Capital One 2007 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

27

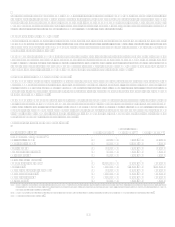

to a third party in a borrowing arrangement. Commercial letters of credit are short-term commitments issued primarily to facilitate

trade finance activities for customers and are generally collateralized by the goods being shipped to the client. Collateral requirements

are similar to those for funded transactions and are established based on managements credit assessment of the customer.

Management conducts regular reviews of all outstanding letters of credit and customer acceptances, and the results of these reviews

are considered in assessing the adequacy of the Companys allowance for loan and lease losses.

Loan and Line of Credit Commitments

For credit extended through credit cards, only drawn and outstanding loan balances are recorded on the Consolidated Balance Sheet.

The Company has unused available credit card lines and does not anticipate that all of its customers will exercise their entire available

line at any given point in time. The Company generally has the right to increase, reduce, cancel, alter or amend the terms of these

available lines of credit at any time.

The Company enters into commitments to extend credit other than credit card lines that are legally binding conditional agreements

having fixed expirations or termination dates and specified interest rates and purposes. These commitments generally require

customers to maintain certain credit standards. Collateral requirements and loan-to-value ratios are the same as those for funded

transactions and are established based on managements credit assessment of the customer. Commitments may expire without being

drawn upon. Therefore, the total commitment amount does not necessarily represent future requirements.

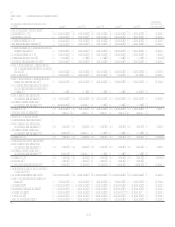

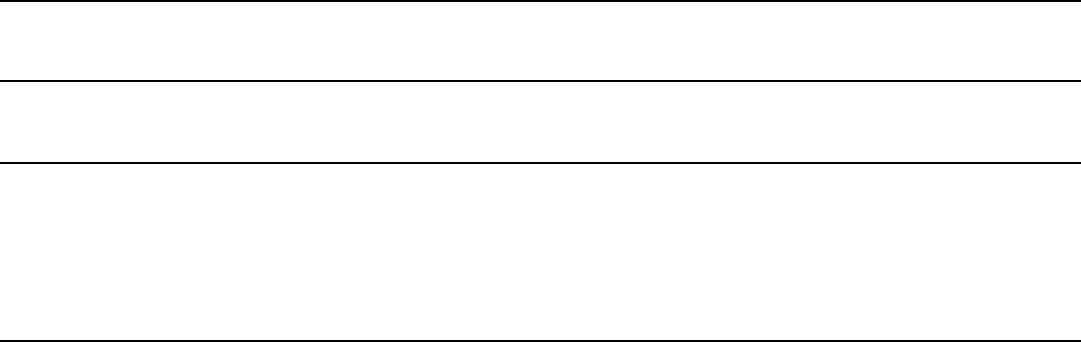

IV. Reconciliation to GAAP Financial Measures

The Companys consolidated financial statements prepared in accordance with accounting principles generally accepted in the United

States (GAAP) are referred to as its reported financial statements. Loans included in securitization transactions which qualify as

sales under GAAP have been removed from the Companys reported balance sheet. However, servicing fees, finance charges, and

other fees, net of charge-offs, and interest paid to investors of securitizations are recognized as servicing and securitizations income on

the reported income statement.

The Companys managed consolidated financial statements reflect adjustments made related to effects of securitization transactions

qualifying as sales under GAAP. The Company generates earnings from its managed loan portfolio which includes both the on-

balance sheet loans and off-balance sheet loans. The Companys managed income statement takes the components of the servicing

and securitizations income generated from the securitized portfolio and distributes the revenue and expense to appropriate income

statement line items from which it originated. For this reason, the Company believes the managed consolidated financial statements

and related managed metrics to be useful to stakeholders.

As of and for the year ended December 31, 2007

(Dollars in millions) Total Reported

Securitization

Adjustments(1) Total Managed(2)

Income Statement Measures(3)

Net interest income $ 6,530 $ 4,490 $ 11,020

Non-interest income $ 8,054 $ (2,288) $ 5,766

Total revenue $ 14,584 $ 2,202 $ 16,786

Provision for loan losses $ 2,637 $ 2,201 $ 4,838

Net charge-offs $ 1,961 $ 2,201 $ 4,162

Balance Sheet Measures

Loans held for investment $ 101,805 $ 49,557 $ 151,362

Total assets $ 150,590 $ 48,707 $ 199,297

Average loans held for investment $ 93,837 $ 51,185 $ 145,022

Average earning assets $ 124,426 $ 49,076 $ 173,502

Average total assets $ 148,983 $ 50,410 $ 199,393

Delinquencies $ 3,721 $ 2,143 $ 5,864

(1) Income statement adjustments for the year ended December 31, 2007 reclassify the net of finance charges of $6,334.8 million, past due fees of $1,004.1 million, other

interest income of $(167.3) million and interest expense of $2,681.7 million; and net charge-offs of $2,201.5 million to non-interest income from net interest income and

provision for loan losses, respectively.

(2) The managed loan portfolio does not include auto loans which have been sold in whole loan sale transactions where the Company has retained servicing rights.

(3) Based on continuing operations.