Capital One 2007 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

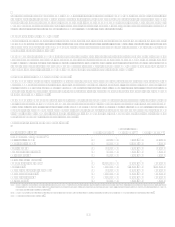

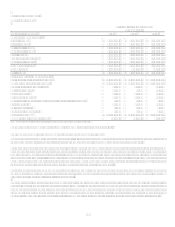

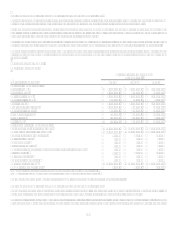

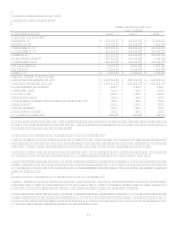

CAPITAL ONE FINANCIAL CORPORATION

Table 1: Financial Summary

Year Ended December 31, Change

(Dollars in thousands) 2007(6) 2006(5) 2005(4) 2007 vs. 2006 2006 vs. 2005

Earnings (Reported):

Net Interest Income $ 6,529,845

$ 5,091,446 $ 3,680,242 $ 1,438,399 $ 1,411,204

Non-Interest Income:

Servicing and securitizations 4,840,677

4,209,637 3,945,183 631,040 264,454

Service charges and other customer-related fees 2,057,854

1,770,340 1,493,690 287,514 276,650

Mortgage servicing and other 166,776

177,893 142,894 (11,117) 34,999

Interchange 500,484

549,074 514,196 (48,590) 34,878

Other 488,432

294,080 262,142 194,352 31,938

Total non-interest income 8,054,223

7,001,024 6,358,105 1,053,199 642,919

Total Revenue(1) 14,584,068

12,092,470 10,038,347 2,491,598 2,054,123

Provision for loan and lease losses 2,636,502

1,476,438 1,491,072 1,160,064 (14,634)

Marketing 1,347,836

1,444,324 1,379,938 (96,488) 64,386

Restructuring expenses 138,237

138,237

Operating expenses 6,591,937

5,499,367 4,338,335 1,092,570 1,161,032

Income before taxes 3,869,556

3,672,341 2,829,002 197,215 843,339

Income taxes 1,277,837

1,245,964 1,019,855 31,873 226,109

Income from continuing operations, net of tax 2,591,719

2,426,377 1,809,147 165,342 617,230

Loss from discontinued operations, net of tax (1,021,387) (11,884) (1,009,503) (11,884)

Net Income $ 1,570,332

$ 2,414,493 $ 1,809,147 $ (844,161) $ 605,346

Common Share Statistics:

Basic EPS:

Income from continuing operations, net of tax $ 6.64

$ 7.84 $ 6.98 $ (1.20) $ 0.86

Loss from discontinued operations, net of tax (2.62) (0.04) (2.58) (0.04)

Net Income $ 4.02

$ 7.80 $ 6.98 $ (3.78) $ 0.82

Diluted EPS:

Income from continuing operations, net of tax $ 6.55

$ 7.65 $ 6.73 $ (1.10) $ 0.92

Loss from discontinued operations, net of tax (2.58) (0.03) (2.55) (0.03)

Net Income $ 3.97

$ 7.62 $ 6.73 $ (3.65) $ 0.89

Selected Balance Sheet Data(3):

Reported loans held for investment (period end) $ 101,805,027 $ 96,512,139 $ 59,847,681 $ 5,292,888 $ 36,664,458

Managed loans held for investment (period end) 151,362,417

146,151,268 105,527,491 5,211,149 40,623,777

Reported loans held for investment (average) 93,541,825

63,577,279 40,734,237 29,964,546 22,843,042

Managed loans held for investment (average) 144,727,006

111,328,595 85,265,023 33,398,411 26,063,572

Allowance for loan and lease losses 2,963,000

2,180,000 1,790,000 783,000 390,000

Interest bearing deposits (period end) 71,943,913

74,122,822 43,092,096 (2,178,909) 31,030,726

Total deposits (period end) 82,990,462

85,770,892 47,933,267 (2,780,430) 37,837,625

Interest bearing deposits (average) 73,980,520

45,739,027 28,370,735 28,241,493 17,368,292

Total deposits (average) $ 85,427,225

$ 50,673,434 $ 29,019,652 $ 34,753,792 $ 21,653,782

Selected Company Metrics (Reported) (3):

Return on average assets (ROA) 1.79% 2.55% 2.95% (0.76) (0.40)

Return on average equity (ROE) 10.28% 14.97% 17.08% (4.69) (2.11)

Net charge-off rate 2.10% 2.21% 3.55% (0.11) (1.34)

Net interest margin 5.38% 6.06% 6.63% (0.68) (0.57)

Revenue margin 12.01% 14.38% 18.08% (2.37) (3.70)

Selected Company Metrics (Managed) (3):

Return on average assets (ROA) 1.33% 1.70% 1.72% (0.37) (0.02)

Net charge-off rate 2.88% 2.84% 4.25% 0.04 (1.41)

Net interest margin 6.46% 6.88% 7.80% (0.42) (0.92)

Revenue margin 9.85% 10.66% 12.46% (0.81) (1.80)

(1) In accordance with the Companys finance charge and fee revenue recognition policy, the amounts billed to customers but not recognized as revenue were $1.1 billion, $0.9

billion and $1.0 billion for the years ended December 31, 2007, 2006 and 2005, respectively.

(2) Prior period amounts have been reclassified to conform with current period presentation.

(3) Based on continuing operations.

(4) On November 16, 2005, the Company acquired 100% of the outstanding common stock of Hibernia Corporation for total consideration of $5.0 billion.

(5) On December 1, 2006, the Company acquired 100% of the outstanding common stock of North Fork Bancorporation for total consideration of $13.2 billion.

(6) Discontinued operations related to the shutdown of mortgage origination operations of GreenPoints wholesale mortgage banking unit in 2007.

Summary of the Reported Income Statement

The following is a detailed description of the financial results reflected in Table 1 Financial Summary. Additional information is

provided in Section XII, Tabular Summary as detailed in sections below.