Capital One 2007 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

92

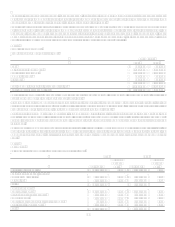

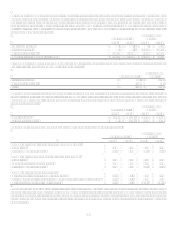

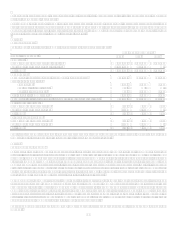

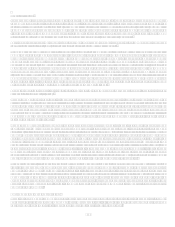

Significant components of the Companys deferred tax assets and liabilities as of December 31, 2007 and 2006 were as follows:

December 31

2007 2006

Deferred tax assets:

Allowance for loan losses $ 1,034,253 $ 721,241

Unearned income 158,926

113,261

Net unrealized losses on securities and derivative instruments 68,340

67,009

Employee stock plans 160,668

122,029

Rewards & sweepstakes programs 439,254

165,791

Valuation difference of acquired loans 149,247

175,291

Retained liabilityManufactured Housing 50,814

30,461

Employee benefits 35,864

56,720

Foreign tax credit carryforward 103,902

12,103

Other 290,437

250,315

Subtotal 2,491,705

1,714,221

Valuation allowance (21,301) (14,621)

Total deferred tax assets 2,470,404

1,699,600

Deferred tax liabilities:

Securitizations 72,539

75,540

Deferred revenue 534,143

663,821

Property & equipment 49,665

72,777

Prepaid expenses 7,542

55,078

Leasing activities 18,632

16,595

Core deposit and other intangibles 423,230

543,000

Servicing assets 89,258

91,429

Other foreign deferred taxes 10,844

14,441

Other 123,200

159,914

Total deferred tax liabilities 1,329,053

1,692,595

Net deferred tax assets (liabilities) $ 1,141,351 $ 7,005

(1) Prior period amounts have been reclassified to conform with current period presentation.

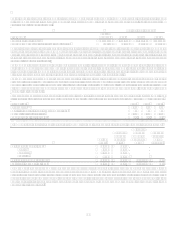

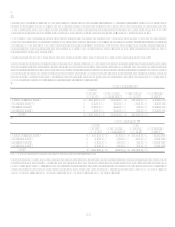

Included in Other deferred tax assets at December 31, 2007, the Company has a $3.7 million net operating loss carryforward for U.S.

federal income taxes purposes with a tax value of $1.2 million that expires in 2020. The Company has net operating loss

carryforwards for state purposes with a tax value of $22.5 million that expire from 2008 to 2027. The Company has foreign tax credit

carryforwards of $103.9 million that expire in 2014 through 2017.

During 2007, the valuation allowance for certain tax credit carryforwards decreased by $7.9 million as a result of a determination that

the Company would have sufficient foreign tax credit limitation in future years. The state valuation allowance was increased by $14.5

million, primarily related to state net operating loss carryforwards acquired through the purchase of North Fork Bancorporation, Inc.

for which subsequently recognized tax benefits will reduce goodwill.

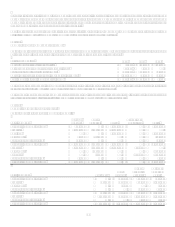

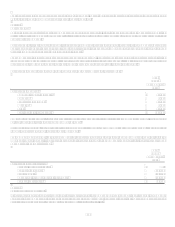

The deferred tax liability for deferred revenue represents late fees, interchange, cash advance fees and overlimit fees. These items are

generally treated as original issue discount (OID) for tax purposes and recognized over the life of the related credit card receivables.

These items are recognized in the income statement as income in the year earned. For income statement purposes, late fees are

reported as interest income, and interchange, cash advance fees and overlimit fees are reported as non- interest income.

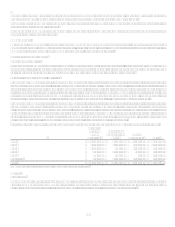

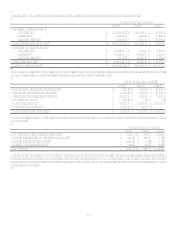

December 31

2007 2006

Deferred revenue:

OIDlate fees $ 845,215

$ 877,759

OIDall other 653,486

986,681

Gross deferred tax liability $ 1,498,701 $ 1,864,440

Net federal deferred tax liability $ 534,143

$ 663,821

(1) Prior period amounts have been reclassified to conform with current period presentation.

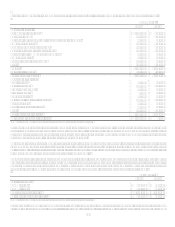

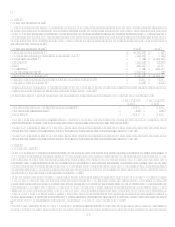

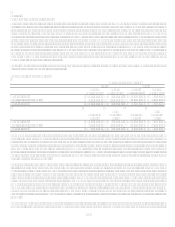

In June 2006, the FASB issued FASB Interpretation No. 48, Accounting for Uncertainty in Income Taxes, an Interpretation of FASB

Statement No. 109 (FIN 48). FIN 48 clarifies the accounting for uncertainty in income taxes recognized in accordance with SFAS