Capital One 2007 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.22

Item 7. Managements Discussion and Analysis of Financial Condition and Results of Operations

I. Introduction

Capital One Financial Corporation (the Corporation) is a diversified financial services company whose banking and non-banking

subsidiaries market a variety of financial products and services. The Corporations principal subsidiaries are:

Capital One Bank (COB) which currently offers credit and debit card products, other lending products and deposit

products.

Capital One, National Association (CONA) which offers a broad spectrum of banking products and financial services to

consumers, small businesses and commercial clients.

Another subsidiary of the Corporation, Superior Savings of New England, N.A. (Superior) focuses on telephonic and media-based

generation of deposits.

As of January 1, 2008, Capital One Auto Finance (COAF) moved from a principal subsidiary of the Corporation to become a direct

operating subsidiary of CONA. COAF offers automobile and other motor vehicle financing products.

During 2007, Capital One F.S.B. and North Fork Bank merged with and into CONA.

In the third quarter of 2007, the Company shut down the mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint Mortgage (GreenPoint), an operating subsidiary of CONA. Additional information can be found in Item 8Financial

Statements and Supplementary DataNotes to the Consolidated Financial StatementsNote 2Discontinued Operations.

The Corporation and its subsidiaries are hereafter collectively referred to as the Company.

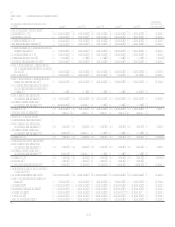

The Company continues to deliver on its strategy of combining the power of national scale lending and local scale banking. As of

December 31, 2007, the Company had $83.0 billion in deposits and $151.4 billion in managed loans outstanding.

The Companys earnings are primarily driven by lending to consumers and commercial customers and by deposit-taking activities

which generate net interest income, and by activities that generate non-interest income, including the sale and servicing of loans and

providing fee-based services to customers. Customer usage and payment patterns, credit quality, levels of marketing expense and

operating efficiency all affect the Companys profitability.

The Companys primary expenses are the costs of funding assets, provision for loan losses, operating expenses (including associate

salaries and benefits, infrastructure maintenance and enhancements, and branch operations and expansion costs), marketing expenses,

and income taxes.

II. Critical Accounting Estimates

The Notes to the Consolidated Financial Statements contain a summary of the Companys significant accounting policies, including a

discussion of recently issued accounting pronouncements. Several of these policies are considered to be more critical to the portrayal

of the Companys financial condition, since they require management to make difficult, complex or subjective judgments, some of

which may relate to matters that are inherently uncertain. Areas with significant judgment and/or estimates or that are materially

dependent on management judgment include: determination of the level of allowance for loan and lease losses, valuation of goodwill

and other intangibles, finance charge, interest and fee revenue recognition, valuation of mortgage servicing rights, valuation of

representation and warranty reserves, valuation of retained interests from securitization transactions, recognition of customer reward

liability, treatment of derivative instruments and hedging activities, and accounting for income taxes.

Additional information about accounting policies can be found in Item 8 Financial Statements and Supplementary DataNotes to

the Consolidated Financial StatementsNote 1.

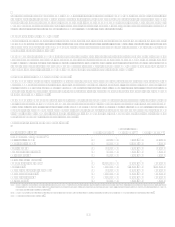

Determination of Allowance for Loan and Lease Losses

The allowance for loan and lease losses is maintained at the amount estimated to be sufficient to absorb probable principal losses, net

of principal recoveries (including recovery of collateral), inherent in the existing reported loan portfolios. The provision for loan losses

is the periodic cost of maintaining an adequate allowance. The amount of allowance necessary is based on distinct allowance

methodologies depending on the type of loans which include specifically identified criticized loans, migration analysis, forward loss

curves and historical loss trends. In evaluating the sufficiency of the allowance for loan and lease losses, management takes into

consideration the following factors: recent trends in delinquencies and charge-offs including bankrupt, deceased and recovered

amounts; forecasting uncertainties and size of credit risks; the degree of risk inherent in the composition of the loan portfolio;

economic conditions; legal and regulatory guidance; credit evaluations and underwriting policies; seasonality; and the value of

collateral supporting the loans. To the extent credit experience is not indicative of future performance or other assumptions used by

management do not prevail, loss experience could differ significantly, resulting in either higher or lower future provision for loan