Capital One 2007 Annual Report Download - page 122

Download and view the complete annual report

Please find page 122 of the 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.100

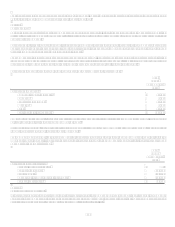

Industry Litigation

In accordance with the provisions of Statement of Financial Accounting Standards No. 5, Accounting for Contingencies, (SFAS 5 ),

the Company accrues for a litigation related liability when it is probable that such a liability has been incurred and the amount of the

loss can be reasonably estimated. In addition, the Companys subsidiary banks are members of Visa U.S.A., Inc. (Visa). As members,

the Companys subsidiary banks have indemnification obligations to Visa with respect to final judgments and settlements of the

litigation against Visa. The Company accounts for its indemnification obligations to Visa in accordance with the provisions of FASB

Interpretation No. 45, Guarantors Accounting and Disclosure Requirements for Guarantees, (FIN 45).

Over the past several years, MasterCard International (MasterCard) and Visa as well as several of their member banks, have been

involved in several different lawsuits challenging various practices of MasterCard and Visa.

In November 2004, American Express filed an antitrust lawsuit (the Amex lawsuit) against MasterCard and Visa and several

member banks alleging, among other things, that the defendants jointly and severally implemented and enforced illegal exclusionary

agreements that prevented member banks from issuing American Express cards. The complaint requested civil monetary damages.

The Corporation and two of its subsidiaries were named as defendants in this lawsuit. On November 7, 2007, Visa and American

Express announced that the Amex lawsuit had been settled and that the remaining bank defendants named in the lawsuit, including the

Corporation and its subsidiaries, would be dropped as defendants and released from all claims asserted in the lawsuit. The Company

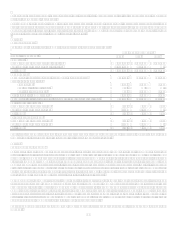

recorded an expense of $79.8 million in the fourth quarter of 2007 in connection with the settlement of the American Express

litigation. That amount includes $48.0 million related to the settlement of the Companys liability and $31.8 million related to the

Companys share of damages as a Visa member, which was recorded in accordance with the provisions SFAS 5. Both amounts are

included in other liabilities within our consolidated balance sheet at December 31, 2007 and are reported in other non-interest expense

within our consolidated statement of income for the year ended December 31, 2007.

Discover Financial Services has filed a similar set of claims against Visa and MasterCard. The Corporation and its subsidiaries are not

defendants in the Discover litigation.

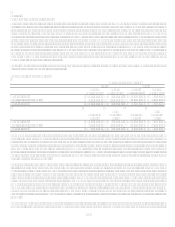

In 2007, a number of individual plaintiffs, each purporting to represent a class of cardholders, filed antitrust lawsuits in the United

States District Court for the Northern District of California against several issuing banks, including the Corporation (the In Re Late

Fees Litigation). These lawsuits allege, among other things, that the defendants conspired to fix the level of late fees and over-limit

fees charged to cardholders, and that these fees are excessive. In May 2007, the cases were consolidated for all purposes and a

consolidated amended complaint was filed alleging violations of federal statutes and state law. The amended complaint requests civil

monetary damages, which could be trebled. In November 2007, the court dismissed the amended complaint. Plaintiffs have indicated

that they intend to appeal that order.

In 2005, a number of entities, each purporting to represent a class of retail merchants, filed antitrust lawsuits (the Interchange

lawsuits) against MasterCard and Visa and several member banks, including the Corporation and its subsidiaries, alleging among

other things, that the defendants conspired to fix the level of interchange fees. The complaints seek injunctive relief and civil monetary

damages, which could be trebled. Separately, a number of large merchants have asserted similar claims against Visa and MasterCard

only. In October 2005, the class and merchant Interchange lawsuits were consolidated before the United States District Court for the

Eastern District of New York for certain purposes, including discovery. Discovery is proceeding in these cases. We believe that we

have meritorious defenses and intend to defend these cases vigorously. Given the complexity of the issues raised by these lawsuits and

the uncertainty regarding: (i) the outcome of these suits, (ii) the likelihood and amount of any possible judgments, (iii) the likelihood,

amount and validity of any claim against the member banks, including the Corporation and its subsidiary banks, (iv) changes in

industry structure that may result from the suits and (v) the effects of these suits, in turn, on competition in the industry, member

banks, and interchange fees, the Corporation cannot determine at this time the long-term effects of these suits.

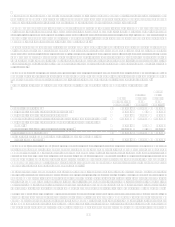

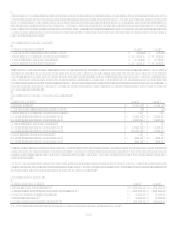

In connection with litigation pending against Visa, Capital One Financial Corporation has recorded an indemnification related

liability, in accordance with FIN 45, of $59.1 million for estimated possible damages, reflecting Capital Ones share of potential

damages as a Visa member. The indemnification related liability is included in other liabilities within our consolidated balance sheet

at December 31, 2007 and is reported in other non-interest expense within our consolidated statement of income for the year ended

December 31, 2007. The indemnification related liability includes $48.4 million for the Interchange lawsuits and $10.7 million for the

Discover Financial Services claim. Due to the complex nature of the litigation pending against Visa and the inherent difficulty of

predicting the outcome of pending litigation, the Company cannot determine the maximum potential amount of its share of potential

damages as a Visa member.

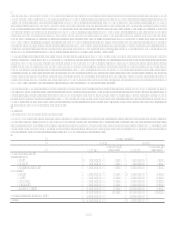

Other Pending and Threatened Litigation

In addition, the Company is commonly subject to various pending and threatened legal actions relating to the conduct of its normal

business activities. In the opinion of management, the ultimate aggregate liability, if any, arising out of any such pending or threatened

legal actions will not be material to its consolidated financial position or its results of operations.