Capital One 2007 Annual Report Download

Download and view the complete annual report

Please find the complete 2007 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Capital One Financial Corporation |2007 Annual Report

2007 annual report

Table of contents

-

Page 1

Capital One Financial Corporation | 2007 Annual Report 2007 annual report -

Page 2

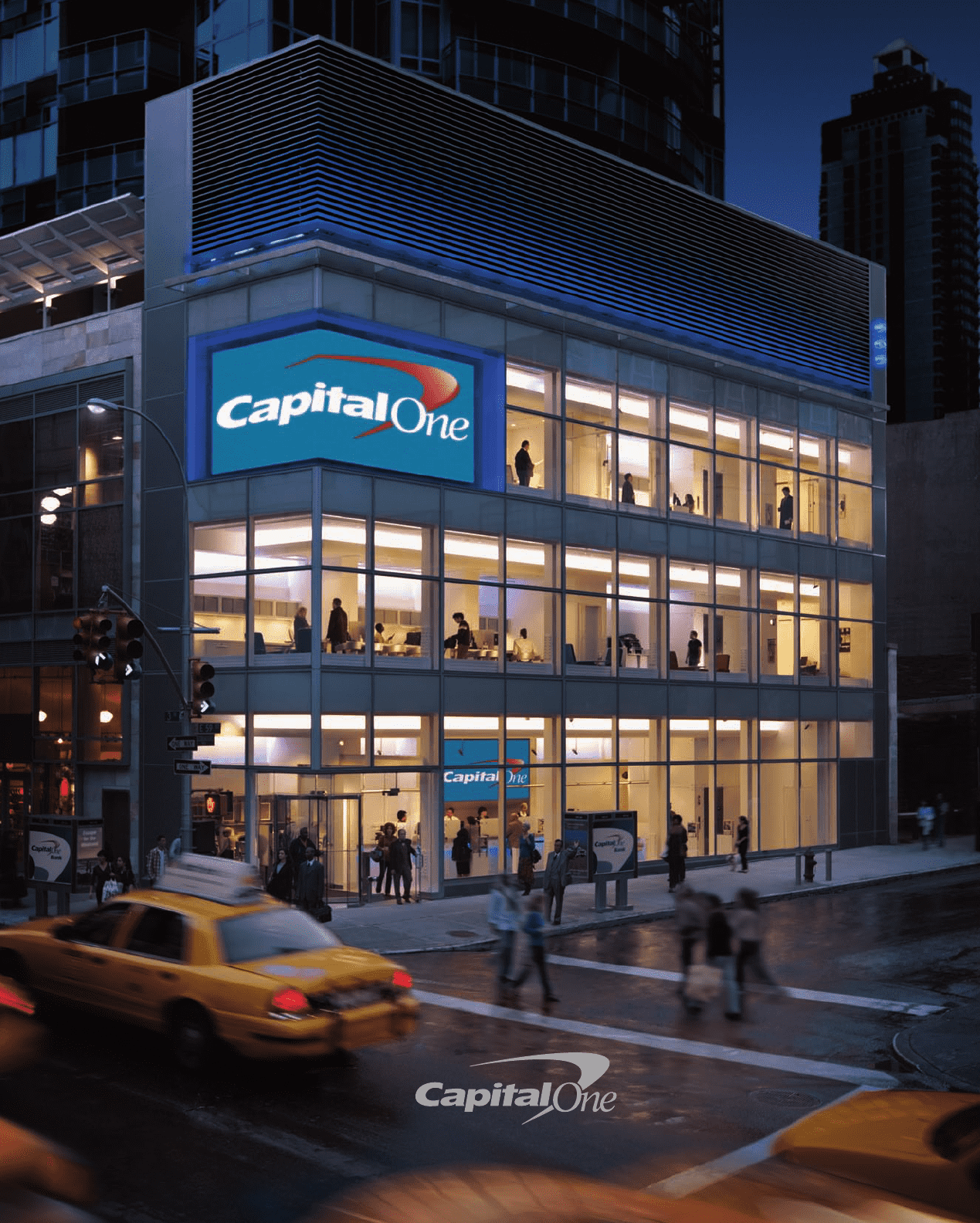

Newly rebranded Capital One Bank branch at the corner of 59th and 3rd in New York. This Manhattan branch combines cuttingedge design with convenient location. -

Page 3

... have made over the years to fortify our company in anticipation of difficult times. We made the decision to transform our company with our entry into banking, significantly reducing our reliance on the capital markets. Nearly half of our assets are now deposit funded. Our bank has provided us with... -

Page 4

... value. We Are Well-Positioned To Create Enduring Shareholder Value "We are driving shareholder value through the disciplined management of our balance sheet." From the beginning, we have worked to generate shareholder value by building a strong, diversified company that is structurally advantaged... -

Page 5

...the balance sheet, and the resulting change in our risk profile, decreases our capital requirements significantly and creates substantial capital efficiency benefits. A combination of our high returns on tangible equity, capital efficiency, and slower growth is driving significant capital generation... -

Page 6

... revenue growth in our credit card and banking businesses, stronger growth in our other national lending businesses, and improved operating efficiency. The resulting earnings growth over the cycle, combined with the return of capital to our shareholders, should drive above-average total returns... -

Page 7

"From the inception of the company, we have been focused on building a company that is robust and resilient during both good times and bad." 5 -

