Capital One 2007 Annual Report Download - page 117

Download and view the complete annual report

Please find page 117 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

95

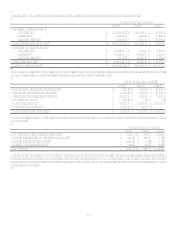

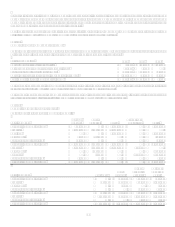

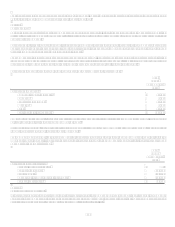

In addition to the $1.5 billion ASR, the Company repurchased $1.5 billion of shares in open market repurchases during the year ended

December 31, 2007. The impact of the share repurchases, including the ASR, on basic and diluted EPS for the year ended

December 31, 2007 was $0.21 and $0.20, respectively. The impact on basic and diluted EPS from continuing operations for the year

ended December 31, 2007 was $0.34 and $0.33, respectively.

Additional share repurchase information is included in Part 2, Item 7. Section V, Management Summary, 2007 Significant Events and

Part 2, Item 5. Market for Companys Common Equity and Related Stockholder Matters.

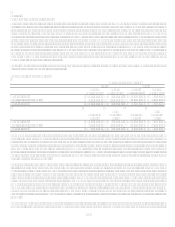

Note 17

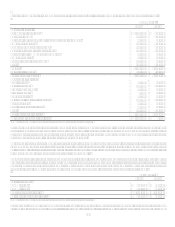

Cumulative Other Comprehensive Income

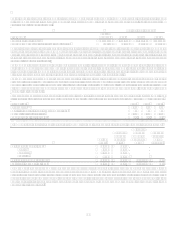

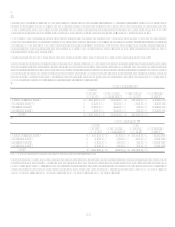

The following table presents the cumulative balances of the components of other comprehensive income, net of deferred tax of $68.3

million, $67.0 million and $22.2 million as of December 31, 2007, 2006 and 2005, respectively:

As of December 31 2007 2006 2005

Unrealized gains (losses) on securities $ 9,279 $ (47,134) $ (71,253)

Net unrecognized elements of defined benefit plans 32,846 3,439

Foreign currency translation adjustments 375,258 291,759 45,693

Unrealized (losses) gains on cash flow hedging instruments (102,135) 18,116 31,689

Total cumulative other comprehensive income $ 315,248 $ 266,180 $ 6,129

During 2007, 2006 and 2005, the Company reclassified $34.7 million, $10.1 million and $32.2 million, respectively of net gains, after

tax, on derivative instruments from cumulative other comprehensive income into earnings.

During 2007, 2006 and 2005, the Company reclassified $28.3 million, $(81.9) million and $(3.0) million, respectively of net gains

(losses) on sales of securities, after tax, from cumulative other comprehensive income into earnings.

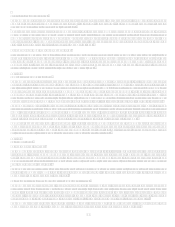

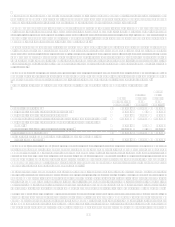

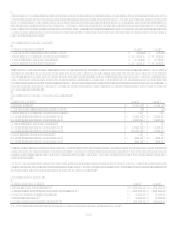

Note 18

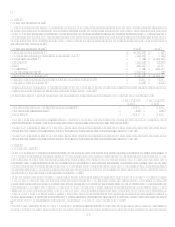

Goodwill and Other Intangible Assets

The following table provides a summary of goodwill.

Total Company

National

Lending Local

Banking Other

Discontinued

Operations Total

Balance at December 31, 2005 $ 718,065 $ $ 3,188,334 $ $ 3,906,399

Transfers 1,545,993 1,642,341 (3,188,334)

Additions 9,732,627 9,732,627

Adjustments 3,795 (18,413) (14,618)

Foreign currency translation 11,027 11,027

Balance at December 31, 2006 $ 2,278,880 $ 1,623,928 $ 9,732,627 $ $ 13,635,435

Transfers 3,954,025 5,128,602 (9,732,627) 650,000

Adjustments (148,339) (148,339)

Disposals (9,151) (650,000) (659,151)

Foreign currency translation 2,795 2,795

Balance at December 31, 2007 $ 6,235,700 $ 6,595,040 $ $ $ 12,830,740

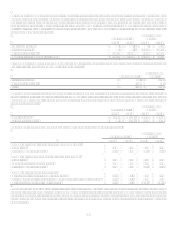

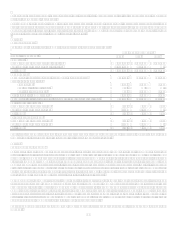

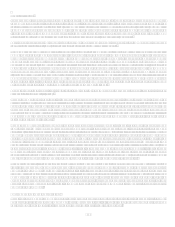

Total Company U.S. Card

Auto

Finance

Global

Financial

Services

National

Lending

Total

Balance at December 31, 2005 $ $ 328,192 $ 389,873 $ 718,065

Transfers 762,284 431,661 352,048 1,545,993

Adjustments 3,795 3,795

Foreign currency translation 11,027 11,027

Balance at December 31, 2006 $ 762 284 $ 763,648 $ 752,948 $ 2,278,880

Transfers 2,242,896 666,740 1,044,389 3,954,025

Foreign currency translation 2,795 2,795

Balance at December 31, 2007 $ 3,005,180 $ 1,430,388 $ 1,800,132 $ 6,235,700