Capital One 2007 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.33

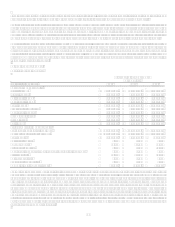

In the Auto Finance sub-segment, the Company has started to scale back lending across the credit spectrum. In the dealer prime

business, the Company is focusing on a selective network of dealers with whom it has established deep relationships and who have

historically produced better credit and profit performance.

The Auto Finance business is focused on originating loans with better credit characteristics by tightening underwriting and steering

originations upmarket within both the subprime and prime parts of the market. In subprime, the Company has stopped originating

loans to the riskiest sub-segments, essentially exiting the riskiest 25% of subprime. In prime, the Company has largely exited the so-

called near prime space, which has resulted in an improvement in the average FICO scores of prime originations. Today, the

average FICO scores of prime originations are 30 points better than prime originations from the fourth quarter of 2006, and 70 points

better than prime originations from the fourth quarter of 2005.

The Company believes that significantly reduced originations, a smaller portfolio with better credit characteristics, improved pricing,

and aggressive management of operating expenses should combine to help the auto finance business achieve better financial returns in

2008. Lower loan balances, however, may temporarily put upward pressure on metrics like charge-off and delinquency rates, even if

actual trends in charge-off and delinquency dollars are improving. The Company will continue to monitor the performance of the auto

finance business carefully, and expects to adjust quickly in line with rapidly changing market conditions.

In the Global Financial Services (GFS) sub-segment, North American GFS businesses are generally expected to experience similar

trends as in the U.S. Card sub-segment. The Company remains cautious in its outlook for the U.K. and Canada, given the risk that

U.S. economic pressures could spread to other parts of the world.

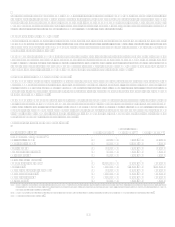

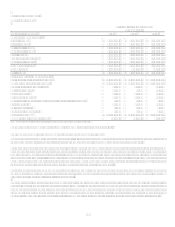

VI. Financial Summary

Table 1 provides a summary view of the consolidated income statement and selected metrics at and for the years ended December 31,

2007, 2006 and 2005.