Capital One 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

97

Note 19

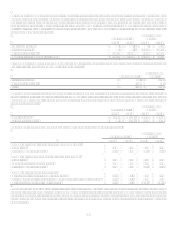

Mortgage Servicing Rights

Mortgage Servicing Rights (MSRs), are recognized when mortgage loans are sold in the secondary market and the right to service

these loans are retained for a fee, and are carried at fair value; changes in fair value are recognized in mortgage servicing and other.

The Company continues to operate the mortgage servicing business and to report the changes in the fair value of MSRs in continuing

operations. To evaluate and measure fair value, the underlying loans are stratified based on certain risk characteristics, including loan

type, note rate and investor servicing requirements. The following table sets forth the changes in the fair value of mortgage servicing

rights during 2007 and 2006:

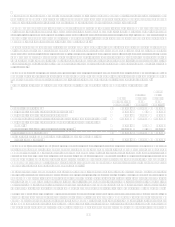

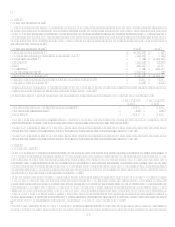

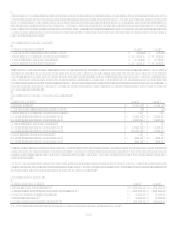

Mortgage Servicing Rights: 2007 2006

Balance, Beginning of period $ 252,295 $

Cumulative effect adjustment for the adoption of FAS 156 15,187

Acquired in Acquisition 252,353

Originations 65,948 8,756

Sales (3,340) (170)

Amortization (8,644)

Change in fair value, net (82,501)

Balance at December 31, 2007 247,589 $ 252,295

Ratio of Mortgage Servicing Rights to Related Loans Serviced for Others 0.85% 0.92%

Weighted Average Service Fee 0.28 0.28

Fair value adjustments to the MSR for the year ended December 31, 2007 included a $56.9 million decrease due to run-off and a $25.3

million decrease due to changes in the valuation inputs and assumptions.

The significant assumptions used in estimating the fair value of the servicing assets at December 31, 2007 were as follows:

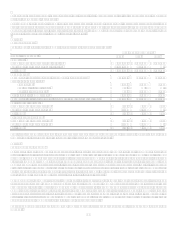

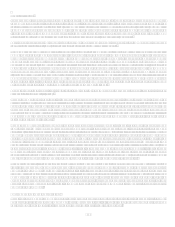

December 31,

2007

December 31,

2006

Weighted average prepayment rate (includes default rate) 27.62% 28.89%

Weighted average life (in years) 3.4 3.4

Discount rate 10.44% 10.50%

At December 31, 2007, the sensitivities to immediate 10% and 20% increases in the weighted average prepayment rates would

decrease the fair value of mortgage servicing rights by $13.6 million and $25.7 million, respectively.

As of December 31, 2007, the Companys mortgage loan servicing portfolio consisted of mortgage loans with an aggregate unpaid

principal balance of $42.0 billion, of which $29.4 billion was serviced for investors other than the Company.

As of December 31, 2006, the Companys mortgage loan servicing portfolio consisted of mortgage loans with an aggregate unpaid

principal balance of $56.1 billion, of which $33.1 billion was serviced for investors other than the Company.

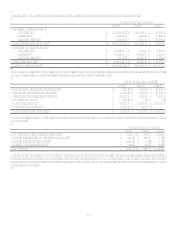

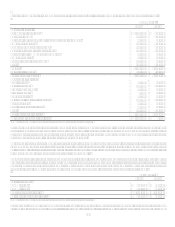

Note 20

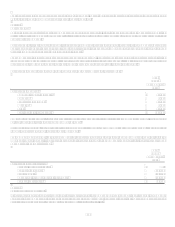

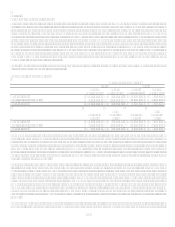

Regulatory Matters

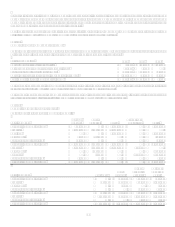

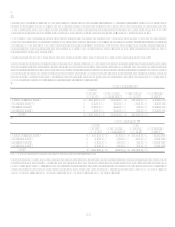

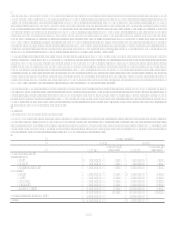

The Company and COB are subject to capital adequacy guidance adopted by the Federal Reserve Board (the Federal Reserve), and

CONA and Superior are subject to capital adequacy guidelines adopted by the Office of the Comptroller of the Currency (the OCC,

and with the Federal Reserve, collectively, the regulators). The capital adequacy guidelines set minimum risk-based and leverage

capital requirements that are based on quantitative and qualitative measures of their assets and off-balance sheet items. The Federal

Reserve holds the Corporation to similar minimum capital requirements. Failure to meet minimum capital requirements can result in

possible additional, mandatory discretionary actions by a federal banking agency that, if undertaken, could have a material adverse

effect on the Corporations consolidated financial statements.

The Corporation plans to convert COB to a national association in the first quarter of 2008. The new name of COB will be Capital

One Bank (USA), National Association. As a national association, COB will be regulated primarily by the OCC and its deposits will

continue to be insured by the Deposit Insurance Fund of the FDIC up to applicable limits. Upon conversion of COB to a national

association, COB will implement the OCCs minimum payment requirements over the course of this year, which will require COB to

utilize a new formula to calculate minimum payment amounts for its credit card customer base. The new formula will increase

minimum payment amounts under some circumstances, which could result in an increase in delinquencies and defaults, as well as an

increase in the allowance for loan losses, for COBs credit card portfolio. In addition, the new requirements may adversely impact fee

revenue. The Company is still evaluating the impact of the OCC minimum payment requirements.

As of December 31, 2007, COB, CONA, and Superior (collectively, the Banks) each exceeded the minimum regulatory

requirements to which it was subject. The Banks all were considered well-capitalized under applicable capital adequacy guidelines.