Capital One 2007 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.13

U.K. Bank obtains capital through earnings or through additional capital infusion from COB, subject to approval under Regulation K

of the rules administered by the Federal Reserve. If the U.K. Bank is unable to generate or maintain sufficient capital on favorable

terms, it may choose to restrict its growth to reduce the regulatory capital required. Following the introduction of the Capital

Requirements Directive, the U.K. Bank continues to have a healthy capital surplus and the impact of the new capital regime has been

fully factored into the U.K. Banks financial and capital planning. In addition, the U.K. Bank is limited by the U.K. Companies Act

1985 in its distribution of dividends to COB in that such dividends may only be paid out of the U.K. Banks distributable profits.

As in the U.S., in non-U.S. jurisdictions where we operate, we face a risk that the laws and regulations that are applicable to us (or the

interpretations of existing laws by relevant regulators) may change in ways that adversely impact our business. The OFT is

investigating Visas and MasterCards current methods of setting interchange fees applicable to U.K. domestic transactions. Cross-

border interchange fees are also coming under scrutiny from the European Commission, which in December 2007 issued a decision

notice stating that MasterCards interchange fees applicable to cross border transactions are in breach of European Competition Law.

A similar decision is expected in relation to Visas cross border interchange fees. While there is not expected to be a final

determination of the OFTs case before the end of 2009, the most likely outcome is that interchange fees will be reduced and this

could adversely affect the yield on U.K. credit card portfolios, including ours, and could therefore adversely impact our earnings.

Finally, in the United Kingdom, the Consumer Credit Act 2006 received Royal Assent on March 30, 2006 and has an implementation

timetable extending from 2006 to 2008. The purpose of the Act is to reform the Consumer Credit Act1974. The key areas covered

by the Act are as follows: the creation of an unfair relationship test to enable debtors to challenge unfair relationships with creditors,

the creation of alternative dispute resolution options for credit agreements, a requirement on lenders to provide additional information

to debtors after the agreement is made, and a stricter licensing regime that will give the OFT new powers to fine lenders for their

behavior. At present it is not believed that these changes will have a material impact on the U.K. Banks business model.

Finally, we were cited by the FSA following an investigation into the sale of payment protection insurance (PPI). PPI is a cross-sell

product which protects a borrowers ability to keep up the payments on their credit card or loan in case of an accident, sickness or

unemployment for a period of up to 12 months. In relation to our sale of PPI, we were fined by the FSA for failing to have adequate

systems and controls and for failing to treat our customers fairly. Prior to the FSAs investigation, Capital One had started a project to

implement a number of significant improvements to its sales and administrative processes concerning PPI with a focus on customer

communications. Capital One proactively worked with the FSA and has addressed all of its concerns. The fine did not have a material

adverse effect on our results of operations or financial condition, and was significantly lower than other recent fines the FSA have

imposed on other providers for failings in this area. Following subsequent thematic work in this area, the FSA noted that the U.K.

Bank improved significantly in a number of areas and that the FSA did not have any major concerns at this time.

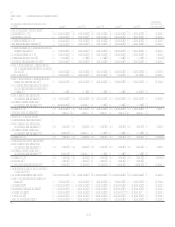

Statistical Information

The statistical information required by Item 1 can be found in Item 6 Selected Financial Data, Item 7 Management Discussion and

Analysis of Financial Condition and Results of Operations and in Item 8, Financial Statements and Supplementary Data.

Item 1A. Risk Factors

This Annual Report on Form 10-K contains forward-looking statements within the meaning of the Private Securities Litigation

Reform Act of 1995. We also may make written or oral forward-looking statements in our periodic reports to the Securities and

Exchange Commission on Forms 10-Q and 8-K, in our annual report to shareholders, in our proxy statements, in our offering circulars

and prospectuses, in press releases and other written materials and in statements made by our officers, directors or employees to third

parties. Statements that are not about historical facts, including statements about our beliefs and expectations, are forward-looking

statements. Forward-looking statements include, but are not limited to information relating to our future earnings per share, growth in

managed loans outstanding, product mix, segment growth, managed revenue margin, funding costs, operations costs, employment

growth, marketing expense, delinquencies and charge-offs. Forward-looking statements also include statements using words such as

expect, anticipate, hope, intend, plan, believe, estimate or similar expressions. We have based these forward-looking

statements on our current plans, estimates and projections, and you should not unduly rely on them.

Forward-looking statements are not guarantees of future performance. They involve risks, uncertainties and assumptions, including the

risks discussed below. Our future performance and actual results may differ materially from those expressed in forward-looking

statements. Many of the factors that will determine these results and values are beyond our ability to control or predict. Forward-

looking statements speak only as of the date that they are made, and we undertake no obligation to publicly update or revise any

forward-looking statements, whether as a result of new information, future events or otherwise. You should carefully consider the

factors discussed below in evaluating these forward-looking statements.