Capital One 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.70

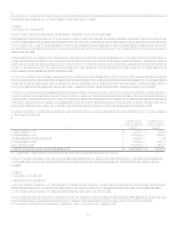

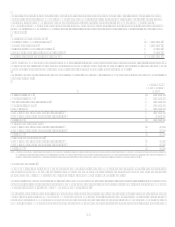

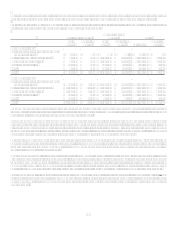

Gains on securitization transactions and fair value adjustments related to residual interests in securitizations are recognized in

servicing and securitizations income and amounts due from the trusts are included in accounts receivable from securitizations. As of

December 31, 2007 and December 31, 2006, the retained interest in securitizations held by the Company totaled $2.3 billion and $2.2

billion, respectively.

The gain on sale recorded from off-balance sheet securitizations is recorded based on the estimated fair value of the assets sold and

retained and liabilities incurred, and is recorded at the time of sale, net of transaction costs, in servicing and securitizations income.

The related receivable is the interest-only strip, which is based on the present value of the estimated future cash flows from excess

finance charges and past-due fees over the sum of the return paid to security holders, estimated contractual servicing fees and credit

losses. The interest-only strip and other retained interests are accounted for as trading securities with changes in the estimated fair

value recorded in servicing and securitizations income. To the extent assumptions used by management do not prevail, fair value

estimates of the interest-only strip could differ significantly, resulting in either higher or lower future servicing and securitization

income, as applicable.

The Company does not recognize servicing assets or servicing liabilities for servicing rights retained from consumer loan

securitizations since the servicing fee approximates just adequate compensation to the Company for performing the servicing.

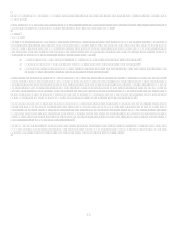

Loans Held for Investment

Loans held for investment include consumer and commercial loans. Consumer loans include credit card, installment, auto and

mortgage loans. Credit card loans are reported at their principal amounts outstanding and include uncollected billed interest and fees.

All new originations of consumer and commercial loans, except for certain mortgage loans previously originated under GreenPoint,

are deemed to be held for investment at origination because management has the intent and ability to hold them for the foreseeable

future or until maturity or payoff. Management believes the foreseeable future is relatively short based on the weighted average life of

the consumer loans and the homogeneous nature of the receivables. In determining the amount of loans held for investment,

management makes judgments about the Companys ability to fund these loans through means other than securitization, such as

investments, deposits and other borrowings. Management assesses whether loans can continue to be held for investment on a quarterly

basis by considering capital levels and scheduled maturities of funding instruments used.

Consumer loan balances that are expected to be securitized in the next three months are accounted for as held for sale. The loans that

have been identified as held for sale are carried at the lower of aggregate cost or fair value and an allowance for loan losses is not

provided for these loans. Management believes its ability to reasonably forecast the amount of existing consumer loans that should be

accounted for as held for sale is limited to three months from the balance sheet date because of the short-term nature of the assets, the

revolving nature of the securitization structures and the fact that securitizations that occur beyond three months will involve a

significant proportion of consumer loans that have not yet been originated. The Company continues to include these loans in loans

held for investment because separate classification in the Reported Consolidated Balance Sheets and related impacts to the Reported

Consolidated Statements of Income is considered immaterial to the Companys financial statements. Cash flows associated with loans

that are originated with the intent to hold for investment are classified as investing cash flow, regardless of a subsequent change of

intent. Certain mortgage loans associated with the GreenPoint shut down, which were previously categorized as held for sale and

marked at the lower of aggregate cost or fair value, were transferred to held for investment at December 31, 2007. Cash flows

associated with these loans were included in operating cash flows. All other loans are reported at their principal amounts outstanding.

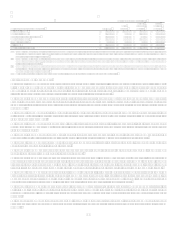

Nonperforming Assets

Nonperforming Assets include nonaccrual loans, impaired loans, certain restructured loans on which interest rates or terms of

repayment have been materially revised, foreclosed and repossessed assets.

Commercial loans, consumer real estate and auto loans are placed in nonaccrual status at 90 days past due or sooner if, in

managements opinion, there is doubt concerning full collectibility of both principal and interest. All other consumer loans and small

business credit card loans are not placed in nonaccrual status prior to charge-off.

At the time a loan is placed on nonaccrual status, interest and fees accrued but not collected through the end of the previous quarter are

systematically reversed and charged against income. Interest payments received on nonaccrual loans are applied to principal if there is

doubt as to the collectibility of the principal; otherwise, these receipts are recorded as interest income. A loan remains in nonaccrual

status until it is current as to principal and interest and the borrower demonstrates the ability to fulfill the contractual obligation.

Upon foreclosure or repossession, loans are adjusted, if necessary, to the estimated fair value of the underlying collateral and

transferred to other assets, net of a valuation allowance for selling costs. We estimate market values primarily based on appraisals

when available or quoted market prices on liquid assets.