Capital One 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.25

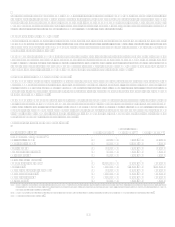

contractual servicing fees and credit losses. Gains on securitization transactions, fair value adjustments related to residual interests and

earnings on the Companys securitizations are included in servicing and securitizations income in the Consolidated Statements of

Income and amounts due from the trusts are included in accounts receivable from securitizations on the Consolidated Balance Sheets.

Certain estimates inherent in the determination of the fair value of the retained interests are influenced by factors outside the

Companys control, and as a result, such estimates could materially change and actual results could be materially different from such

estimates. Any future gains that will be recognized in accordance with SFAS 140 will be dependent on the timing and amount of

future securitizations. The Company intends to continuously assess the performance of new and existing securitization transactions,

and therefore the valuation of retained interests, as estimates of future cash flows change.

As of December 31, 2007 and 2006, the retained interest related to securitization transactions totaled $2.3 billion and $2.2 billion,

respectively.

Recognition of Customer Rewards Liability

The Company offers products, primarily credit cards, that provide program members with various rewards such as airline tickets, free

or deeply discounted products or cash rebates, based on account activity. The Company establishes a rewards liability based on points

earned which are ultimately expected to be redeemed and the average cost per point redemption. As points are redeemed, the rewards

liability is relieved. The cost of reward programs is primarily reflected as a reduction to interchange income. The rewards liability will

be affected over time as a result of changes in the number of account holders in the reward programs, the actual amount of points

earned and redeemed, general economic conditions, the actual costs of the rewards, changes made by reward partners and changes that

the Company may make to the reward programs in the future. To the extent assumptions used by management do not prevail, rewards

costs could differ significantly, resulting in either a higher or lower future rewards liability, as applicable.

As of December 31, 2007 and 2006, the rewards liability was $1.3 billion and $1.1 billion, respectively.

Treatment of Derivative Instruments and Hedging Activities

The Company utilizes certain derivative instruments to minimize significant unplanned fluctuations in earnings caused by interest rate

and foreign exchange rate volatility. The Companys goal is to manage sensitivity to changes in rates by offsetting the repricing or

maturity characteristics of certain balance sheet assets and liabilities, thereby limiting the impact on earnings. The use of derivative

instruments does expose the Company to credit and market risk. The Company manages credit risk through strict counterparty credit

risk limits and/or collateralization agreements.

At inception, the Company determines if a derivative instrument meets the criteria for hedge accounting under SFAS No. 133,

Accounting for Derivative Instruments and Hedging Activities as amended by SFAS No. 138, Accounting for Certain Derivative

Instruments and Certain Hedging Activities. Ongoing effectiveness evaluations are made for instruments that are designated and

qualify as hedges. If the derivative is free standing, no assessment of effectiveness is needed by management.

Accounting for Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes, recognizing the current and

deferred tax consequences of all transactions that have been recognized in the financial statements using the provisions of the enacted

tax laws. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax bases of assets

and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are expected to reverse.

The Company adopted the provisions of FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an Interpretation

of FASB Statement No. 109, (FIN 48) effective January 1, 2007. As a result of adoption, the Company recorded a $29.7 million

reduction in retained earnings. The reduction in retained earnings upon adoption is the net impact of a $46.5 million increase in the

liability for unrecognized tax benefits and a $16.8 million increase in deferred tax assets. In addition, the Company reclassified $471.1

million of unrecognized tax benefits from deferred tax liabilities to current taxes payable to conform to the deferred tax measurement

and balance sheet presentation requirements of FIN 48.

The calculation of the Companys income tax provision is complex and requires the use of estimates and judgments. When analyzing

business strategies, the Company considers the tax laws and regulations that apply to the specific facts and circumstances for any

transaction under evaluation. This analysis includes the amount and timing of the realization of income tax provisions or benefits.

Management closely monitors tax developments in order to evaluate the effect they may have on its overall tax position and the

estimates and judgments utilized in determining the income tax provision and records adjustments as necessary.

The Company records valuation allowances to reduce deferred tax assets to the amount that is more likely than not to be realized. In

making this assessment, management analyzes future taxable income, reversing temporary differences and ongoing tax planning

strategies. Should a change in circumstances lead to a change in judgment about the realizability of deferred tax assets in future years,