Capital One 2007 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

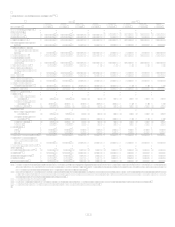

110

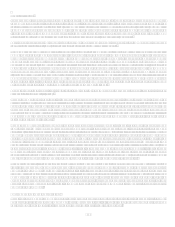

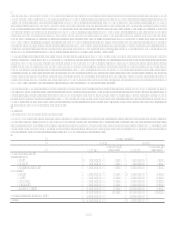

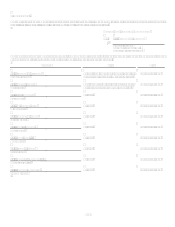

(2) As of December 31, 2007 $1.6 billion of junior subordinated debentures have been reported as other borrowings. These borrowings were classified as borrowings from

subsidiaries at December 31, 2006.

Year Ended December 31

Statements of Income 2007 2006 2005

Interest from temporary investments $ 300,394 $ 323,870 $ 201,196

Interest expense 504,708 265,585 152,531

Dividends, principally from bank subsidiaries 2,056,639 1,950,000 1,170,000

Non-interest income 12,982 4,807 371

Non-interest expense 241,660 129,491 27,065

Income before income taxes and equity in undistributed earnings of subsidiaries 1,623,647 1,883,601 1,191,971

Income tax (benefit) expense (245,052) (67,653) 5,032

Equity in undistributed earnings of subsidiaries 723,020 475,123 622,208

Income from continuing operations, net of tax 2,591,719 2,426,377 1,809,147

Loss from discontinued operations, net of tax (1,021,387) (11,884)

Net income $ 1,570,332 $ 2,414,493 $ 1,809,147

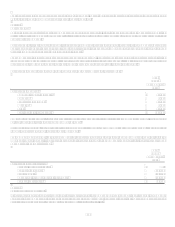

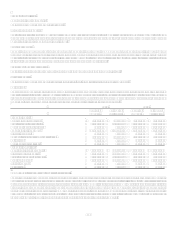

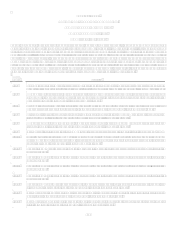

Year Ended December 31

Statements of Cash Flows 2007 2006 2005

Operating Activities:

Net income $ 1,570,332 $ 2,414,493 $ 1,809,147

Adjustments to reconcile net income to net cash provided by operating activities:

Equity in (earnings) loss of subsidiaries

Continuing operations (723,020) (475,123) (622,208)

Discontinued operations 1,021,387 11,884

Loss on sale of securities available for sale 223

Loss on repurchase of senior notes 12,444

Amortization of discount of senior notes 7,293 1,347 2,818

Stock plan compensation expense 301,972 212,317 149,496

(Increase) decrease in other assets (216,052) 19,159 212,019

Increase (decrease) in other liabilities 522,714 (448,363) 43,452

Net cash provided by operating activities 2,484,849 1,735,714 1,607,168

Investing Activities:

Decrease (increase) in investment in subsidiaries 969,122 68,953 (911,348)

Purchases of securities available for sale (127) (52,686)

Proceeds from sale of securities available for sale 53,569

(Increase) decrease in loans to subsidiaries (1,930,666) (1,065,622) 115,952

Net cash used for acquisitions (10,464) (5,010,821) (2,261,757)

Net cash used in investing activities (918,566) (6,060,176) (3,057,153)

Financing Activities:

Increase (decrease) in borrowings from subsidiaries 166,876 1,379,497 (81,463)

Issuance of senior notes 1,495,740 3,185,588 1,262,035

Maturities of senior notes (462,500) (225,000) (162,500)

Repurchases of senior notes (150,000) (597,196)

Dividends paid (42,055) (32,324) (27,504)

Purchases of treasury stock (3,024,969) (21,615) (40,049)

Net proceeds from issuances of common stock 43,493 36,751 770,311

Proceeds from share based payment activities 192,361 238,355 312,176

Net cash (used in) provided by financing activities (1,781,054) 4,561,252 1,435,810

(Decrease) increase in cash and cash equivalents (214,771) 236,790 (14,175)

Cash and cash equivalents at beginning of year 239,473 2,683 16,858

Cash and cash equivalents at end of year $ 24,702 $ 239,473 $ 2,683