Capital One 2007 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

are assumed to mature consistent with business line expectations or, when available in the case of marketable securities, market

expectations. As of December 31, 2007, the Companys Asset/Liability Management Policy limited the change in projected 12-month

earnings due to instantaneous parallel rate shocks of +/-200 basis points to less than 3% of base net interest income. The measurement

of impact to current earnings includes the change in net interest income and the change in the valuation of mortgage servicing rights

driven by the change in interest rates. As of December 31, 2007 the Company estimated a 1.9% reduction in 12-month net interest

income for an immediate 200 basis point rate increase and a 1.2% increase in 12-month net interest income for an immediate 200 basis

point rate decline.

In addition to limits related to possible changes in 12-month net interest income, as of December 31, 2007 the Asset/Liability

Management Policy limited the pre-tax change in economic value of equity due to instantaneous parallel rate shocks of 200 basis

points to less than 12%. As of December 31, 2007, the estimated reduction in economic value of equity due to an adverse 200 basis

point rate shock was 4.1%.

The precision of the measures used to manage interest rate risk is limited due to the inherent uncertainty of the underlying forecast

assumptions. These measures do not consider the impact of the effects of changes in the overall level of economic activity associated

with various interest rate scenarios. In addition, the measurement of interest rate sensitivity includes assumptions on the ability of

management to take action to mitigate further exposure to changes in interest rates, including, within legal and competitive

constraints, the repricing of interest rates on outstanding credit card loans and deposits.

The Company manages and mitigates its interest rate sensitivity through several techniques, which include, but are not limited to,

changing the maturity and repricing characteristics of various balance sheet categories and by entering into interest rate derivatives.

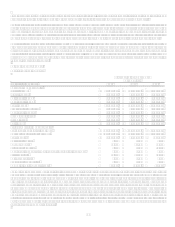

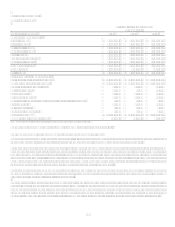

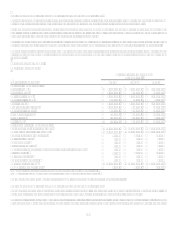

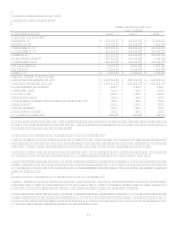

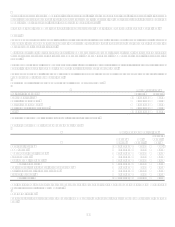

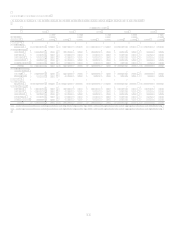

Table 12 reflects the interest rate repricing schedule for earning assets and interest-bearing liabilities as of December 31, 2007.

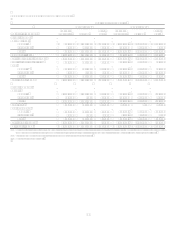

Table 12: Interest Rate Sensitivity

As of December 31, 2007

Subject to Repricing

(Dollars in Millions) Within

180 Days

>180 Days-

1 Year

>1 Year-

5 Years

Over

5 Years

Earning assets:

Federal funds sold and resale agreements $ 1,767 $ $ $

Interest-bearing deposits at other banks 677

Securities available for sale 3,633 2,387 10,839 2,923

Mortgage loans held for sale 267 5 31 13

Other 2,098

Loans held for investment 35,615 13,490 37,630 15,070

Total earning assets 44,057 15,882 48,500 18,006

Interest-bearing Liabilities:

Interest-bearing deposits 40,541 7,773 20,478 3,152

Senior and subordinated notes 2,374 716 2,902 4,721

Other borrowings 22,765 1,588 2,231

Total interest-bearing Liabilities 65,680 10,077 25,611 7,873

Non-rate related net items 1,767 (425) (4,047) (8,928)

Interest sensitivity gap (19,856) 5,380 18,842 1,205

Impact of swaps 17,303 (4,235) (11,775) (1,293)

Impact of consumer loan securitizations (9,126) 486 (123) 9,578

Interest sensitivity gap adjusted for impact of securitizations and

swaps (11,679) 1,631 6,944 9,490

Adjusted gap as a percentage of managed assets (5.86)% 0.82% 3.48% 4.76%

Adjusted cumulative gap (11,679) (10,048) (3,104) 6,386

Adjusted cumulative gap as a percentage of managed assets (5.86)% (5.04)% (1.56)% 3.20%

Foreign Exchange Risk

The Company is exposed to changes in foreign exchange rates which may impact translated income and expense associated with

foreign operations. In order to limit earnings exposure to foreign exchange risk, the Companys Asset/Liability Management Policy

requires that material foreign currency denominated transactions be hedged. As of December 31, 2007, the estimated reduction in 12-