finally, the

Company expects an increase in introductory rate assets in the U.S. Card portfolio as it pursues targeted opportunities with superprime

revolver customers. Despite the modestly lower revenue margins which result from these factors, the Company remains confident that

continued strong revenue margins well enable the U.S. Card business to weather cyclical economic pressures.

The Company expects the U.S. Card managed charge-off rate to be in the mid-6% range in the first half of 2008, consistent with

delinquencies through the latter half of 2007.

The Company continues to take actions to further strengthen resiliency and sustain well-above hurdle financial returns in the face of

cyclical credit challenges. For example, the Company specifically designs product structures and tightly manages credit lines

appropriate to each part of the credit risk spectrum. The Company maintains a prudent and measured approach to underwriting and

marketing. In 2008, the Company expects little to no loan growth in U.S. Card, and no material change in the mix of the U.S. Card

portfolio. The Company has increased collections capacity and intensity early in the current credit cycle. Finally, the Company

continues to pursue process and efficiency improvements, leveraging the new infrastructure platform implemented successfully in

2007.