Page 8

... in home values. We updated our credit models to reflect the rapidly evolving competitive and economic environment. And we pulled back on lower resiliency business segments across the company, such as the prime revolver segment in U.S. Card and the GreenPoint mortgage originations business, to... -

Page 9

... of the business by making selected pricing changes, such as repricing certain assets where the matched funding had expired after many years following the conversion to our new credit card operating system. These "Despite an intensely competitive environment, our U.S. Card business continued to... -

Page 10

...of credit card disclosures. Many other issuers have been criticized for practices such as "universal default" (where issuers increase interest rates because of customer behavior on other loans or changes to credit bureau scores) and double-cycle billing. In contrast, Capital One never used universal... -

Page 11

... worse overall credit performance on a portfolio basis. The year's brightest spot for COAF was the introduction of our new dealer relationship model. We have integrated the various programs from our legacy auto acquisitions and now are presenting one integrated face to the dealer. Early returns are... -

Page 12

... a new senior management team to build a winning retail and commercial bank in all of our markets in New York, New Jersey, Connecticut, Louisiana, and Texas. The team is led by Lynn Pike as president of our banking division. Lynn brings a wealth of banking experience to our company from her years at... -

Page 13

... to report that the integration is on track. We have completed the Hibernia integration and have converted to the Capital One brand in Texas and Louisiana. We have integrated our human resources, finance, and treasury functions across the enterprise. Our national credit card and auto businesses now... -

Page 14

...business." We launched Capital One CardLab in late 2007 with an integrated marketing campaign that included innovative television ads featuring a mad scientist and a futuristic space warlord who become obsessed with building their own Capital One credit cards. Our brand launch in Louisiana and Texas... -

Page 15

...leadership from our board of directors and our executive team. Our board is fully engaged on every aspect of our business. They ask tough questions and are focused on driving shareholder value. We have a strong management team, bolstered by a wealth of new executive talent recruited into the company... -

Page 16

... culture. Our people faced a number of challenges in 2007 and they uniformly rose to the occasion. As we look to 2008, we have a lot of work to do. We must remain sharply focused on disciplined management of capital, costs, and credit risk to succeed in a difficult environment and create shareholder... -

Page 17

... 2004 2005 2006 2007 diluted earnings per share $6.21 $4.85 $6.73 $7.62 diluted earnings per share from continuing $7.65 operations $6.73 $6.21 $4.85 $3.97 $6.55 2003 2004 2005 2006 2007 2003 2004 2005 2006 2007 Managed loans are comprised of reported loans and off-balance-sheet... -

Page 18

S E G M E N T R E S U LT S u.s. card managed loans ($ in billions) net income ($ in millions) $53.6 $48.6 $49.5 $52.1 $1,823.4 $1,609.4 $1,387.3 $2,116.3 2004 2005 2006 2007 2004 2005 2006 2007 auto finance managed loans ($ in billions) net income ($ in millions) $25.1 $21.8 $16.4 ... -

Page 19

S E G M E N T R E S U LT S global financial services managed loans ($ in billions) net income ($ in millions) $27.0 $21.2 $23.4 $29.3 $274.0 $213.1 $186.0 $299.4 2004 2005 2006 2007 2004 2005 2006 2007 banking deposits ($ in billions) net income ($ in millions) $73.3 $574.2 $35.3... -

Page 20

18 -

Page 21

... loans held for investment Average total assets Tangible common equity to tangible assets ratio Managed Performance Metrics(1): Net interest margin Revenue margin Risk-adjusted margin Net charge-off rate Delinquency rate Efficiency ratio Year-end total loan accounts Full-time equivalent employees... -

Page 22

... Corporation Capital One Financial Corporation Executive Officers Richard D. Fairbank Chairman of the Board, Chief Executive Officer and President Robert M. Alexander E. R. CampbellC, F Former Chairman Hibernia Corporation Chief Information Officer and Head of Enterprise Customer Management... -

Page 23

... Capital One Drive McLean, Virginia (Address of Principal Executive Offices) 22102 (Zip Code) RegistrantÂ's telephone number, including area code: (703) 720-1000 Securities registered pursuant to section 12(b) of the act: Title of Each Class Name of Each Exchange on Which Registered Common Stock... -

Page 24

...and Executive Officers of the Corporation Executive Compensation Security Ownership of Certain Beneficial Owners and Management and Related Stockholder Matters Certain Relationships and Related Transactions Principal Accountant Fees and Services Exhibits, Financial Statement Schedules and Reports on... -

Page 25

... in Canada. Our U.K. Bank has authority, among other things, to accept deposits and provide credit card and installment loans. Our common stock is listed on the New York Stock Exchange under the symbol COF. Our principal executive office is located at 1680 Capital One Drive, McLean, Virginia 22102... -

Page 26

... Board of Directors oversees our accounting, financial reporting, internal controls and risk assessment and management processes. The Audit and Risk Committee also reviews periodic reporting on significant risks and mitigation activities and compliance with corporate risk policies. The Board Finance... -

Page 27

... risk-adjusted returns, and diversification. Our guiding principles, strong central governance, and Board-directed credit risk tolerances are designed to keep senior executives well-informed of credit trends so they can make appropriate credit and business decisions. We preserve day-to-day market... -

Page 28

... risk information is also reported to the Audit and Risk Committee of the Board of Directors. Corporate Audit Services also assesses operational risk and the related quality of internal controls and quality of risk management through our audit activities. The company holds operational risk capital... -

