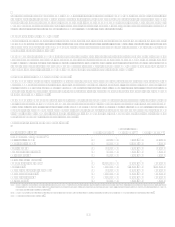

Capital One 2007 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

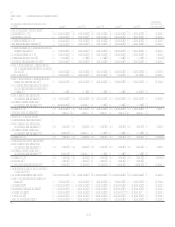

(Dollars in millions, Except Per Share Data) 2007 2006(5) 2005(4) 2004 2003

Five Year

Compound

Growth Rate

Selected Average Reported

Balances(3):

Loans held for investment $ 93,541.8 $ 63,577.3 $ 40,734.2 $ 34,265.7 $ 28,677.6 26.68%

Average earning assets 121.420.4 84,086.7 55,537.0 46,655.7 37,362.3 26.58%

Total assets 144,999.1 95,254.7 61,360.5 50,648.1 41,195.4 28.62%

Interest-bearing deposits 73,980.5 45,739.0 28,370.7 24,313.3 19,768.0 30.21%

Total deposits 85,427.2 50,673.4 29,019.7 24,313.3(2) 19,768.0(2) 34.01%

Borrowings 29,885.9 24,305.1 18,031.9 15,723.6 12,978.0 18.15%

Stockholders equity 25,203.1 16,203.4 10,594.3 7,295.5 5,323.5 36.47%

Reported Metrics(3):

Revenue margin 12.01

%

14.38% 18.08

(1)

% 19.08% 21.95%

Net interest margin 5.38 6.06 6.63(1) 6.44 7.45

Risk adjusted margin 10.40 12.71 15.47 16.31 17.54

Delinquency rate 3.66 2.74 3.14 3.85 4.79

Net charge-off rate 2.10 2.21 3.55 3.78 5.74

Return on average assets 1.79 2.55 2.95 3.05 2.76

Return on average equity 10.28 14.97 17.08 21.16 21.34

Average equity to average assets 17.38 17.01 17.27 14.40 12.92

Non-interest expense as a % of

average loans held for

investment 8.64 10.92 14.04 15.53 16.94

Efficiency ratio 54.44 57.42 56.96 59.78 59.22

Allowance as a % of loans held for

investment 2.91 2.26 2.99 3.94 4.86

Managed Metrics(3):

Revenue margin 9.85

%

10.66% 12.45(1)% 12.89% 14.65%

Net interest margin 6.46 6.88 7.80(1) 7.88 8.64

Risk adjusted margin 7.40 8.23 8.76 9.03 9.38

Delinquency rate 3.87 3.02 3.24 3.82 4.46

Net charge-off rate 2.88 2.84 4.25 4.41 5.86

Return on average assets 1.33 1.70 1.72 1.73 1.52

Non-interest expense as a % of

average loans held for

investment 5.58 6.24 6.71 7.22 7.72

Efficiency ratio 47.30 50.17 46.81 49.01 47.44

Average loans held for investment $ 144,727.0 $ 111,328.6 $ 85,265.0 $ 73,711.7 $ 62,911.9 18.13%

Average earning assets $ 170,496.1 $ 129,812.8 $ 98,097.2 $ 84,240.3 $ 69,873.2 19.53%

Year-end loans held for investment $ 151,362.4 $ 146,151.3 $ 105,527.5 $ 79,861.3 $ 71,244.8 16.27%

Year-end total loan accounts 48.5 50.0 49.7 48.6 47.0 0.63%

(1) Prior period amounts have been reclassified to conform with current period presentation.

(2) Non-interest bearing deposits for the years 20032004 were included in other liabilities.

(3) Based on continuing operations.

(4) On November 16, 2005, the Company acquired 100% of the outstanding common stock of Hibernia Corporation for total consideration of $5.0 billion.

(5) On December 1, 2006, the Company acquired 100% of the outstanding common stock of North Fork Bancorporation for total consideration of $13.2 billion.

(6) Discontinued operations related to the shutdown of mortgage origination operations of GreenPoints wholesale mortgage banking unit in 2007.