Capital One 2007 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

89

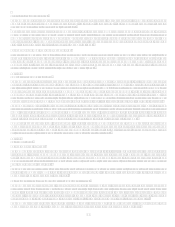

During 2007, the Company recognized curtailments attributable to the freezing of one of the qualified plans assumed in the North

Fork acquisition and special termination benefits attributable to the freezing of one of the qualified plans assumed in the North Fork

acquisition and to the termination of employees in the closure of GreenPoints mortgage origination operations. The $22.1 million

reduction in other postretirement benefit obligation from plan amendments in 2007 relates to the Companys decision to begin phasing

out its contributions toward retiree health care costs so that employees becoming retirement eligible in 2013 and later years will

receive no employer contributions.

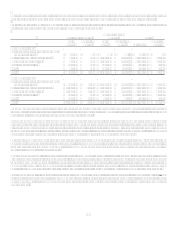

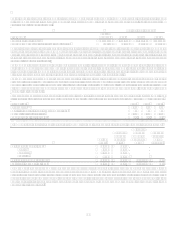

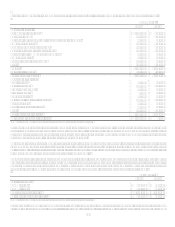

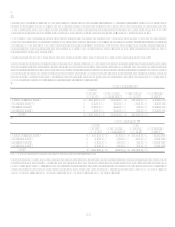

Pension Benefits

2007 2006 2007 2006

Transition obligation $

$ $

$ (331)

Prior service credit

31,940

14,712

Net actuarial gain (loss) 15,574

(2,928) 4,858

(6,163)

Cumulative other comprehensive income $ 15,574 $ (2,928) $ 36,798 $ 8,218

Pretax amounts in cumulative other comprehensive income that are expected to be recognized as decreases (increases) of net periodic

benefit cost for the year ending December 31, 2008 consist of:

Pension Benefits

Postretirement

Benefits

Prior service credit $ $ 9,628

Net actuarial gain (loss) (125) 114

Total $ (125) $ 9,742

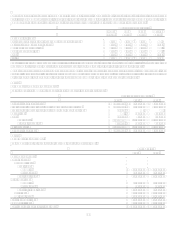

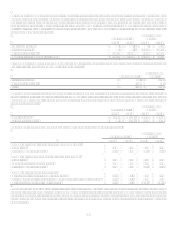

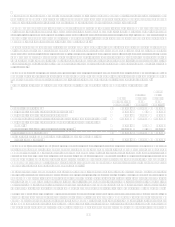

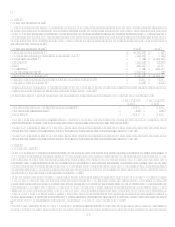

The following table sets forth the aggregate benefit obligation and aggregate fair value of plan assets for plans with benefit obligations

in excess of plan assets. Based on the status of the Companys pension plans, the information presented also represents the aggregate

pension accumulated benefit obligation and aggregate fair value of plan assets for pension plans with accumulated benefit obligations

in excess of plan assets.

Pension Benefits

2007 2006 2007 2006

Benefit obligation $ 10,604 $ 17,704 $ 59,783 $ 84,210

Fair value of plan assets $

$ 4,498 $ 8,356

$ 7,682

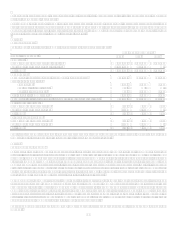

The following table presents weighted-average assumptions used in the accounting for the plans.

Pension Benefits

Postretirement

Benefits

2007 2006 2007 2006

Assumptions for benefit obligations at measurement date:

Discount rate 6.2% 5.6% 6.3% 5.7%

Rate of compensation increase n/a 4.0% n/a n/a

Assumptions for periodic benefit cost for the year ended:

Discount rate 5.6% 5.5% 5.7% 5.5%

Expected rate of return on plan assets 7.5% 7.5% 7.5% 7.5%

Rate of compensation increase 4.0% 4.0% n/a n/a

Assumptions for year-end valuations:

Health care cost trend rate assumed for next year n/a n/a 9.3% 9.3%

Rate to which the cost trend rate is assumed to decline (the ultimate trend rate) n/a n/a 5.0% 5.0%

Year the rate reaches the ultimate trend rate n/a n/a 2017 2016

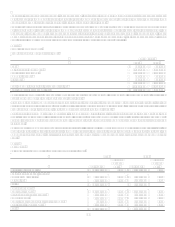

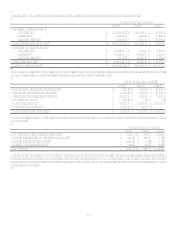

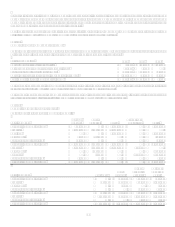

To develop the expected long-term rate of return on plan assets assumption, consideration was given to the current level of expected

returns on risk-free investments (primarily government bonds), the historical level of the risk premium associated with the other asset

classes in which the portfolio is invested and the expectations for future returns of each asset class. The expected return for each asset

class was then weighted based on the target asset allocation to develop the expected long-term rate of return on assets assumption for

the portfolio.

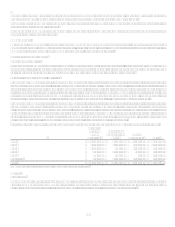

Postretirement

Benefits

Postretirement

Benefits