Page 29

... time, our transfer to this new technology platform will allow us to achieve cost savings, increase speed to market, expand product and service flexibility, and enhance our ability to innovate while reducing operational risk. Planning is complete for North Fork BankÂ's integration into Capital One... -

Page 30

... or acquisitions and/or be required to discontinue existing activities that are not generally permissible for bank holding companies. COB is a banking corporation chartered under Virginia law and a member of the Federal Reserve System, the deposits of which are insured by the Deposit Insurance Fund... -

Page 31

... funds for the Corporation to pay dividends on its stock, make payments on corporate debt securities and meet its other obligations. There are various federal and state law limitations on the extent to which the Banks can finance or otherwise supply funds to the Corporation through dividends, loans... -

Page 32

...all loans in COBÂ's programs that are targeted at customers either with a Fair, Isaac and Company (Â"FICOÂ") score of 660 or below or with no FICO score. COB holds on average 200% of the total risk-based capital requirement that would otherwise apply to such assets. FFIEC Account Management Guidance... -

Page 33

... other regulations covering their business operations, including sales and trading practices, public offerings, publication of research reports, use and safekeeping of client funds and securities, capital structure, record-keeping and the conduct of directors, officers and employees. As part of our... -

Page 34

...the Securities and Exchange Commission (Â"SECÂ") and contains a number of significant changes relating to the responsibilities of directors and officers and reporting and governance obligations of SEC reporting companies. In addition, the Sarbanes-Oxley Act also created the Public Company Accounting... -

Page 35

... are not limited to information relating to our future earnings per share, growth in managed loans outstanding, product mix, segment growth, managed revenue margin, funding costs, operations costs, employment growth, marketing expense, delinquencies and charge-offs. Forward-looking statements also... -

Page 36

... rates and fees), credit limit and other product features. Larger, better capitalized companies may be able to offer credit cards at better rates and with more attractive features than we can offer. Our other consumer lending businesses, including auto lending, small business lending, home loan... -

Page 37

...we use to make loans to customers and invest in debt securities and other earning assets. We earn interest on these loans and assets and pay interest on the money we borrow from institutions and depositors. Changes in interest rates, including changes in the relationship between short term rates and... -

Page 38

... our existing management talent and recruit new talent as needed, we face a competitive market for such talent and there can be no assurance that we will continue to be able to maintain and build a management team capable of running our increasingly large and complex business. Also, we may acquire... -

Page 39

... we depend on the capital markets for funding and capital, we could experience reduced availability and increased cost of funding if our debt ratings were lowered. Also, we compete for funding with other banks, savings banks and similar companies, some of which are publicly traded. Many of these... -

Page 40

...the market price of our stock. Item 1B. Unresolved Staff Comments. Not applicable. Item 2. Properties. Our real estate portfolio is used to support all of our business segments. We own the 570,000 square foot headquarters building located at 1680 Capital One Drive in McLean, Virginia. The building... -

Page 41

...Â's Common Equity and Related Stockholder Matters. Total Number of Shares Purchased as Part of Publicly Announced Plans(1) 2,785,382 10,642,308 Â- 13,427,690 Maximum Amount That May Yet be Purchased Under the Plan or Program(1) $ 594,376 Â- Â- (Dollars in thousands, except per share information... -

Page 42

...3.97 Dividends 0.11 Book value as of year-end 65.18 Selected Year-End Reported Balances(3): Loans held for investment $ 101,805.0 Allowance for loan and lease 2,963.0 losses Total assets 150,499.1 Interest-bearing deposits 71,943.9 Total deposits 82,990.5 Borrowings 37,261.9 StockholdersÂ' equity 24... -

Page 43

... (5) 2005 (4) 2004 2003 Five Year Compound Growth Rate Selected Average Reported Balances(3): Loans held for investment Average earning assets Total assets Interest-bearing deposits Total deposits Borrowings StockholdersÂ' equity Reported Metrics(3): Revenue margin Net interest margin Risk... -

Page 44

... are: • • Capital One Bank (Â"COBÂ") which currently offers credit and debit card products, other lending products and deposit products. Capital One, National Association (Â"CONAÂ") which offers a broad spectrum of banking products and financial services to consumers, small businesses and... -

Page 45

... that used to estimate the allowance related to expected principal losses on reported loans. The suppression amount is calculated by adding any current period change in the estimate of the uncollectible portion of finance charge and fee receivables to the amount of finance charges and fees charged... -

Page 46

... secondary market and the right to service these loans are retained for a fee, and are carried at fair value; changes in fair value are recognized in mortgage servicing and other income. The Company continues to operate the mortgage servicing business and to report the changes in the fair value of... -

Page 47

.... Recognition of Customer Rewards Liability The Company offers products, primarily credit cards, that provide program members with various rewards such as airline tickets, free or deeply discounted products or cash rebates, based on account activity. The Company establishes a rewards liability based... -

Page 48

...subject to substantial credit, repayment and interest rate risks on transferred assets if the off-balance sheet loans are not paid when due. Securitization investors and the trusts only have recourse to the retained residual interests, not the CompanyÂ's assets. See Item 8 Â"Financial Statements and... -

Page 49

...outstanding loan balances are recorded on the Consolidated Balance Sheet. The Company has unused available credit card lines and does not anticipate that all of its customers will exercise their entire available line at any given point in time. The Company generally has the right to increase, reduce... -

