Capital One 2007 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.30

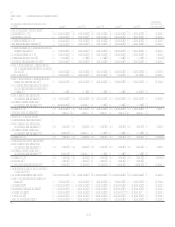

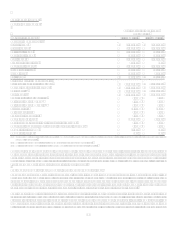

Year Ended December 31, 2006 Compared to Year Ended December 31, 2005

Net income was $2.4 billion, or $7.62 per share (diluted) for 2006, compared to $1.8 billion, or $6.73 per share (diluted) for 2005. Net

income for 2006 included an after-tax loss from discontinued operations of $11.9 million, or $0.03 per share (diluted).

Income from continuing operations for 2006 was $2.4 billion, an increase of $617.2 million, or 34% from 2005. Diluted earnings per

share from continuing operations for 2006 were $7.65, an increase of 14% from 2005.

Results from continuing operations for 2006 include:

The impact of a full year of results of operations from the Hibernia acquisition in November 2005 and one month of North

Fork Bank acquisition which was completed on December 1, 2006. The dilutive impact on earnings per share of $0.32

from the 103.8 million incremental shares issued in December 2006 related to the North Fork acquisition.

Revenue growth resulting from managed loan growth in the Auto Finance and Global Financial Services sub-segments

and a full year of Hibernia results, offset by declining revenues in U.S. Card driven by ongoing changes in product

strategy.

Slight decline in the provision for loan losses compared to 2005, despite reported loan growth, due to increased

concentration of higher credit quality loans in the reported loan portfolio combined with a continued favorable loss

environment resulting from, in part, a slower than expected return of bankruptcy related charge-offs to historical levels,

and the alignment of allowance methodologies across acquired businesses.

Increased non-interest expenses driven primarily by a full year of Hibernias results which contributed $951.3 million

(which includes integration costs and costs to support the branch expansion efforts) of the overall increase, the one month

impact of the North Fork acquisition which added $97.4 million of operating expense, and increased costs for

infrastructure investments, including the conversion of the Companys cardholder transaction and account processing

platform.

Managed loans as of December 31, 2006 were $146.2 billion, up 39% from 2005. Excluding the $31.7 billion of loans

from the North Fork acquisition, managed loans grew to $114.4 billion, with organic loan growth at 10% year over year.

Diversified funding from the acquisition of North Fork which added $38.5 billion of deposits to the Companys balance

sheet. Deposits were $85.8 billion at December 31, 2006.

2006 Significant Events

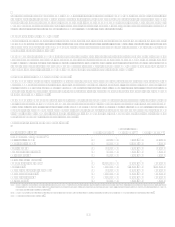

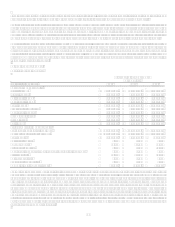

Acquisition of North Fork Bancorporation

On December 1, 2006, Capital One acquired 100% of the outstanding common stock of North Fork Bancorporation, a bank holding

company with more than 350 bank branches in the New York metropolitan area and a nationwide mortgage business. Pursuant to the

Merger Agreement, each share of North Fork common stock outstanding at the effective time of the merger was converted into the

right to receive either $28.144 in cash or 0.3692 of a share of Capital One common stock, at the election of each North Fork

stockholder, subject to proration due to limitations on the aggregate amount of cash to be paid by Capital One in the merger and

depending on the election of other North Fork stockholders, as specified in the Merger Agreement. The total consideration for the

acquisition was $13.2 billion.

The average of the closing prices of Capital One common stock on the NYSE for the five trading days ending the day before the

completion of the merger was $76.24. The total consideration of $13.2 billion included the value of outstanding stock options and was

paid with the issuance of 103.8 million shares of Capital Ones common stock and $5.2 billion in cash consideration. Upon

completion of the merger, outstanding options of North Fork were exchanged for options of Capital One with the number of options

and option price adjusted for the exchange ratio. Capital One financed the cash portion of the acquisition through a combination of

short term liquidity conversions and debt offerings. Specifically, Capital One acquired the common shares by liquidating $1.0 billion

of federal funds sold and resale agreements and by issuing $995.0 million of junior subordinated debentures and $3.2 billion of senior

and subordinated debt.

Debt Issuance to fund North Fork Acquisition

In June 2006, the Company issued $345.0 million aggregate principal amount of 7.5% junior subordinated debentures that are

scheduled to mature on June 15, 2066. For regulatory capital purposes the debentures are treated as equity and serve to increase Tier 1

and Total Risk Based Capital at the holding company level.

In July 2006, the Company issued $650.0 million aggregate principal amount of 7.686% junior subordinated debentures that are

scheduled to mature on August 15, 2036. For regulatory capital purposes the debentures are treated as equity and serve to increase

Tier 1 and Total Risk Based Capital at the holding company level.