Capital One 2007 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.26

the Company would adjust related valuation allowances in the period that the change in circumstances occurs, along with a

corresponding increase or charge to income.

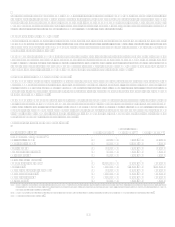

For the years ended December 31, 2007 and 2006, the provision for income taxes on continuing operations was $1.3 billion and $1.2

billion, respectively, and as of December 31, 2007 and 2006, the valuation allowance was $21.3 million and $14.6 million,

respectively.

III. Off-Balance Sheet Arrangements

Off-Balance Sheet Securitizations

The Company actively engages in off-balance sheet securitization transactions of loans for funding purposes. The Company receives

the proceeds from third party investors for securities issued from the Companys securitization vehicles which are collateralized by

transferred receivables from the Companys portfolio. Securities outstanding totaling $48.9 billion and $49.0 billion as of

December 31, 2007 and 2006, respectively, represent undivided interests in the pools of consumer loan receivables that are sold in

underwritten offerings or in private placement transactions.

The securitization of consumer loans has been a significant source of liquidity for the Company. Maturity terms of the existing

securitizations vary from 2008 to 2025 and, for revolving securitizations, have accumulation periods during which principal payments

are aggregated to make payments to investors. As payments on the loans are accumulated and are no longer reinvested in new loans,

the Companys funding requirements for such new loans increase accordingly. The Company believes that it has the ability to

continue to utilize off-balance sheet securitization arrangements as a source of liquidity; however, a significant reduction or

termination of the Companys off-balance sheet securitizations could require the Company to draw down existing liquidity and/or to

obtain additional funding through the issuance of secured borrowings or unsecured debt, the raising of additional deposits or the

slowing of asset growth to offset or to satisfy liquidity needs.

Recourse Exposure

The credit quality of the receivables transferred is supported by credit enhancements, which may be in various forms including

interest-only strips, subordinated interests in the pool of receivables, cash collateral accounts, cash reserve accounts and accrued

interest and fees on the investors share of the pool of receivables. Some of these credit enhancements are retained by the seller

and are referred to as retained residual interests. The Companys retained residual interests are generally restricted or

subordinated to investors interests and their value is subject to substantial credit, repayment and interest rate risks on

transferred assets if the off-balance sheet loans are not paid when due. Securitization investors and the trusts only have recourse

to the retained residual interests, not the Companys assets. See Item 8 Financial Statements and Supplementary DataNotes

to the Consolidated Financial StatementsNote 24 for quantitative information regarding retained interests.

Collections and Amortization

Collections of interest and fees received on securitized receivables are used to pay interest to investors, servicing and other fees,

and are available to absorb the investors share of credit losses. For revolving securitizations, amounts collected in excess of that

needed to pay the above amounts are remitted, in general, to the Company. Under certain conditions, some of the cash collected

may be retained to ensure future payments to investors. For amortizing securitizations, amounts collected in excess of the

amount that is used to pay the above amounts are generally remitted to the Company, but may be paid to investors in further

reduction of their outstanding principal. See Item 8 Financial Statements and Supplementary DataNotes to the Consolidated

Financial StatementsNote 24 for quantitative information regarding revenues, expenses and cash flows that arise from

securitization transactions.

Securitization transactions may amortize earlier than scheduled due to certain early amortization triggers, which would

accelerate the need for funding. Additionally, early amortization would have a significant impact on the ability of the Company

to meet regulatory capital adequacy requirements as all off-balance sheet loans experiencing such early amortization would be

recorded on the balance sheet and accordingly would require incremental regulatory capital. As of December 31, 2007, no early

amortization events related to the Companys off-balance sheet securitizations have occurred.

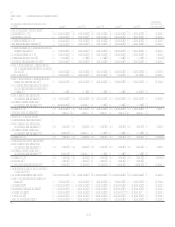

The amounts of investor principal from off-balance sheet consumer loans as of December 31, 2007 that are expected to amortize

into the Companys consumer loans, or be otherwise paid over the periods indicated, are summarized in Table 11. Of the

Companys total managed loans, 33% and 34% were included in off-balance sheet securitizations for the years ended

December 31, 2007 and 2006, respectively.

Letters of Credit

The Company issues letters of credit (financial standby, performance standby and commercial) to meet the financing needs of its

customers. Standby letters of credit are conditional commitments issued by the Company to guarantee the performance of a customer