Capital One 2007 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.29

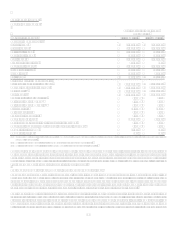

Restructuring Charges Associated with Cost Initiative

During the second quarter of 2007, we announced a broad-based initiative to reduce expenses and improve our competitive cost

position. We recognized $138.2 million in restructuring charges in 2007. Additional information can be found in Item 8 Financial

Statements and Supplementary DataNotes to the Consolidated Financial StatementsNote 22Restructuring.

Share Repurchase

During 2007, we executed a $3.0 billion stock repurchase program, resulting in a net share retirement of 43,717,110 shares. Additional

information can be found in Item 8 Financial Statements and Supplementary DataNotes to the Consolidated Financial

StatementsNote 16Accelerated Share Repurchase Program and Part 2, Item 5. Market for Companys Common Equity and

Related Stockholder Matters.

Litigation Settlements and Reserves

During the fourth quarter of 2007, we recognized a pre-tax charge of $79.8 million for liabilities in connection with the antitrust

lawsuit settlement with American Express. Additionally, we recorded a legal reserve of $59.1 million for estimated possible damages

in connection with other pending Visa litigation, reflecting our share of such potential damages as a Visa member. Additional

information can be found in Item 8 Financial Statements and Supplementary DataNotes to the Consolidated Financial

StatementsNote 21Commitments, Contingencies and Guarantees and Part 1, Item 3. Legal Proceedings.

Sale of Interest in Spain

During 2007, the Company completed the sale of its interest in a relationship agreement to develop and market consumer credit

products in Spain and recorded a net gain related to this sale of $31.3 million consisting of a $41.6 million increase in non-interest

income partially offset by a $10.3 million increase in non-interest expense.

Gain on Sale of MasterCard Shares

As a result of MasterCards IPO in 2006, Capital One owned class B shares of MasterCard common stock, with sale restrictions that

were originally scheduled to expire on May 31, 2010. In 2007 shareholders approved an amendment to the MasterCard Certificate of

Incorporation that provides for an accelerated conversion of class B common stock into class A common stock. The MasterCard Board

of Directors approved a conversion window running from August 4 to October 5, 2007, during which time owners of class B shares

may voluntarily elect to convert and sell a certain number of their shares. During the conversion period, Capital One elected to convert

and sell 300,482 shares of MasterCard class B common stock. The Company recognized gains of $43.4 million on these transactions

in non-interest income.

Gain on Sale of Securities

In 2001 we acquired a 7% stake in the privately held company DealerTrack, a leading provider of on-demand software and data

solutions for the automotive retail industry. DealerTrack went public in 2005. During the first quarter of 2007 we sold our remaining

interest of 1,832,767 shares for $52.2 million resulting in a pre-tax gain of $46.2 million in non-interest income.

Senior Note Issuance

During the third quarter 2007, we closed the public offering of $1.5 billion aggregate principal amount of our Senior Notes Due 2017

(the Notes). The Notes were issued pursuant to a Senior Indenture dated as of November 1, 1996 (the Indenture) between the

Corporation and The Bank of New York Trust Company, N.A. (as successor to Harris Trust and Savings Bank), as Indenture Trustee.

Proceeds from the sale of the notes will be used for general corporate purposes, which may include repurchases of shares of our

common stock. Additional information can be found in Item 8 Financial Statements and Supplementary DataNotes to the

Consolidated Financial StatementsNote 9Borrowings and Part 2, Item 7, Section VIII. Funding.

Acceleration of Equity Awards

During the second quarter of 2007, a charge of $39.8 million was taken against salaries and associate benefits. This charge was taken

as a result of the accelerated vesting of equity awards in conjunction with the transition of the Banking leadership team, consistent

with the terms of the awards. This charge is not included as a restructuring charge associated with our 2007 cost initiative.

Income Taxes

We recognized a $69.0 million one-time tax benefit in the second quarter of 2007 resulting from previously unrecognized tax benefits

related to our international tax position. In addition, we recognized a $29.7 million reduction in retained earnings associated with the

adoption of FIN 48 in 2007.