Capital One 2007 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

88

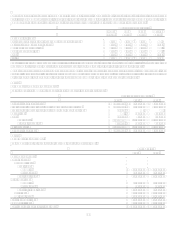

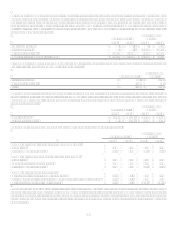

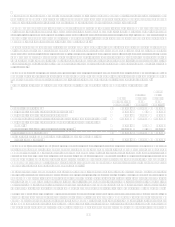

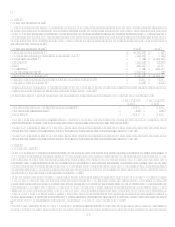

The Companys policy is to amortize prior service amounts on a straight-line basis over the average remaining years of service to full

eligibility for benefits of active plan participants.

Full disclosure of certain prior period information is omitted due to immateriality. Net periodic postretirement benefit expense was

$8.5 million and $6.7 million for 2005 and 2004, respectively. The liability recognized on the consolidated balance sheet for the

legacy other postretirement benefit plan at December 31, 2005 was $42.0 million.

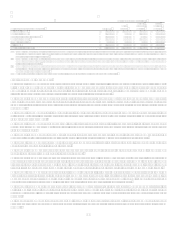

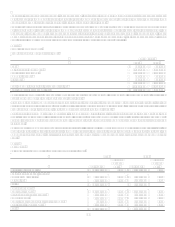

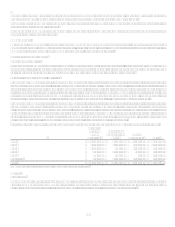

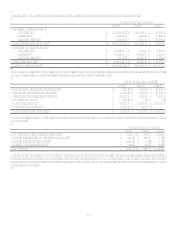

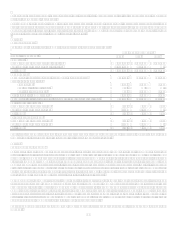

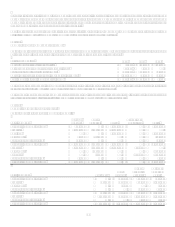

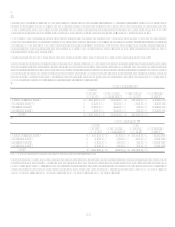

The following table sets forth, on an aggregated basis, changes in the benefit obligations and plan assets, how the funded status is

recognized in the balance sheet, and the components of net periodic benefit cost.

Pension Benefits

Postretirement

Benefits

2007 2006 2007 2006

Change in benefit obligation:

Benefit obligation at beginning of year $ 220,741 $ 7,597 $ 84,210

$ 47,989

Service cost 15,014

1,087 8,823

6,942

Interest cost 12,034

1,347 4,678

2,708

Plan participant contributions

532

Benefits paid (20,028) (3,450) (4,218) (1,430)

Benefit obligation assumed through acquisition

214,478

33,248

Net actuarial gain (16,285) (318) (10,714) (5,247)

Amendments 363

(22,074)

Curtailments (8,808) (1,454)

Special termination benefits 4,895

Benefit obligation at end of year $ 207,926 $ 220,741 $ 59,783

$ 84,210

Change in plan assets:

Fair value of plan assets at beginning of year $ 303,726 $ 5,528 $ 7,682

$

Actual return on plan assets 23,757

2,344 674

46

Employer contributions 880

129 3,686

149

Plan participant contributions

532

Plan assets acquired through acquisition

299,175

7,636

Benefits paid (20,028) (3,450) (4,218) (149)

Fair value of plan assets at end of year $ 308,335 $ 303,726 $ 8,356

$ 7,682

Funded status at end of year $ 100,409 $ 82,985 $ (51,427) $ (76,528)

Balance Sheet Presentation:

Other assets $ 111,013 $ 96,191 $

$

Other liabilities (10,604) (13,206) (51,427) (76,528)

Net amount recognized at end of year $ 100,409 $ 82,985 $ (51,427) $ (76,528)

Accumulated benefit obligation at end of year $ 207,926 $ 213,061 n/a

n/a

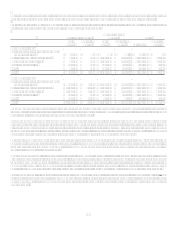

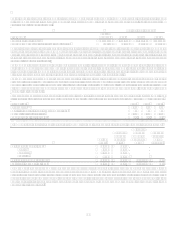

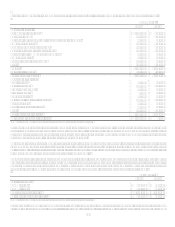

Components of net periodic benefit cost:

Service cost $ 15,014

$ 1,087 $ 8,373

$ 6,942

Interest cost 12,034

1,347 4,678

2,708

Expected return on plan assets (21,688) (2,223) (574) (46)

Amortization of transition obligation, prior service credit, and net actuarial

loss 188

175 (4,308) (3,711)

Curtailment gain (8,483) (1,454)

Special termination benefits 4,895

Net periodic benefit cost $ 1,960

$ 386 $ 6,715

$ 5,893

Changes recognized in other comprehensive income, pretax:

Transition obligation $

$ 276

Prior service (cost) credit (363) 21,798

Net actuarial gain 18,354

10,814

Reclassification adjustments for amounts recognized in net periodic benefit

cost 511

(4,308)

Total recognized in other comprehensive income $ 18,502

$ 28,580