Page 50

... pending Visa litigation. The impact of the CompanyÂ's $3.0 billion share repurchase program completed in 2007. Moderate loan (held for investment) growth primarily attributable to the acquisition of North Fork in December 2006, offset somewhat by a portfolio sale related to a co-branded credit card... -

Page 51

... sell a certain number of their shares. During the conversion period, Capital One elected to convert and sell 300,482 shares of MasterCard class B common stock. The Company recognized gains of $43.4 million on these transactions in non-interest income. Gain on Sale of Securities In 2001 we acquired... -

Page 52

... December 2006 related to the North Fork acquisition. Revenue growth resulting from managed loan growth in the Auto Finance and Global Financial Services sub-segments and a full year of Hibernia results, offset by declining revenues in U.S. Card driven by ongoing changes in product strategy. Slight... -

Page 53

...to the North Fork acquisition, in December 2006 the Company sold a number of Treasury and Agency securities realizing a loss of $34.9 million in non-interest expense. Sale of Mortgage Loans During the fourth quarter, the Company entered agreements and established the price with third parties to sell... -

Page 54

... intense competitive environment for deposits to continue in 2008. As a result, the Company expects loan growth rate and deposit growth rate in the low single digits in its Local Banking segment in 2008. Planning is complete for North Fork BankÂ's integration into Capital OneÂ's existing technology... -

Page 55

... dollars are improving. The Company will continue to monitor the performance of the auto finance business carefully, and expects to adjust quickly in line with rapidly changing market conditions. In the Global Financial Services (GFS) sub-segment, North American GFS businesses are generally... -

Page 56

... acquired 100% of the outstanding common stock of North Fork Bancorporation for total consideration of $13.2 billion. Discontinued operations related to the shutdown of mortgage origination operations of GreenPointÂ's wholesale mortgage banking unit in 2007. Summary of the Reported Income Statement... -

Page 57

...year of Hibernia activity and $16.8 million from the North Fork acquisition. Excluding the impact of acquisitions, 2006 service charges and other customer-related fee income declined $84.5 million or 6% from 2005. This was reflective of the reported loan growth being concentrated in the Auto Finance... -

Page 58

...charges associated with our 2007 cost initiative, and the accelerated vesting of restricted stock related to the transition to new management in our Local Banking business. Non-interest expense increased 21% for the year ended December 31, 2006 compared to 2005, reflecting a 5% increase in marketing... -

Page 59

... increases in certain tax credits. The decrease in the 2006 rate compared to 2005 was primarily due to the resolution of certain tax issues and audits for prior years with the Internal Revenue Service resulting in $70.7 million reduction to 2006 income tax expense. Loan Portfolio Summary The Company... -

Page 60

... acquisition of North Fork which added $222.2 million of allowance for loan losses at December 31, 2006. The remaining increase was the result of 8% growth in the reported loan portfolio, exclusive of the North Fork loans portfolio. For additional information, see section XII, Tabular Summary, Table... -

Page 61

... Number of active ATMs Number of locations (1) (2) (3) $ $ $ $ $ $ $ $ $ $ Includes domestic non-interest bearing deposits, NOW accounts, money market deposit accounts, savings accounts, certificates of deposit of less than $100,000 and other consumer time deposits. Net interest marginÂ-loans... -

Page 62

... costs associated with the integration of Hibernia and North Fork. These activities progressed as planned during the year and all Hibernia related integration activities were completed. In 2007, the Company opened 39 new banking locations across Louisiana, New Jersey, New York, Texas and Virginia... -

Page 63

... in 2005 and earlier periods. Managed purchase volume increased by 3% over the prior year. Purchase volume growth was muted by a deceleration in retail sales growth, the sale of the co-branded credit card partnership and the impact of other deliberate strategy choices. Total revenues increased by... -

Page 64

... of balances from existing customers. Purchase volume growth of 13% shows continued growth within the rewards business along with healthy retail sales growth. Total revenues declined 2% for the year, primarily driven by changes in product strategy. In 2006, U.S. Card had increasingly focused... -

Page 65

...of 2007 as the Auto Finance sub-segment realized the benefits of the integration of the dealer programs of the legacy Capital One, Onyx, Hibernia, and North Fork auto lending businesses. Year Ended December 31, 2006 Compared to Year Ended December 31, 2005 Net income for the Auto Finance sub-segment... -

Page 66

... to Year Ended December 31, 2005 Net income for the Global Financial Services sub-segment increased 47% during 2006 as a result of strong growth and profitability across all North American businesses. Strong 2006 growth in North America was offset by challenges in Europe. Total revenue increased 11... -

Page 67

..., the Corporation must file a new Automatic Shelf Registration Statement at least once every three years. The Senior and Subordinated Global Bank Note Program gives COB the ability to issue securities to both U.S. and non-U.S. lenders and to raise funds in U.S. and foreign currencies, subject... -

Page 68

... Deposit Rates Non-interest bearing NOW accounts Money market deposit accounts Savings Accounts Other consumer time deposits Total core deposits Public fund certificate of deposits of $100,000 or more Certificates of deposit of $100,000 or more Foreign time deposits Total deposits Year Ended... -

Page 69

... the Company manages the use and availability of various funding sources to meet its current and future operating needs. These needs are largely a result of asset growth, securitization, debt and deposit maturities, and payments of other corporate obligations. To facilitate liquidity risk management... -

