Capital One 2007 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

45

Non-interest expense increased 1% during 2006. Non-interest expense in 2005 included a $28.2 million impairment charge related to

the write-off of goodwill and other charges related to the Companys insurance brokerage business. Exclusive of the one time charge,

non-interest expense increased 3% during 2006, well below the growth in revenue of 11% and average loans of 14%.

VIII. Funding

Funding Availability

The Company has established access to a variety of funding sources. Table 7 illustrates the Companys unsecured funding sources and

its two auto securitization warehouses.

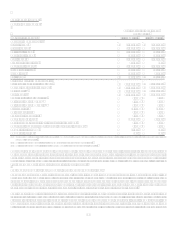

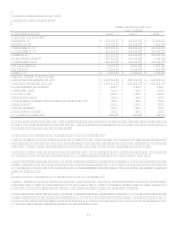

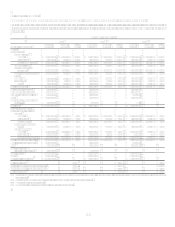

Table 7: Funding Availability

(Dollars or dollar equivalents in millions)

Effective/

Issue Date Availability(1)(6) Outstanding(4)

Final

Maturity(5)

Senior and Subordinated Global Bank Note Program(2) 6/05 $ 1,800 $ 3,193

Senior Domestic Bank Note Program(3) 4/97 $ 168

Capital One Auto Loan Facility I(7) 3/02 $ 55 $ 4,218

Capital One Auto Loan Facility II(7) 3/05 $ 1,122 $ 128

Corporation Shelf Registration 5/06 * N/A **

(1) All funding sources are non-revolving except for the Capital One Auto Loan Facilities. Funding availability under the credit facilities is subject to compliance with certain

representations, warranties and covenants. Funding availability under all other sources is subject to market conditions.

(2) The notes issued under the Senior and Subordinated Global Bank Note Program may have original terms of thirty days to thirty years from their date of issuance. This

program was updated in June 2005.

(3) The notes issued under the Senior Domestic Bank Note Program have original terms of one to ten years. The Senior Domestic Bank Note Program is no longer available for

issuances.

(4) Amounts outstanding are as of December 31, 2007.

(5) Maturity date refers to the date the facility terminates, where applicable.

(6) Availability does not include unused conduit capacity related to securitization structures of $10.2 billion at December 31, 2007.

(7) The outstanding facility balances for the auto securitization conduits were paid-off in January 2008.

* The Corporation and certain of its subsidiaries have registered an indeterminate amount of securities pursuant to the Automatic Shelf Registration Statement that are

available for future issuance.

** Under SEC rules, the Automatic Shelf Registration Statement expires three years after filing. Accordingly, the Corporation must file a new Automatic Shelf Registration

Statement at least once every three years.

The Senior and Subordinated Global Bank Note Program gives COB the ability to issue securities to both U.S. and non-U.S. lenders

and to raise funds in U.S. and foreign currencies, subject to conditions customary in transactions of this nature.

Prior to the establishment of the Senior and Subordinated Global Bank Note Program, COB issued senior unsecured debt through an

$8.0 billion Senior Domestic Bank Note Program. COB did not renew the Senior Domestic Bank Note Program for future issuances

following the establishment of the Senior and Subordinated Global Bank Note Program.

In June 2004, the Company terminated its Domestic Revolving and Multicurrency Credit Facilities and replaced them with a new

revolving credit facility (Credit Facility) providing for an aggregate of $750.0 million in unsecured borrowings from various lending

institutions to be used for general corporate purposes. On April 30, 2007 the Credit Facility was terminated.

Collateralized Revolving Credit Facilities

In March 2002, COAF entered into a revolving warehouse credit facility collateralized by a security interest in certain auto loan assets

(the Capital One Auto Loan Facility I). As of December 31, 2007, the Capital One Auto Loan Facility I had the capacity to issue up

to $4.1 billion in secured notes. The Capital One Auto Loan Facility I has multiple participants each with separate renewal dates. The

facility does not have a final maturity date. Instead, each participant may elect to renew the commitment for another set period of time.

Interest on the facility is based on commercial paper rates. The Capital One Auto Loan Facility I was paid down in January 2008.

In March 2005, COAF entered into a second revolving warehouse credit facility collateralized by a security interest in certain auto

loan assets (the Capital One Auto Loan Facility II). As of December 31, 2007, the Capital One Auto Loan Facility II had the

capacity to issue up to $1.3 billion in secured notes. The facility does not have a final maturity date. Instead, the participant may elect

to renew the commitment for another set period of time. Interest on the facility is based on commercial paper rates. The Capital One

Auto Loan Facility II was paid down in January 2008.

Corporation Shelf Registration Statement

As of December 31, 2007, the Corporation had an effective shelf registration statement under which the Corporation from time to time

may offer and sell an indeterminate aggregate amount of senior or subordinated debt securities, preferred stock, depositary shares