Capital One 2007 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.38

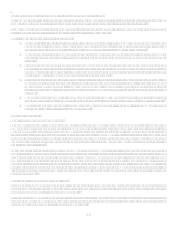

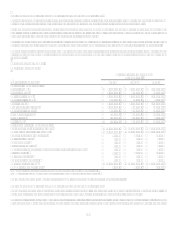

Nonperforming Loans

Nonperforming loans as a percentage of total loans held for investment were 0.82% and 0.43% at December 31, 2007 and 2006,

respectively.

For additional information, see section XIII, Tabular Summary, Table G (Nonperforming Assets).

Allowance for loan and lease losses

The allowance for loan and lease losses related to loans held for investment increased $783.0 million, or 36% to $3.0 billion at

December 31, 2007. The increase is driven primarily by an increase in our coverage ratio of allowance to loans held for investment as

a result of delinquencies and economic weakening in the latter part of 2007 as evidenced by increased delinquencies and consistent

with recently released economic indicators.

The allowance for loan losses was $2.2 billion at December 31, 2006, an increase of $390.0 million from December 31, 2005. The

increase was driven primarily by the acquisition of North Fork which added $222.2 million of allowance for loan losses at

December 31, 2006. The remaining increase was the result of 8% growth in the reported loan portfolio, exclusive of the North Fork

loans portfolio.

For additional information, see section XII, Tabular Summary, Table H (Summary of Allowance for Loan and Lease Losses).

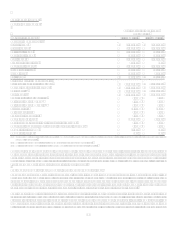

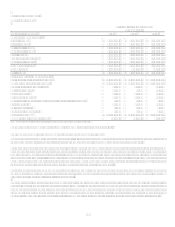

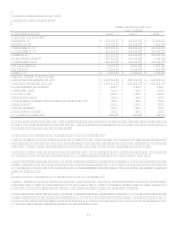

VII. Reportable Segment Summary for Continuing Operations

We manage our business as two distinct operating segments: Local Banking and National Lending. The Local Banking and National

Lending segments are considered reportable segments based on quantitative thresholds applied to the managed loan portfolio for

reportable segments provided by SFAS No. 131, Disclosures about Segments of an Enterprise and Related Information.

As management makes decisions on a managed basis within each segment, information about reportable segments is provided on a

managed basis.

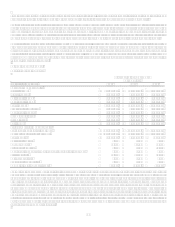

In the third quarter of 2007, the Company shut down mortgage origination operations of its wholesale mortgage banking unit,

GreenPoint. The results of the mortgage origination operations are being reported as discontinued operations for each period

presented, and are not included in segment results of the Company. The results of GreenPoints mortgage servicing business continue

to be reported as part of the Companys continuing operations. The mortgage servicing function was moved into the Local Banking

segment in conjunction with the shutdown of the mortgage origination operation, and the results of the Local Banking segment were

restated to include the mortgage servicing results for each period of 2007. During the fourth quarter of 2007, GreenPoints held for

investment commercial mortgage portfolio results were moved into the Local Banking segment. GreenPoints held for investment

consumer portfolio results were moved into the Other category for the fourth quarter of 2007.

We maintain our books and records on a legal entity basis for the preparation of financial statements in conformity with GAAP. The

following table presents information prepared from our internal management information system, which is maintained on a line of

business level through allocations from legal entities.