Page 70

... securities, along with cash and cash equivalents, provide increased liquidity and flexibility to support the CompanyÂ's funding requirements. Deposits Core deposits are comprised of domestic non-interest bearing deposits, NOW accounts, money market deposit accounts, savings accounts, certificates... -

Page 71

... manage interest rate exposure. In most cases, this exposure is related to the funding of fixed rate assets with floating rate obligations, including off-balance sheet securitizations. The Company also enters into forward foreign currency exchange contracts to reduce sensitivity to changing foreign... -

Page 72

...3.20% The Company is exposed to changes in foreign exchange rates which may impact translated income and expense associated with foreign operations. In order to limit earnings exposure to foreign exchange risk, the CompanyÂ's Asset/Liability Management Policy requires that material foreign currency... -

Page 73

... of the Guidelines, the Corporation has treated as subprime all loans in COBÂ's targeted Â"subprimeÂ" programs to customers either with a FICO score of 660 or below or with no FICO score. COB holds on average 200% of the total risk-based capital charge that would otherwise apply to such assets. This... -

Page 74

... investment Securities available for sale Other Domestic International Total Total earning assets Cash and due from banks Allowance for loan losses Premises and equipment, net Other Total assets from discontinued operations Total assets Liabilities and Equity: Interest-bearing liabilities Deposits... -

Page 75

... available for sale(2) Other Domestic(2) International Total Total interest income Interest Expense: Deposits Domestic International Total Senior notes Other borrowings Domestic International Total Total interest expense Net interest income (1) (2) (3) 2006 vs. 2005 Yield/ Rate Increase (Decrease... -

Page 76

...CÂ-MANAGED LOAN PORTFOLIO Year Ended December 31 2006 2005 (Dollars in thousands) Year-End Balances: Reported loans held for investment: Consumer loans Credit cards Domestic International Total credit card Installment loans Domestic International Total installment loans Auto loans(1) Mortgage loans... -

Page 77

... loans Domestic International Total installment loans Auto loans(1) Mortgage loans Total consumer loans Commercial loans Total managed loans held for investment (1) (2) Includes the auto loans of North Fork and Hibernia Based on continuing operations 2007(2) 2006 Year Ended December 31 2005... -

Page 78

... 31 2007 (Dollars in thousands) Reported: Consumer $ loans Commercial loans Total $ % of Total Loans 63.31% $ 36.69% 100.00% $ 2006 % of Total Loans 67.11% $ 32.89% 100.00% $ 2005 % of Total Loans 82.51% $ 17.49% 100.00% $ 2004 % of Total Loans 92.95% $ 7.05% 100.00% $ 2003 % of Total Loans 93.02... -

Page 79

... (Dollars in thousands) Reported(1): Loans held for investment Loans delinquent: 30-59 days 60-89 days 90-119 days 120-149 days 150 or more days Total Loans delinquent by geographic area: Domestic International Managed(2): Loans held for investment Loans delinquent: 30-59 days 60-89 days 90-119 days... -

Page 80

... presented on a reported and managed basis. Year Ended December 31 2006 2005 $ 63,577,279 1,407,489 2.21% $ 111,328,595 3,158,080 2.84% $ 40,734,237 1,446,649 3.55% $ 85,265,023 3,623,154 4.25% (Dollars in thousands) Reported: Average loans held for investment Net charge-offs Net charge-offs as... -

Page 81

...Dollars in thousands) Nonperforming loans held for investment(1): Commercial ConsumerÂ-real estate ConsumerÂ-auto Total nonperforming loans held for investment Foreclosed property Repossessed assets Total nonperforming assets (1) Our policy is not to classify credit card loans as nonperforming loans... -

Page 82

...charge-offs of $22.3 million and $29.2 million in 2006 and 2005, respectively, relating to certain loans which have been segregated into pools apart from the remaining portfolio and accounted for under Statement of Position 03-3, Accounting for Certain Loans or Debt Securities Acquired in a Transfer... -

Page 83

Item 7A. Quantitative and Qualitative Disclosures about Market Risk The information required by Item 7A is included in Item 7, Â"ManagementÂ's Discussion and Analysis of Financial Condition and Results of OperationsÂ-Market Risk Management.Â" 61 -

Page 84

... CONSOLIDATED BALANCE SHEETS December 31 (In Thousands, Except Share and Per Share Data) Assets: Cash and due from banks Federal funds sold and resale agreements Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Mortgage loans held for sale Loans held... -

Page 85

... after provision for loan and lease losses Non-Interest Income: Servicing and securitizations Service charges and other customer-related fees Mortgage servicing and other Interchange Other Total non-interest income Non-Interest Expense: Salaries and associate benefits Marketing Communications and... -

Page 86

...losses on securities, net of income tax benefit of $31,706 Foreign currency translation adjustments Unrealized gains in cash flow hedging instruments, net of income taxes of $21,373 Other comprehensive income Comprehensive income Cash dividendsÂ-$.11 per share Purchase of treasury stock Issuances of... -

Page 87

...of debt Losses on repurchase of senior notes Mortgage loans held for sale: Transfers in and originations Gains on sales Proceeds from sales Stock plan compensation expense Changes in assets and liabilities, net of effects from purchase of companies acquired: Increase in interest receivable (Increase... -

