Capital One 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

reportable segment is based on a wide range of indicators to include both historical and forecasted operating results. See Note 4 for

further discussion of the Companys operating and reportable segments.

Note 2

Discontinued Operations

Shutdown of Mortgage Origination Operations of Wholesale Mortgage Banking Unit

In the third quarter of 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint, realizing an after-tax loss for the year ended December 31, 2007 of $1.0 billion. GreenPoint was acquired by the

Company in December 2006 as part of the North Fork acquisition. The results of the mortgage origination operations of GreenPoint

have been accounted for as a discontinued operation and have been removed from the Companys results from continuing operations

for 2007 and 2006.

The results of GreenPoints mortgage servicing business continue to be reported as part of the Companys continuing operations. The

mortgage servicing function was moved into the Local Banking Segment in conjunction with the shutdown of the mortgage

origination operation and the results of the Local Banking Segment include the mortgage servicing results for each period of 2007.

The commercial and consumer mortgage held for investment portfolios were reported in the Local Banking Segment and the Other

category, respectively, in the fourth quarter of 2007.

The Company retained $1.6 billion of certain GreenPoint loans and reclassified them from mortgage loans held for sale to held for

investment during 2007. Continuing cash flows from the held for investment loan portfolios are included in the Companys results of

continuing operations for the fourth quarter of 2007 and classified as operating cash flows in the statement of cash flows. The

Company will have no significant continuing involvement in the operations of the originate and sell business of GreenPoint.

Major components of the $1.0 billion after-tax loss associated with the shut down of GreenPoints origination operations include

approximately $646.0 million from the non-cash write-down of goodwill associated with the acquisition of GreenPoint as part of the

North Fork Bancorporation in December 2006, $238.8 million of valuation adjustments, $81.3 million in restructuring charges

associated with severance benefits and facilities closure and $55.3 million in loss from operations. The vast majority of charges

associated with the shutdown of GreenPoints mortgage origination operations were incurred in the third quarter of 2007.

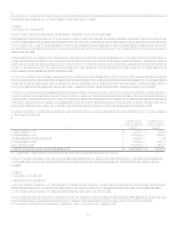

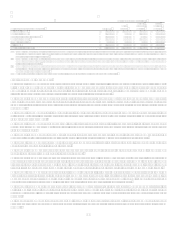

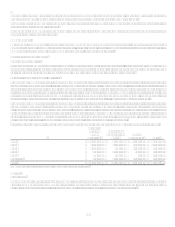

The following is summarized financial information for discontinued operations related to the closure of the Companys wholesale

mortgage banking unit:

Year Ended

December 31,

2007

Year Ended

December 31,

2006

Net interest income(1) $ 62,402

$ 8,184

Non-interest income (229,285) (4,292)

Provision for loan and lease losses 80,151

Non-interest expense 989,189

23,502

Income tax benefit (214,836) (7,726)

Loss from discontinued operations, net of taxes $ (1,021,387) $ (11,884)

(1) Net interest income includes funding charges of $70.0 million in 2007 based on funds transfer pricing methodology.

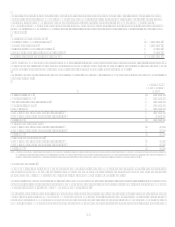

The Companys wholesale mortgage banking unit had assets of approximately $91.3 million as of December 31, 2007 consisting of

$35.8 million of mortgage loans held for sale and other related assets. The related liabilities consisted of obligations to fund these

assets.

Note 3

Business Combinations

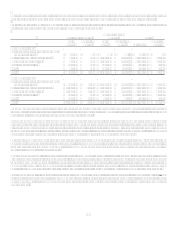

North Fork Bancorporation

On December 1, 2006, the Company acquired 100% of the outstanding common stock of North Fork Bancorporation (North Fork),

a regional bank holding company headquartered in New York conducting commercial and retail banking from branch locations in

New York, New Jersey, and Connecticut, with a national mortgage banking business.

The acquisition was accounted for under the purchase method of accounting, and, as such, the assets and liabilities of North Fork were

recorded at their respective fair values as of December 1, 2006. The results of North Forks operations were included in the

Companys Consolidated Reported Statement of Income commencing December 1, 2006.