Capital One 2007 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

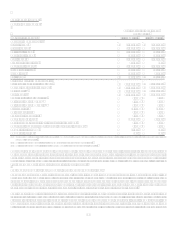

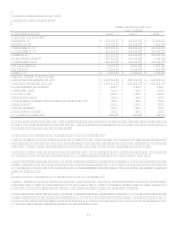

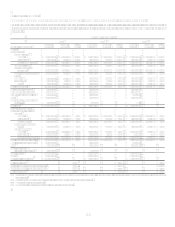

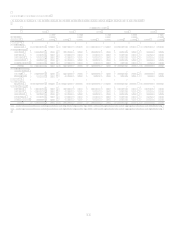

Table 10: Short Term Borrowings

(Dollars in Thousands)

Maximum

Outstanding

as of any

Month-End

Outstanding

as of

Year-End

Average

Outstanding

Average

Interest

Rate

Year-End

Weighted

Average

Interest

Rate

2007:

Federal funds purchased and resale

agreements $ 3,504,745 $ 683,186 $ 1,689,647 4.74% 3.19%

Other 4,345,490 4,345,490 2,635,113 5.91 5.88

Total $ 5,028,676 $ 4,324,760 5.45% 5.51%

2006:

Federal funds purchased and resale

agreements $ 3,736,470 $ 3,736,470 $ 1,662,961 4.20% 5.27%

Other 3,198,710 1,716,055 1,323,998 5.75 5.89

Total $ 5,452,525 $ 2,986,959 4.89% 5.28%

2005:

Federal funds purchased and resale

agreements $ 2,332,173 $ 745,719 $ 704,458 2.69% 3.62%

Other 1,453,181 1,271,014 840,860 4.88 2.09

Total $ 2,016,733 $ 1,545,318 3.88% 2.66%

Table 11 summarizes the amounts and maturities of the contractual funding obligations of the Company, including off-balance sheet

funding.

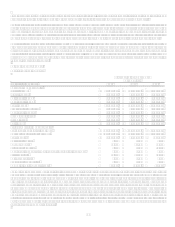

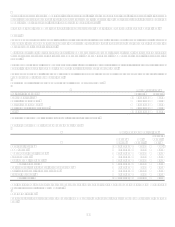

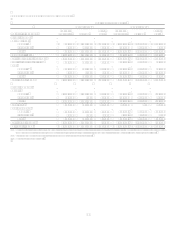

Table 11: Funding Obligations

As of December 31, 2007 Total Up to 1 year 1-3 years 4-5 years After 5 years

Interest-bearing time deposits(1) $ 29,104,759 $ 18,871,926 $ 7,859,207 $ 1,710,740 $ 662,886

Senior and subordinated notes 10,712,706 1,808,760 2,361,793 1,801,426 4,740,727

Other borrowings(2) 26,583,683 15,250,370 9,545,088 482,912 1,305,313

Operating leases 1,165,352 145,153 250,728 201,728 567,743

Off-balance sheet securitization amortization 48,864,562 9,447,921 16,632,890 10,590,612 12,193,139

Total obligations $ 116,431,062 $ 45,524,130 $ 36,649,706 $ 14,787,418 $ 19,469,808

(1) Includes only those interest bearing deposits which have a contractual maturity date.

(2) Other borrowings includes secured borrowings for the Companys on-balance sheet auto loan securitizations, junior subordinated capital income securities and debentures,

FHLB advances, federal funds purchased and resale agreements and other short-term borrowings.

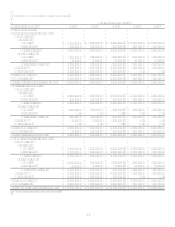

The terms of the lease and credit facility agreements related to certain other borrowings and operating leases in Table 10 require

several financial covenants (including performance measures and equity ratios) to be met. If these covenants are not met, there may be

an acceleration of the payment due dates noted above. As of December 31, 2007, the Company was not in default of any such

covenants.

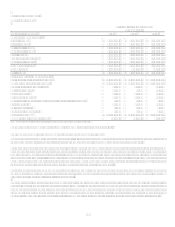

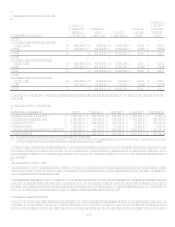

Liquidity Risk Management

Liquidity risk management refers to the way the Company manages the use and availability of various funding sources to meet its

current and future operating needs. These needs are largely a result of asset growth, securitization, debt and deposit maturities, and

payments of other corporate obligations.

To facilitate liquidity risk management, the Company uses a variety of funding sources to establish a maturity pattern that provides a

prudent mixture of short-term and long-term funds. The Company obtains funds through the gathering of deposits, issuing debt and

equity, and securitizing assets. Further liquidity is provided to the Company through committed facilities. As of December 31, 2007,

the Company had over $11.4 billion in unused conduit capacity available for liquidity needs.

Securities Available for Sale

The Company held $10.5 billion in available for sale investment securities, net of $9.3 billion in pledged available-for-sale investment

securities and $4.8 billion of cash and cash equivalents at December 31, 2007, compared to $6.0 billion in available-for-sale

investment securities, net of $9.5 billion in pledged available-for-sale investment securities and $4.7 billion of cash and cash