Page 88

... are: • • Capital One Bank (Â"COBÂ") which currently offers credit and debit card products, other lending products and deposit products. Capital One, National Association (Â"CONAÂ") which offers a broad spectrum of banking products and financial services to consumers, small businesses and... -

Page 89

...other postretirement benefit plans (collectively, Â"defined benefit plansÂ") to recognize the funded status of their defined benefit plans in the Consolidated Balance Sheet, measure the fair value of plan assets and benefit obligations as of the date of the fiscal year-end Consolidated Balance Sheet... -

Page 90

... benefits) to be classified as financing cash flows. Significant Accounting Policies Cash and Cash Equivalents Cash and cash equivalents includes cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks. Cash paid for interest for the years ended... -

Page 91

... for sale is determined using current secondary market prices for loans with similar coupons, maturities and credit quality. The fair value of mortgage loans held for sale is impacted by changes in market interest rates. The exposure to changes in market interest rates is hedged primarily by selling... -

Page 92

... the servicing fee approximates just adequate compensation to the Company for performing the servicing. Loans Held for Investment Loans held for investment include consumer and commercial loans. Consumer loans include credit card, installment, auto and mortgage loans. Credit card loans are reported... -

Page 93

...against income when the loans are placed on nonaccrual status. Credit card loans charge off at 180 days past the statement cycle date and other consumer loans generally charge-off at 120 days past due or upon repossession of collateral. The entire balance of an account is contractually delinquent if... -

Page 94

... reserve balance was $93.4 million and $156.0 million, respectively. Rewards Liability The Company offers products, primarily credit cards, that provide reward program members with various rewards such as airline tickets, free or deeply discounted products or cash rebates, based on account activity... -

Page 95

... of credit card finance charge and fee receivables using an estimate of future nonprincipal losses. This formula is consistent with that used to estimate the allowance related to expected principal losses on reported loans. The suppression amount is calculated by adding any current period change in... -

Page 96

... common stock of North Fork Bancorporation (Â"North ForkÂ"), a regional bank holding company headquartered in New York conducting commercial and retail banking from branch locations in New York, New Jersey, and Connecticut, with a national mortgage banking business. The acquisition was accounted for... -

Page 97

... ending the day before the completion of the merger, which was $76.24. Costs to acquire North Fork: Capital One common stock issued Cash consideration paid Fair value of employee stock options Investment banking, legal, and consulting fees Total consideration paid for North Fork $ 7,914,463 5,200... -

Page 98

...credit and certain debit card activities. Auto Finance sub-segment which includes automobile and other motor vehicle financing activities. Global Financial Services sub-segment consisting of international lending activities, small business lending, installment loans, home loans, healthcare financing... -

Page 99

... expenses Income tax provision (benefit) Net income (loss) Loans held for investment $ $ $ National Lending 7,623,855 4,364,164 3,664,399 5,359,758 1,036,415 1,927,447 89,222,031 Local Banking N/A N/A N/A N/A N/A N/A N/A Year Ended December 31, 2005 Total Managed Other(2) $ 31,599 $ 7,655... -

Page 100

... Services sub-segment, $0.6 million was allocated to the Auto Finance segment, and the remainder of the balance was held in the Other category. During 2005, the Company recognized a $28.2 million impairment charge related to the write-off of the CompanyÂ's insurance brokerage business. The charge... -

Page 101

... a significant increase in bankruptcy related charge-offs during 2005 which is reflected in the provision for loan losses. The majority of the increase was allocated to the U.S. Card sub-segment. MasterCard Stock Sale In 2007, shareholders approved an amendment to the MasterCard Certificate of... -

Page 102

.... The unrealized losses of the CompanyÂ's investment in federal agency mortgage-backed securities were primarily caused by interest rate and spread volatility. The contractual cash flows of these investments are guaranteed by an agency of the U.S. government. Accordingly, it is expected that... -

Page 103

...December 31 2007 2006 Year-End Balances: Reported loans: Consumer loans: Credit cards Domestic International Total credit cards Installment loans Domestic International Total installment loans Auto loans Mortgage loans Total consumer loans Commercial loans Total reported loans held for investment 81... -

Page 104

... of write-off in premises equipment net of $28.7 million of accumulated depreciation and amortization). As discussed in Note 3Â-Business Combinations, the Company completed its acquisition of North Fork Bank in December 2006. The acquisition added: $168.5 million in land, $299.4 million in buildings... -

Page 105

... Statement expires three years after filing. Accordingly, the Corporation must file a new Automatic Shelf Registration Statement at least once every three years. Other Borrowings Secured Borrowings COAF maintained twenty-three agreements to transfer pools of consumer loans accounted for as secured... -

Page 106

... During 2007, the Company utilized Federal Reserve Home Loan Bank (FHLB) advances of $6.8 billion which are secured by the CompanyÂ's investment in FHLB stock and by a blanket floating lien on portions of the CompanyÂ's residential mortgage loan portfolio. FHLB stock totaled $424.6 million at... -

Page 107

... date using a Black-Scholes option-pricing model. The fair value of options granted during 2007, 2006 and 2005 was estimated using the weighted average assumptions summarized below: Assumptions Dividend yield (1) Volatility factors of stockÂ's expected market price Average risk-free interest rate... -

Page 108

...COO) with an exercise price equal to the fair market value on the date of grant. The CEO and former COO gave up their salaries for the year 2001 and their annual cash incentives, annual option grants and Senior Executive Retirement Plan contributions for the years 2000 and 2001 in exchange for their... -

