Capital One 2007 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.9

The Corporation is also registered as a financial institution holding company under Virginia law and as such is subject to periodic

examination by Virginias Bureau of Financial Institutions. The Corporation also faces regulation in the international jurisdictions in

which it conducts business (see below under International Regulation).

In addition to the CONA and Superior merger, the Corporation plans additional consolidations to streamline its operations.

Dividends and Transfers of Funds

Dividends to the Corporation from its direct and indirect subsidiaries represent a major source of funds for the Corporation to pay

dividends on its stock, make payments on corporate debt securities and meet its other obligations. There are various federal and state

law limitations on the extent to which the Banks can finance or otherwise supply funds to the Corporation through dividends, loans or

otherwise. These limitations include minimum regulatory capital requirements, federal and state banking law requirements concerning

the payment of dividends out of net profits or surplus, Sections 23A and 23B of the Federal Reserve Act and Regulation W governing

transactions between an insured depository institution and its affiliates, and general federal and state regulatory oversight to prevent

unsafe or unsound practices. In general, federal and applicable state banking laws prohibit, without first obtaining regulatory approval,

insured depository institutions, such as the Banks, from making dividend distributions if such distributions are not paid out of

available earnings or would cause the institution to fail to meet applicable capital adequacy standards. In addition, under Virginia law,

the Bureau of Financial Institutions may limit the payment of dividends by COB if the Bureau of Financial Institutions determines that

such a limitation would be in the public interest and necessary for COBs safety and soundness.

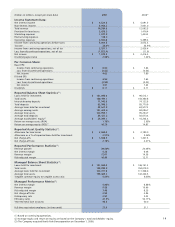

Capital Adequacy

The Banks are subject to capital adequacy guidelines adopted by federal banking regulators. For a further discussion of the capital

adequacy guidelines, see Item 7 Managements Discussion and Analysis of Financial Condition and Results of OperationsCapital

Adequacy and Item 8 Financial Statements and Supplementary DataNote 20Regulatory Matters. The Banks were well

capitalized under these guidelines as of December 31, 2007.

Basel Committee

In late 2007, the federal banking regulators published their final regulations to implement the international accord on revised risk-

based capital rules known as Basel II, a capital regime that would apply to the largest and most complex institutions. The new

capital regime is not currently mandatory for the Company, but could become so as we grow, in particular as our non-U.S. business

grows. Application of the new capital rules could require us to increase the minimum level of capital that we hold. We will continue to

closely monitor regulators implementation of the new rules with respect to the large institutions that are subject to it and assess the

likely eventual impact to us.

FDICIA

Among other things, the Federal Deposit Insurance Corporation Improvement Act of 1991 (FDICIA) requires federal bank

regulatory authorities to take prompt corrective action (PCA) with respect to insured depository institutions that do not meet

minimum capital requirements. FDICIA establishes five capital ratio levels: well-capitalized, adequately-capitalized, undercapitalized,

significantly undercapitalized and critically undercapitalized. As of December 31, 2007, each of the Banks met the requirements for a

well-capitalized institution. The well-capitalized classification is determined solely for the purposes of applying FDICIAs PCA

provisions, as discussed below, and should not be viewed as describing the condition or future prospects of a depository institution,

including the Banks. Were any of the Banks to lose their status as well-capitalized they could be required to increase capital or lose

access to deposits.

The Banks may accept brokered deposits as part of their funding. Under FDICIA, only well-capitalized and adequately-

capitalized institutions may accept brokered deposits. Adequately-capitalized institutions, however, must first obtain a waiver from

the FDIC before accepting brokered deposits, and such deposits may not pay rates that significantly exceed the rates paid on deposits

of similar maturity from the institutions normal market area or the national rate on deposits of comparable maturity, as determined by

the FDIC, for deposits from outside the institutions normal market area.

Liability for Commonly-Controlled Institutions

Under the cross-guarantee provision of the Financial Institutions Reform, Recovery and Enforcement Act of 1989 (FIRREA),

insured depository institutions such as the Banks may be liable to the FDIC with respect to any loss incurred or reasonably anticipated

to be incurred, by the FDIC in connection with the default of, or FDIC assistance to, any commonly controlled insured depository

institution. The Banks are commonly controlled within the meaning of the FIRREA cross-guarantee provision.