Capital One 2007 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

90

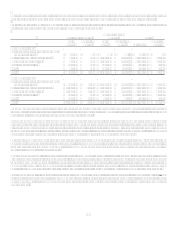

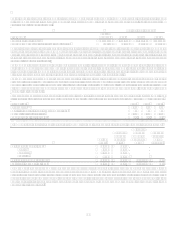

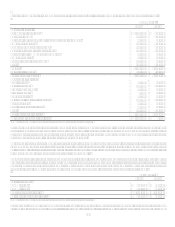

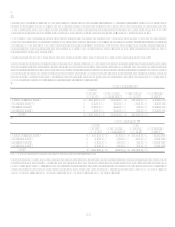

Assumed health care cost trend rates have a significant effect on the amounts reported for the other postretirement benefit plans. A

one-percentage point change in assumed health care cost trend rates would have the following effects:

2007 2006

1% Increase 1% Decrease 1% Increase 1% Decrease

Effect on year-end postretirement benefit obligation $ 5,684 $ (4,817) $ 9,393 $ (7,768)

Effect on total service and interest cost components $ 1,780 $ (1,459) $ 2,014 $ (1,595)

Plan Assets

The qualified defined benefit pension plan asset allocations as of the annual measurement dates are as follows:

2007 2006

Equity securities 70% 60%

Debt securities 30% 38%

Other 2%

Total 100% 100%

The investment guidelines provide the following asset allocation targets and ranges: domestic equity target of 50% and allowable

range of 45% to 55%, international equity target of 20% and allowable range of 15% to 25%, and domestic debt securities target of

30% and allowable range of 25% to 40%.

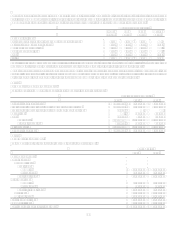

Expected future benefit payments

The following benefit payments, which reflect expected future service, as appropriate, are expected to be paid:

Pension

Benefits Postretirement

Benefits

2008 $ 30,121 $ 3,239

2009 15,947 3,634

2010 15,101 4,009

2011 15,097 4,390

2012 16,141 4,588

2013 - 2017 70,883 26,364

In 2008, $0.9 million in contributions are expected to be made to the pension plans, and $3.2 million in contributions are expected to

be made to the other postretirement benefit plans.

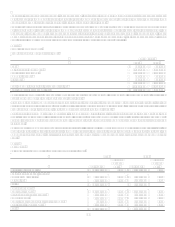

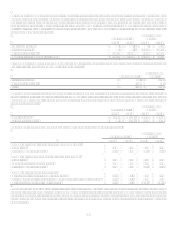

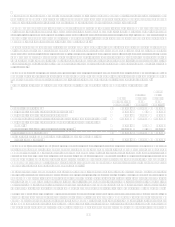

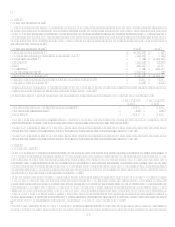

Note 13

Other Non-Interest Expense

Year Ended December 31

2007 2006 2005

Professional services $ 772,022

$ 681,535 $ 490,617

Collections 560,075

525,680 537,772

Fraud losses 123,028

103,010 53,744

Bankcard association assessments 181,076

166,512 136,318

Core deposit intangible amortization 212,107

84,078

Other 538,527

325,820 281,330

Total $ 2,386,835 $ 1,886,635 $ 1,499,781

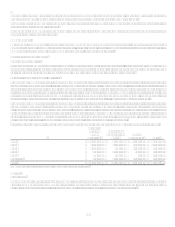

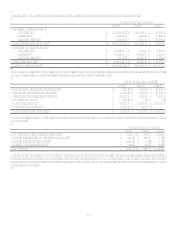

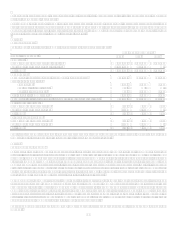

Note 14

Income Taxes

The Company accounts for income taxes in accordance with SFAS No. 109, Accounting for Income Taxes, recognizing the current and

deferred tax consequences of all transactions that have been recognized in the consolidated financial statements using the provisions of

the enacted tax laws. Deferred tax assets and liabilities are determined based on differences between the financial reporting and tax

bases of assets and liabilities and are measured using the enacted tax rates and laws that will be in effect when the differences are

expected to reverse. Valuation allowances are recorded to reduce deferred tax assets to an amount that is more likely than not to be

realized.