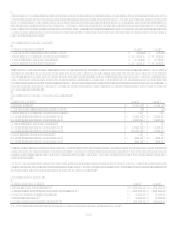

Capital One 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

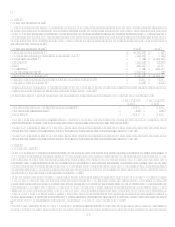

94

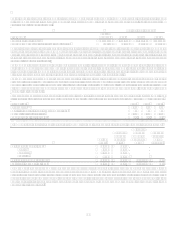

withholding tax on these unremitted earnings is not practicable at this time because such liability is dependent upon circumstances

existing if and when remittance occurs.

As of December 31, 2007, U.S. income taxes have not provided for approximately $276.0 million of previously acquired thrift bad

debt reserves created for tax purposes as of December 31, 1987. These amounts, acquired as a result of the merger with North Fork

Bancorporation, Inc., are subject to recapture in the unlikely event that CONA, as successor to North Fork Bank, makes distributions

in excess of earnings and profits, redeems its stock, or liquidates.

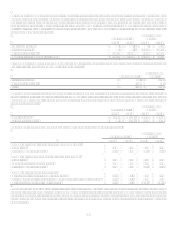

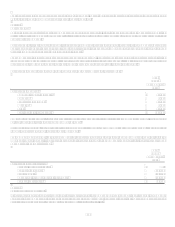

Note 15

Earnings Per Share

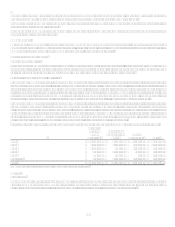

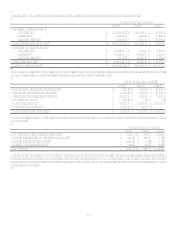

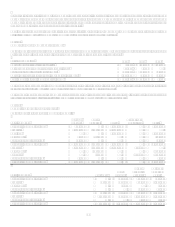

The following table sets forth the computation of basic and diluted earnings per share:

Year Ended December 31

(Shares in Thousands) 2007 2006 2005

Numerator:

Income from continuing operations, net of tax $ 2,591,719 $ 2,426,377 $ 1,809,147

Loss from discontinued operations, net of tax (1,021,387) (11,884)

Net income $ 1,570,332 $ 2,414,493 $ 1,809,147

Denominator:

Denominator for basic earnings per share-Weighted-average shares 390,287 309,584 259,159

Effect of dilutive securities:

Stock options 4,327 6,171 7,367

Contingently issuable shares 192

Restricted stock and units 739 1,268 2,382

Dilutive potential common shares 5,258 7,439 9,749

Denominator for diluted earnings per share-Adjusted weighted-average shares 395,545 317,023 268,908

Basic earnings per share

Income from continuing operations $ 6.64 $ 7.84 $ 6.98

Loss from discontinued operations (2.62) (0.04)

Net income $ 4.02 $ 7.80 $ 6.98

Diluted earnings per share

Income from continuing operations $ 6.55 $ 7.65 $ 6.73

Loss from discontinued operations (2.58) (0.03)

Net income $ 3.97 $ 7.62 $ 6.73

Securities of approximately 7,429,151, 4,538,000 and 1,862,000 during 2007, 2006 and 2005, respectively, were not included in the

computation of diluted earnings per share because their inclusion would be antidilutive.

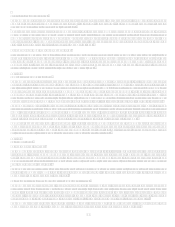

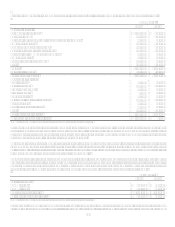

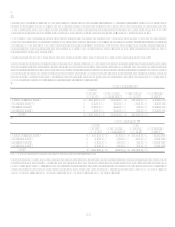

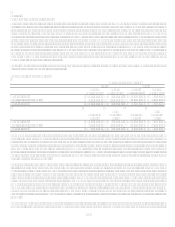

Note 16

Share Repurchase Program

On January 25, 2007 the Company announced a $3.0 billion share repurchase program. On March 12, 2007, the Company entered into

a $1.5 billion accelerated share repurchase (ASR) agreement with Credit Suisse, New York Branch (CSNY). Under the ASR

agreement, the Company purchased $1.5 billion of its $.01 par value common stock at an initial price of $73.57 per share, the closing

price of the Companys common stock on the New York Stock Exchange on April 2, 2007, the effective date of the agreement. The

ASR program was accounted for as an initial treasury stock transaction and a forward stock purchase contract. The initial repurchase

of shares resulted in an immediate reduction of the outstanding shares used to calculate the weighted-average common shares

outstanding for basic and diluted EPS on the effective date of the agreement. The forward stock purchase contract was classified as an

equity instrument and was deemed to have a fair value of $0 at the effective date.

An ASR combines the immediate share retirement benefits of a tender offer with the market impact and pricing benefits of an open

stock repurchase program. The ASR agreement provided that the Company or CSNY would be obligated to make certain additional

payments upon final settlement of the ASR agreement. Most significantly, the Company would receive from, or be required to pay,

CSNY a purchase price adjustment based on the daily volume weighted average market price of the Companys common stock over a

period beginning after the effective date of the agreement through on or around August 22, 2007. These additional payments were to

be satisfied in shares of the Companys common stock. On August 27, 2007, the ASR program terminated with the delivery of

343,512 shares back to CSNY for a net share retirement of 20,045,233 shares.

The arrangements were intended to comply with Rules 10b5-1(c)(1)(i) and 10b-18 of the Securities Exchange Act of 1934, as

amended.