Capital One 2007 Annual Report Download - page 128

Download and view the complete annual report

Please find page 128 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

106

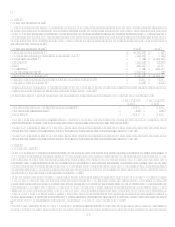

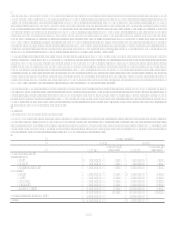

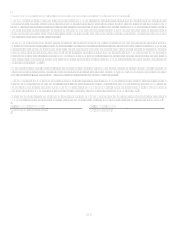

have been removed from the Companys results of continuing operations for all periods presented. Prior to the shutdown of

GreenPoint Mortgage, the Company entered into commitments to originate or purchase loans whereby the interest rate of the loan was

determined prior to funding (interest rate lock commitment). Interest rate lock commitments on mortgage loans that the Company

intent to sell in the secondary market were considered freestanding derivatives. These derivatives were carried at fair value with

changes in fair value reported as a component of gain on sale of loans. In accordance with Staff Accounting Bulletin No, 105,

Application of Accounting Principles to Loan Commitments, interest rate lock commitments were initially valued at zero. Changes in

fair value subsequent to inception were determined based on current secondary market prices for underlying loans with similar

coupons, maturity and credit quality, subject to the anticipated probability that the loans would fund within the terms of the

commitment. The initial value inherent in the loan commitments at origination was recognized through gain on sale of loans when the

underlying loan was sold. Both the interest rate lock commitments and the related hedging instruments were recorded at fair value

with changes in fair value recorded in current earnings as a component of gain on sale of loans. However, as of December 31, 2007,

the Company has zero loan commitments due to the shutdown of GreenPoint Mortgage.

Generally, if interest rates increase, the value of the interest rate lock commitments and funded loans decrease and loan sale margins

are adversely impacted. The Company economically hedges the risk of overall changes in fair value of loans held-for-sale and interest

rate lock commitments generally by entering into mandatory commitments to deliver mortgage whole loans to various investors,

selling forward contracts on government backed mortgage securities and, to a lesser extent, by using futures and options to

economically hedge the fair value of interest rate lock commitments. In accordance with SFAS 133, certain of these positions qualify

as fair value hedges against a portion of the funded held-for-sale loan portfolio and result in adjustments to the carrying value of

designated loans through gain on sale based on fair value changes attributable to the hedged risk. The forward contracts, futures and

options used to economically hedge the loan commitments are accounted for as non-trading derivatives and naturally offset loan

commitment mark-to-market gains and losses recognized as a component of gain on sale.

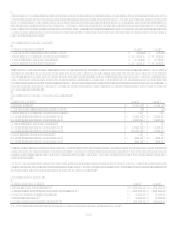

The notional amounts of all forward contracts were zero and $3.4 billion, respectively, for the years ended December 31, 2007 and

2006. Forward contracts designated as fair value hedges associated with mortgage loans held for sale had notional values of zero and

$2.6 billion, respectively, for the year ended December 31, 2007 and 2006. The notional amounts of forward contracts used to manage

the risk associated with interest rate lock commitments on mortgage loans were zero and $0.8 billion, respectively, for the years ended

December 31, 2007 and 2006. The hedge ineffectiveness on fair value hedges included in discontinued operations was not material for

the years ended December 31, 2007 and 2006.

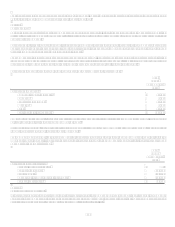

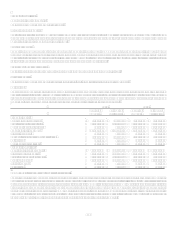

Note 26

Significant Concentration of Credit Risk

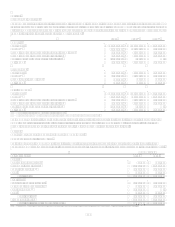

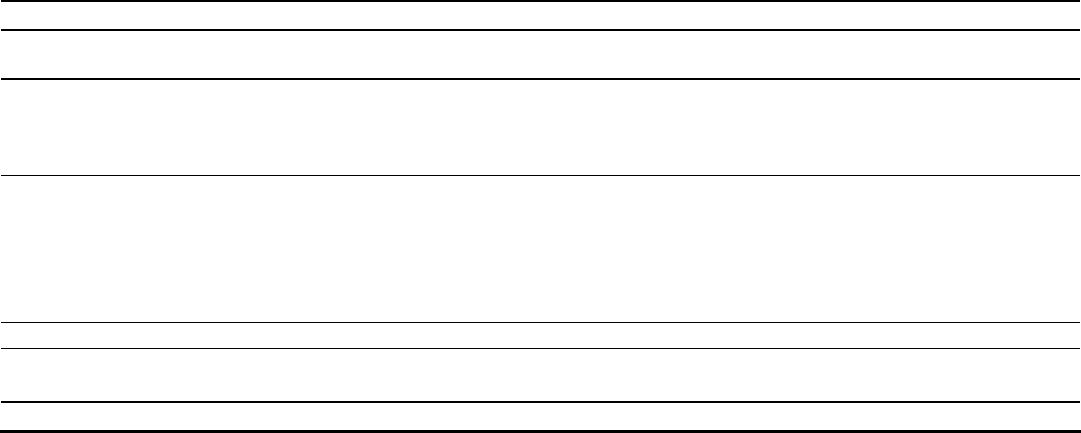

The Company is active in originating loans in the United States and internationally. International loans are originated primarily in

Canada and the United Kingdom. The Company reviews each potential customers credit application and evaluates the applicants

financial history and ability and willingness to repay. Loans are made on an unsecured and secured basis. Certain commercial, small

business, mortgage and automobile loans require collateral in various forms including cash deposits, automobiles and real estate, as

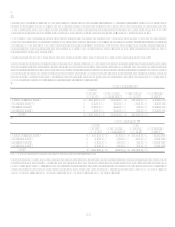

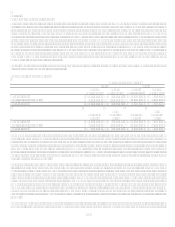

appropriate. The geographic distribution of the Companys loans was as follows:

December 31

2007 2006

Loans

Percentage

of Total Loans

Percentage

of Total

Geographic Region:

International

U.K. $ 8,075,609 5.34% 8,964,525 6.13%

Canada 3,585,940 2.37% 2,782,893 1.90%

Total International 11,661,549 7.71% 11,747,418 8.03%

Domestic

South 51,848,365 34.25% $ 49,604,219 33.94%

West 25,426,312 16.80% 24,897,404 17.04%

Midwest 20,691,790 13.67% 20,179,405 13.81%

Northeast 41,734,401 27.57% 39,722,822 27.18%

Total Domestic 139,700,868 92.29% 134,403,850 91.97%

151,362,417 100.00% 146,151,268 100.00%

Less securitization adjustments (49,557,390) (49,639,129)

Total $ 101,805,027 $ 96,512,139