Page 109

... million in compensation expense for the years ended December 31, 2007, 2006 and 2005, respectively. Under the Purchase Plan, associates of the Company are eligible to purchase common stock through monthly salary deductions of a maximum of 15% and a minimum of 1% of monthly base pay. To date, the... -

Page 110

...at end of year Change in plan assets: Fair value of plan assets at beginning of year Actual return on plan assets Employer contributions Plan participant contributions Plan assets acquired through acquisition Benefits paid Fair value of plan assets at end of year Funded status at end of year Balance... -

Page 111

... qualified plans assumed in the North Fork acquisition and to the termination of employees in the closure of GreenPointÂ's mortgage origination operations. The $22.1 million reduction in other postretirement benefit obligation from plan amendments in 2007 relates to the CompanyÂ's decision to begin... -

Page 112

...on year-end postretirement benefit obligation Effect on total service and interest cost components Plan Assets The qualified defined benefit pension plan asset allocations as of the annual measurement dates are as follows: 2007 70% 30% Â- 100% 2006 60% 38% 2% 100% Equity securities Debt securities... -

Page 113

... acquisitions. Income tax benefit reported in shareholdersÂ' equity was as follows: Year Ended December 31 2007 2006 2005 (18,033) $ (18,004) 2,679 $ 16,635 (31,706) 25,780 (6,750) 21,373 (63,804) Â- Â- 6,378 (77,090) (168,426) (53,041) 1,851 17,675 (83,387) $ (196,763) (64,333) $ Foreign currency... -

Page 114

... of acquired loans Retained liabilityÂ-Manufactured Housing Employee benefits Foreign tax credit carryforward Other Subtotal Valuation allowance Total deferred tax assets Deferred tax liabilities: Securitizations Deferred revenue Property & equipment Prepaid expenses Leasing activities Core deposit... -

Page 115

... by the IRS and other tax authorities in certain countries and states in which the Company has significant business operations. The tax years subject to examination vary by jurisdiction. The IRS is currently examining the CompanyÂ's federal income tax returns for the years 2005 and 2006 as well as... -

Page 116

... the ASR agreement, the Company purchased $1.5 billion of its $.01 par value common stock at an initial price of $73.57 per share, the closing price of the CompanyÂ's common stock on the New York Stock Exchange on April 2, 2007, the effective date of the agreement. The ASR program was accounted for... -

Page 117

... of December 31 Unrealized gains (losses) on securities Net unrecognized elements of defined benefit plans Foreign currency translation adjustments Unrealized (losses) gains on cash flow hedging instruments Total cumulative other comprehensive income 2007 2006 2005 9,279 $ (47,134) $ (71,253) 3,439... -

Page 118

... bank in New York, which created $9.7 billion of goodwill. The goodwill associated with the acquisition of North Fork was held in the Other category at December 31, 2006. The North Fork acquisition goodwill was allocated across the reportable segments during 2007. Goodwill associated with the 2005... -

Page 119

... effect adjustment for the adoption of FAS 156 Acquired in Acquisition Originations Sales Amortization Change in fair value, net Balance at December 31, 2007 Ratio of Mortgage Servicing Rights to Related Loans Serviced for Others Weighted Average Service Fee $ 2007 $ 252,295 15,187 Â- 65,948 (3,340... -

Page 120

... Guidance, the Corporation has treated as subprime all loans in COBÂ's targeted Â"subprimeÂ" programs to customers either with a FICO score of 660 or below or with no FICO score. COB holds on average 200% of the total risk-based capital charge that would otherwise apply to such assets. This results... -

Page 121

...its customers will exercise their entire available line at any given point in time. The Company generally has the right to increase, reduce, cancel, alter or amend the terms of these available lines of credit at any time. As a result of the acquisitions of Hibernia and North Fork, the Company enters... -

Page 122

... for Guarantees, (Â"FIN 45Â"). Over the past several years, MasterCard International (MasterCard) and Visa as well as several of their member banks, have been involved in several different lawsuits challenging various practices of MasterCard and Visa. In November 2004, American Express filed... -

Page 123

...: Year ended December 31, 2007 Restructuring accrual activity: Balance, beginning of period Restructuring charges Cash payments Noncash write-downs and other adjustments Balance, end of period Note 23 Related Party Transactions In the ordinary course of business, executive officers and directors of... -

Page 124

... and past-due fees over the sum of the return paid to security holders, estimated contractual servicing fees and credit losses. The Company periodically reviews the key assumptions and estimates used in determining the value of the interest-only strip. The Company recognizes all changes in the fair... -

Page 125

... upon the type of assets serviced. The Company generally does not record material servicing assets or liabilities for these rights since the contractual servicing fee approximates market rates. Securitization Cash Flows Year Ended December 31 Proceeds from new securitizations Collections reinvested... -

Page 126

...interest rate swap agreements that modify the CompanyÂ's exposure to interest rate risk by effectively converting a portion of the CompanyÂ's public fund certificates of deposit, senior notes, and U.S. Agency investments from fixed rates to variable rates over the next ten years. Adjustments related... -

Page 127

... to foreign currency exchange rate changes on its foreign currency denominated loans. The forward rate agreements allow the Company to Â"lock-inÂ" functional currency equivalent cash flows associated with the foreign currency denominated loans. Any unrealized gains or losses related to cash flow... -

