Capital One 2007 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

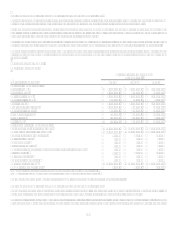

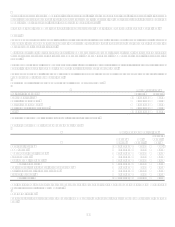

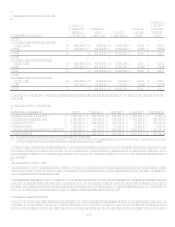

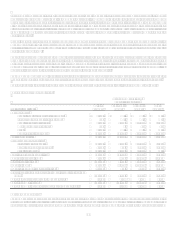

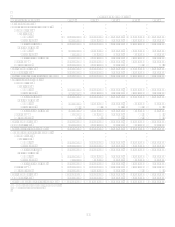

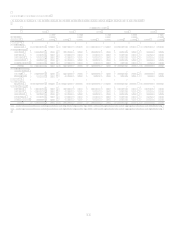

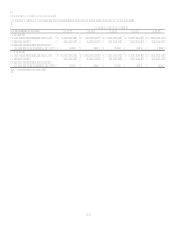

XI. Tabular Summary

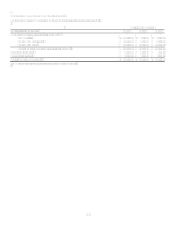

TABLE ASTATEMENTS OF AVERAGE BALANCES, INCOME AND EXPENSE, YIELDS AND RATES

Table A provides average balance sheet data and an analysis of net interest income, net interest spread (the difference between the

yield on earning assets and the cost of interest-bearing liabilities) and net interest margin for the years ended December 31, 2007, 2006

and 2005.

Year Ended December 31

2007 2006(2) 2005(2)

(Dollars in Thousands) Average

Balance Income/

Expense Yield/

Rate Average

Balance Income/

Expense Yield/

Rate Average

Balance Income/

Expense Yield/

Rate

Assets:

Earning assets

Consumer loans(1)

Domestic $ 56,565,058 $ 6,601,387 11.67% $ 47,427,119 $ 5,986,533 12.62% $ 31,891,276 $ 4,226,617 13.25%

International 3,471,453 436,368 12.57% 3,842,113 433,126 11.27% 4,083,531 452,652 11.08%

Total consumer loans 60,036,511 7,037,755 11.72% 51,269,232 6,419,659 12.52% 35,974,807 4,679,269 13.01%

Commercial loans 33,505,314 2,462,373 7.35% 12,308,047 626,814 5.09% 4,759,430 331,570 6.97%

Total Loans held for

investment 93,541,825 9,500,128 10.16% 63,577,279 7,046,473 11.08% 40,734,237 5,010,839 12.30%

Securities available for sale 18,933,750 950,972 5.02% 14,686,556 676,712 4.61% 10,085,562 386,896 3.84%

Other

Domestic 7,792,357 573,158 7.36% 4,716,374 391,351 8.30% 3,309,656 249,961 7.55%

International 1,152,497 53,898 4.68% 1,106,527 50,199 4.54% 1,407,559 79,185 5.63%

Total 8,944,854 627,056 7.01% 5,822,901 441,550 7.58% 4,717,215 329,146 6.98%

Total earning assets 121,420,429 $ 11,078,156 9.12% 84,086,736 $ 8,164,735 9.71% 55,537,014 $ 5,726,881 10.32%

Cash and due from banks 2,112,587 1,680,104

1,000,240

Allowance for loan losses (2,182,667) (1,791,172) (1,482,948)

Premises and equipment, net 2,250,117 1,469,807

842,368

Other 21,398,626 9,809,231

5,463,826

Total assets from discontinued

operations 3,984,100

555,053

Total assets $ 148,983,192

$ 95,809,759

$ 61,360,500

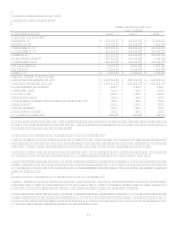

Liabilities and Equity:

Interest-bearing liabilities

Deposits

Domestic $ 71,662,730 $ 2,781,662 3.88% $ 43,409,416 $ 1,700,986 3.92% $ 25,838,996 $ 1,043,211 4.04%

International 2,317,790 124,689 5.38% 2,329,611 113,811 4.89% 2,531,739 129,926 5.13%

Total Deposits 73,980,520 2,906,351 3.93% 45,739,027 1,814,797 3.97% 28,370,735 1,173,137 4.14%

Senior and subordinated

notes 9,840,074 577,128 5.87% 6,820,615 411,643 6.04% 6,820,811 421,218 6.18%

Other borrowings

Domestic 18,955,691 1,050,546 5.54% 16,368,481 836,667 5.11% 11,195,697 451,725 4.03%

International 1,090,149 14,286 1.31% 1,115,981 10,182 0.91% 15,441 559 3.62%

Total other borrowings 20,045,840 1,064,832 5.31% 17,484,462 846,849 4.84% 11,211,138 452,284 4.03%

Total interest-bearing liabilities 103,866,434 $ 4,548,311 4.38% 70,044,104 $ 3,073,289 4.39% 46,402,684 $ 2,046,639 4.41%

Non-interest bearing deposits 11,446,706 4,934,407

648,917

Other 5,349,568

4,169,298

3,714,631

Total liabilities from

discontinued operations 3,117,348

458,528

Total liabilities 123,780,056 79,606,337

50,766,232

Equity 25,203,136 16,203,422

10,594,268

Total liabilities and equity $ 148,983,192

$ 95,809,759

$ 61,360,500

Net interest spread 4.74%

5.32%

5.91%

Interest income to average earning assets 9.12% 9.71% 10.32%

Interest expense to average earning assets 3.74%

3.65%

3.69%

Net interest margin

5.38%

6.06%

6.63%

(1) Interest income includes past-due fees on loans of approximately $704.5 million, $699.5 million and $776.5 million for the years ended December 31, 2007, 2006 and 2005,

respectively.

(2) Prior period amounts have been reclassified to conform with current period presentation.

(3) Based on continuing operations.

(4) Non-accrual loans are included in their respective loan categories.