Capital One 2007 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.28

V. Management Summary and Business Outlook

Management Summary

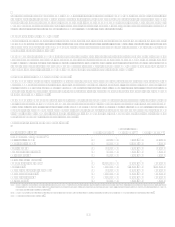

Discontinued Operations

In the third quarter of 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint, resulting in an after-tax loss from discontinued operations of $1.0 billion for the year ended December 31, 2007.

GreenPoint was acquired by the Company in December 2006 as part of the North Fork Bancorporation acquisition. The results of the

mortgage origination operations of GreenPoint have been accounted for as discontinued operations and, accordingly, separately

disclosed from the Companys results of continuing operations for 2007 and 2006. Additional information can be found in Item 8

Financial Statements and Supplementary DataNotes to the Consolidated Financial StatementsNote 2Discontinued

Operations.

Continuing Operations

The following discussion provides a summary of 2007 results compared to 2006 results and 2006 results compared to 2005 results on

a continuing operations basis, unless otherwise noted. Each component is discussed in further detail in subsequent sections of this

analysis.

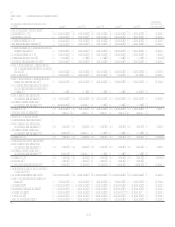

Year Ended December 31, 2007 Compared to Year Ended December 31, 2006

Net income was $1.6 billion, or $3.97 per share (diluted) for 2007, compared to $2.4 billion, or $7.62 per share (diluted) for 2006. Net

income for 2007 included an after-tax loss from discontinued operations of $1.0 billion, or $2.58 per share (diluted), compared to an

after-tax loss from discontinued operations of $11.9 million, or $0.03 per share (diluted) in 2006.

Income from continuing operations for 2007 was $2.6 billion, an increase of $165.3 million, or 7% from 2006. Diluted earnings per

share from continuing operations for 2007 was $6.55, a decrease of 14% from $7.65 in 2006.

Results from continuing operations for 2007 include:

The impact of a full year of results of operations from the North Fork Bank acquisition which was completed on

December 1, 2006 and the dilutive impact on earnings per share of the 103.8 million incremental shares issued in

December 2006 related to the acquisition.

Net interest income and non-interest income growth driven mainly by selective pricing and fee changes in the U.S. Card

portfolio.

Provision for loan and lease losses increase due to the continued normalization of consumer credit following the unusually

favorable credit environment in 2006, adverse delinquency and charge-off trends in our National Lending businesses and

the increase in our coverage ratio in allowance to loans held for investment as a result of economic weakening in the latter

part of 2007 as evidenced by increased delinquencies and consistent with recently released economic indicators.

Restructuring charges of $138.2 million resulting from the Companys broad-based initiative announced during the

second quarter of 2007 to reduce expenses and improve its competitive cost position.

Legal liabilities and reserves of $138.9 million in connection with the Visa antitrust lawsuit settlement with American

Express and estimated possible damages in connection with other pending Visa litigation.

The impact of the Companys $3.0 billion share repurchase program completed in 2007.

Moderate loan (held for investment) growth primarily attributable to the acquisition of North Fork in December 2006,

offset somewhat by a portfolio sale related to a co-branded credit card partnership during first quarter 2007 and our

significant pull back from prime revolver marketing in the U.S. Card sub-segment.

Moderate deposit decrease attributable to deliberate funding decisions including a shift from higher cost brokered deposits

and public funds to lower cost funding options. Deposits were $83.0 billion at December 31, 2007, down $2.8 billion, or

3% from December 31, 2006.

2007 Summary of Significant Events

Shut down of Mortgage Origination Operations of Wholesale Mortgage Banking Unit

See Discontinued Operations above. Additional information can be found in Item 8 Financial Statements and Supplementary

DataNotes to the Consolidated Financial StatementsNote 2Discontinued Operations.