Capital One 2007 Annual Report Download - page 120

Download and view the complete annual report

Please find page 120 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

98

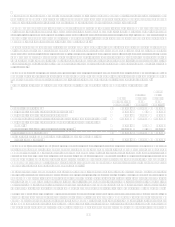

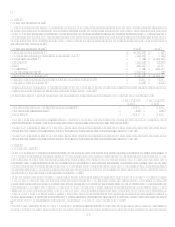

Also as of December 31, 2007, the Corporation was considered well-capitalized under Federal Reserve capital standards for bank

holding companies and, therefore, exceeded all minimum capital requirements. There have been no conditions or events since that we

believe would have changed the capital category of the Corporation or any of the Banks.

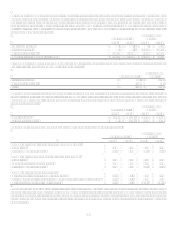

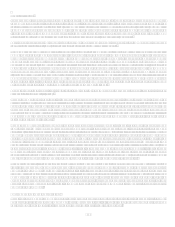

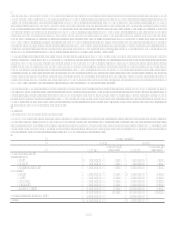

Regulatory

Filing

Basis

Ratios

Applying

Subprime

Guidance

Ratios

Minimum for Capital

Adequacy Purposes

To Be Well Capitalized

Under

Prompt Corrective Action

Provisions

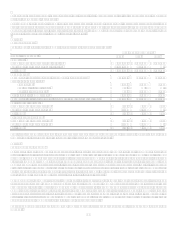

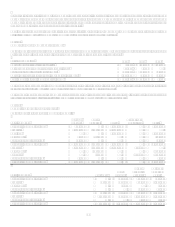

December 31, 2007

Capital One Financial Corp.(1)

Tier 1 Capital 10.13% 9.49% 4.00% N/A

Total Capital 13.05 12.29 8.00 N/A

Tier 1 Leverage 9.00 9.00 4.00 N/A

Capital One Bank

Tier 1 Capital 13.48% 10.45% 4.00% 6.00%

Total Capital 16.57 13.06 8.00 10.00

Tier 1 Leverage 12.81 12.81 4.00 5.00

Capital One, N.A.

Tier 1 Capital 10.75% N/A 4.00% 6.00%

Total Capital 12.11 N/A 8.00 10.00

Tier 1 Leverage 8.37 N/A 4.00 5.00

Superior Bank

Tier 1 Capital 15.07% N/A 4.00% 6.00%

Total Capital 16.33 N/A 8.00 10.00

Tier 1 Leverage 6.71 N/A 4.00 5.00

December 31, 2006

Capital One Financial Corp.(1)

Tier 1 Capital 10.22% 9.36% 4.00% N/A

Total Capital 13.27 12.26 8.00 N/A

Tier 1 Leverage 12.35 12.35 4.00 N/A

Capital One Bank

Tier 1 Capital 12.30% 9.38% 4.00% 6.00%

Total Capital 15.94 12.39 8.00 10.00

Tier 1 Leverage 11.56 11.56 4.00 5.00

Capital One, F.S.B.(2)

Tier 1 Capital 13.01% 10.66% 4.00% 6.00%

Total Capital 14.29 11.93 8.00 10.00

Tier 1 Leverage 13.28 13.28 4.00 5.00

Capital One, N.A.

Tier 1 Capital 11.05% N/A 4.00% 6.00%

Total Capital 12.04 N/A 8.00 10.00

Tier 1 Leverage 7.61 N/A 4.00 5.00

North Fork Bank(2)

Tier 1 Capital 11.21% N/A 4.00% 6.00%

Total Capital 12.11 N/A 8.00 10.00

Tier 1 Leverage 8.09 N/A 4.00 5.00

Superior Bank

Tier 1 Capital 12.28% N/A 4.00% 6.00%

Total Capital 12.60 N/A 8.00 10.00

Tier 1 Leverage 6.16 N/A 4.00 5.00

(1) The regulatory framework for prompt corrective action is not applicable for bank holding companies.

(2) During 2007, Capital One F.S.B and North Fork Bank merged with and into CONA.

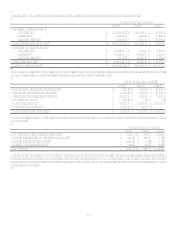

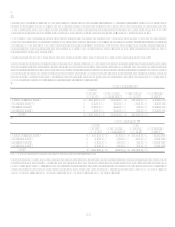

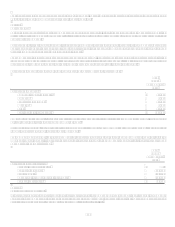

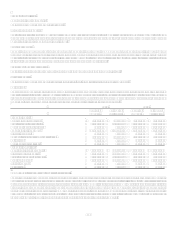

COB treats a portion of its loans as subprime under the Expanded Guidance for Subprime Lending Programs (the Subprime

Guidance) issued by the four federal banking agencies that comprise the Federal Financial Institutions Examination Council

(FFIEC), and have assessed its capital and allowance for loan and lease losses accordingly. Under the Subprime Guidance, COB

exceeds the minimum capital adequacy guidelines as of December 31, 2007.

For purposes of the Subprime Guidance, the Corporation has treated as subprime all loans in COBs targeted subprime programs to

customers either with a FICO score of 660 or below or with no FICO score. COB holds on average 200% of the total risk-based

capital charge that would otherwise apply to such assets. This results in higher levels of regulatory capital at COB.