Capital One 2007 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

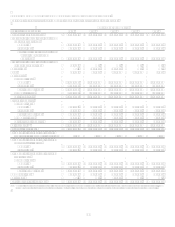

62

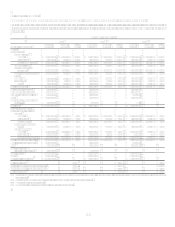

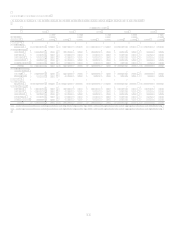

Item 8. Financial Statements and Supplementary Data

CONSOLIDATED BALANCE SHEETS

December 31 (In Thousands, Except Share and Per Share Data) 2007 2006

Assets:

Cash and due from banks $ 2,377,287

$ 2,817,519

Federal funds sold and resale agreements 1,766,762

1,099,156

Interest-bearing deposits at other banks 677,360

743,821

Cash and cash equivalents 4,821,409

4,660,496

Securities available for sale 19,781,587

15,452,047

Mortgage loans held for sale 315,863

10,435,295

Loans held for investment 101,805,027

96,512,139

Less: Allowance for loan and lease losses (2,963,000) (2,180,000)

Net loans held for investment 98,842,027

94,332,139

Accounts receivable from securitizations 4,717,879

4,589,235

Premises and equipment, net 2,299,603

2,203,280

Interest receivable 839,317

816,426

Goodwill 12,830,740

13,635,435

Other 6,141,944

3,614,932

Total assets $ 150,590,369 $ 149,739,285

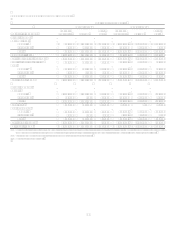

Liabilities:

Non-interest bearing deposits $ 11,046,549

$ 11,648,070

Interest-bearing deposits 71,943,913

74,122,822

Total deposits 82,990,462

85,770,892

Senior and subordinated notes 10,712,706

9,725,470

Other borrowings 26,583,683

24,257,007

Interest payable 631,609

574,763

Other 5,377,797

4,175,947

Total liabilities 126,296,257

124,504,079

Stockholders Equity:

Preferred stock, par value $.01 per share; authorized 50,000,000 shares, none issued or

outstanding

Common stock, par value $.01 per share; authorized 1,000,000,000 shares, 419,224,900 and

412,219,973 issued as of December 31, 2007 and 2006, respectively 4,192

4,122

Paid-in capital, net 15,860,490

15,333,137

Retained earnings 11,267,568

9,760,184

Cumulative other comprehensive income 315,248

266,180

Less: Treasury stock, at cost; 46,370,635 and 2,294,586 shares as of December 31, 2007

and 2006, respectively (3,153,386) (128,417)

Total stockholders equity 24,294,112

25,235,206

Total liabilities and stockholders equity $ 150,590,369 $ 149,739,285

See Notes to Consolidated Financial Statements.