Page 128

... risk of overall changes in fair value of loans held-for-sale and interest rate lock commitments generally by entering into mandatory commitments to deliver mortgage whole loans to various investors, selling forward contracts on government backed mortgage securities and, to a lesser extent, by using... -

Page 129

...of cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks approximate fair value. Securities available for sale The fair value of securities available for sale was determined using current market prices. See Note 1. Mortgage loans held for sale... -

Page 130

... and 2006. The fair value of other interest-bearing deposits was calculated by discounting the future cash flows using estimates of market rates for corresponding contractual terms. Other borrowings The carrying amount of federal funds purchased and resale agreements, FHLB advances, and other short... -

Page 131

... Information The following Parent Company Only financial statements are provided in accordance with Regulation S-X of the Securities and Exchange Commission which requires all issuers or guarantors of registered securities to include separate annual financial statements. Balance Sheets Assets: Cash... -

Page 132

... Decrease (increase) in investment in subsidiaries Purchases of securities available for sale Proceeds from sale of securities available for sale (Increase) decrease in loans to subsidiaries Net cash used for acquisitions Net cash used in investing activities Financing Activities: Increase (decrease... -

Page 133

... Share Repurchase Program On January 31, 2008 the CompanyÂ's Board of Directors authorized the repurchase of up to $2.0 billion of the CompanyÂ's Common Stock. The repurchased shares will be accounted for as treasury shares and may be used for general corporate purposes. The Company will execute the... -

Page 134

... executive and principal financial officer, and effected by the companyÂ's board of directors, management and other personnel, to provide reasonable assurance regarding the reliability of financial reporting and the preparation of financial statements in accordance with generally accepted accounting... -

Page 135

... consolidated statements of income, stockholdersÂ' equity, and cash flows for each of the three years in the period ended December 31, 2007 of Capital One Financial Corporation and our report dated February 28, 2008 expressed an unqualified opinion thereon. /s/ Ernst & Young LLP McLean, Virginia... -

Page 136

... years in the period ended December 31, 2007, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), the effectiveness of Capital One Financial CorporationÂ's internal... -

Page 137

... (loss) Dividends Market prices High Low Average common shares (000s) Average common shares and common equivalent shares (000s) Average Balance Sheet Data: (In Millions) Loans held for investment(3) Total assets(3) Interest-bearing deposits Total deposits StockholderÂ's equity (1) Fourth Quarter... -

Page 138

... and reporting information required to be disclosed within the time periods specified in the Securities and Exchange CommissionÂ's rules and forms. The Corporation has established a Disclosure Committee consisting of members of senior management to assist in this evaluation. (b) Internal Controls... -

Page 139

... Directors and Executive OfficersÂ" and is incorporated herein by reference. The Proxy Statement will be filed with the Securities and Exchange Commission pursuant to Regulation 14A within 120 days of the end of the CorporationÂ's 2007 fiscal year. Item 11. Executive Compensation. The information... -

Page 140

... incorporated herein by reference. The Corporation makes available to investors, free of charge, its reports to the SEC pursuant to the Securities Exchange Act of 1934, including its Reports on Forms 8-K, 10-Q and 10-K, through the CompanyÂ's website at www.capitalone.com/about/invest/financial/, as... -

Page 141

... undersigned, thereunto duly authorized. CAPITAL ONE FINANCIAL CORPORATION By: .. /s/ RICHARD D. FAIRBANK Richard D. Fairbank Chairman of the Board, Chief Executive Officer and President Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the... -

Page 142

...2005, between Capital One Financial Corporation and Hibernia Corporation (incorporated by reference to Exhibit 2.1 of the CorporationÂ's Report on Form 8-K, filed on September 8, 2005). Agreement and Plan of Merger, dated as of March 12, 2006, between Capital One Financial Corporation and North Fork... -

Page 143

... 2006). Guarantee Agreement, dated as of August 1, 2006, between Capital One Financial Corporation and The Bank of New York, as guarantee trustee (incorporated by reference to Exhibit 4.4 of the CorporationÂ's Current Report on Form 8-K, filed on August 4, 2006). Copy of Capital Security Certificate... -

Page 144

... Unit Award Agreement between Capital One Financial Corporation and its executive officers, including Mr. Gary L. Perlin and Mr. John G. Finneran, Jr., pursuant to the CompanyÂ's 2004 Stock Incentive Plan. Capital One Financial Corporation 1999 Non-Employee Directors Stock Incentive Plan, as amended... -

Page 145

... Corporation, 2005 Directors Compensation Plan Summary (incorporated by reference to Exhibit 99.1 of the CorporationÂ's Report on Form 8-K, filed on May 4, 2005). Form of Change of Control Employment Agreement between Capital One Financial Corporation and each of its named executive officers... -

Page 146

... Headquarters 1680 Capital One Drive McLean, VA 22102 Principal Investor Contact Jeff Norris Managing Vice President, Investor Relations Capital One Financial Corporation 1680 Capital One Drive McLean, VA 22102 (703) 720-1000 Common Stock Listed on New York Stock Exchange® Stock Symbol COF Member... -

Page 147

1680 Capital One Drive • McLean, VA 22102 • (703) 720-1000 • www.capitalone.com Created and produced by Capital One and the following: Beatley Gravitt Communications Fultz and Associates, Inc., Production Vedros and Associates, Photography Allied Printing Services, Inc., Printing 10%