Capital One 2007 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

96

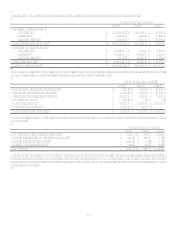

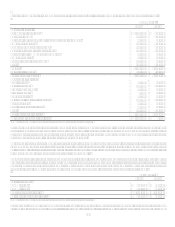

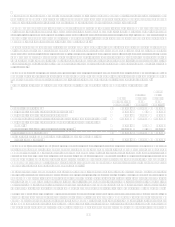

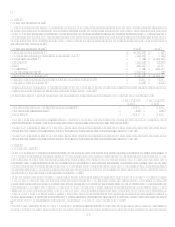

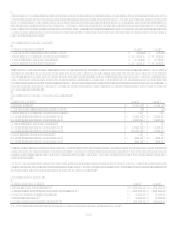

As of December 1, 2006, the Company acquired North Fork Bancorporation, Inc., a commercial and retail bank in New York, which

created $9.7 billion of goodwill. The goodwill associated with the acquisition of North Fork was held in the Other category at

December 31, 2006. The North Fork acquisition goodwill was allocated across the reportable segments during 2007. Goodwill

associated with the 2005 acquisition of Hibernia Corporation was allocated across the reportable segments during 2006.

Goodwill impairment is tested at the reporting unit level, which is an operating segment or one level below on an annual basis in

accordance with Statement of Financial Accounting Standards No. 142, Goodwill and Other Intangible Assets. In the third quarter of

2007, the Company shut down mortgage origination operations at its wholesale mortgage banking unit, GreenPoint. As a result of the

closure of the mortgage originations business, a goodwill impairment loss of $650.0 million ($646.0 million after tax) was recognized

as part of discontinued operations.

For the years ended December 31, 2007 and 2006, no additional impairment on goodwill was required to be recognized.

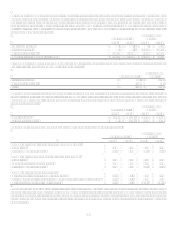

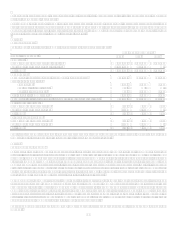

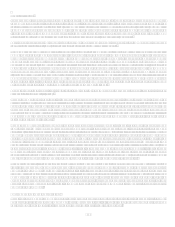

In connection with the acquisitions of Hibernia and North Fork, the Company recorded intangible assets that consisted of core deposit

intangibles, trust intangibles, lease intangibles, and other intangibles, which are subject to amortization. The core deposit and trust

intangibles reflect the estimated value of deposit and trust relationships. The lease intangibles reflect the difference between the

contractual obligation under current lease contracts and the fair market value of the lease contracts at the acquisition date. The other

intangible items relate to customer lists, brokerage relationships and insurance contracts. The following table summarizes the

Companys purchase accounting intangible assets subject to amortization.

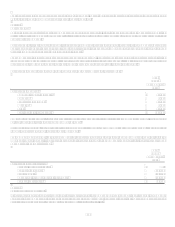

December 31, 2007

Gross

Carrying

Amount

Accumulated

Amortization

Net Carrying

Amount

Amortization

Period

Core deposit intangibles $ 1,320,000 $ (305,606) $ 1,014,394 10.1 years

Lease intangibles(1) 44,862 (9,725) 35,137 7.5 years

Trust intangibles 10,500 (2,330) 8,170 16.0 years

Other intangibles 7,949 (2,836) 5,113 10.6 years

Total $ 1,383,311 $ (320,497) $ 1,062,814

December 31, 2006

Gross

Carrying

Amount

Accumulated

Amortization

Net

Carrying

Amount

Amortization

Period

Core deposit intangibles $ 1,306,806 $ (80,364) $ 1,226,442 11.1 years

Lease intangibles 15,911 (1,647) 14,264 9.0 years

Trust intangibles 10,500 (1,270) 9,230 17.0 years

Other intangibles 11,474 (2,154) 9,320 9.3 years

Total $ 1,344,691 $ (85,435) $ 1,259,256

(1) Above market lease intangibles of $30.6 million were reclassed to other liabilities in 2007.

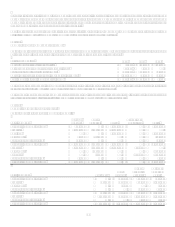

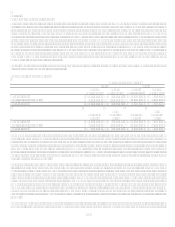

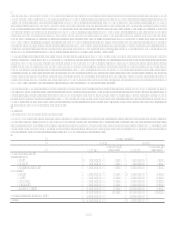

Intangibles are amortized on an accelerated basis over their respective estimated useful lives. Intangible assets are recorded in Other

assets on the balance sheet. Amortization expense related to purchase accounting intangibles totaled $221.4 million for the year ended

December 31, 2007. Amortization expense for intangibles is recorded to non-interest expense. The weighted average amortization

period for all purchase accounting intangibles is 10.1 years. Estimated future amortization is as follows: 2008$200.6 million,

2009$178.2 million, 2010$156.5 million, 2011$135.5 million, 2012$114.5 million.