ICICI Bank 2014 Annual Report Download - page 97

Download and view the complete annual report

Please find page 97 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F9

At

31.03.2014

At

31.03.2013

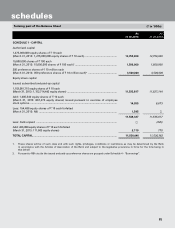

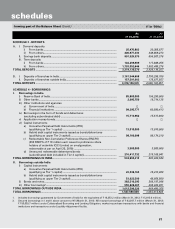

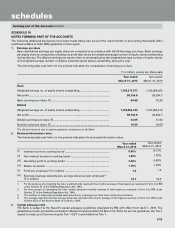

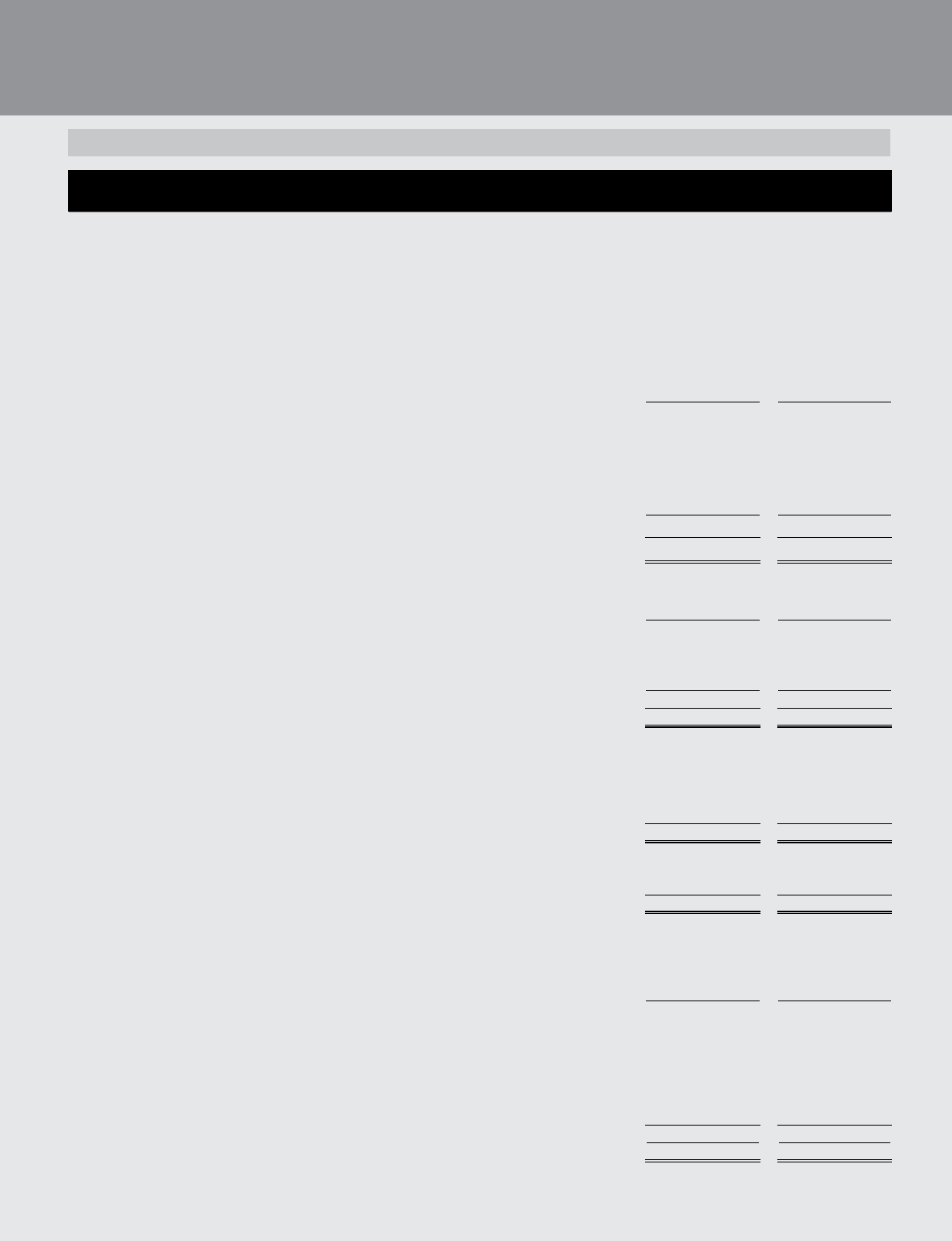

SCHEDULE 8 - INVESTMENTS

I. Investments in India [net of provisions]

i) Government securities ........................................................................................ 951,820,555 923,762,915

ii) Other approved securities ................................................................................... — —

iii) Shares (includes equity and preference shares) ................................................ 24,017,918 25,050,852

iv) Debentures and bonds ........................................................................................ 121,203,629 174,775,171

v) Subsidiaries and/or joint ventures ...................................................................... 65,482,766 65,482,766

vi) Others (commercial paper, mutual fund units, pass through certificates,

security receipts, certificate of deposits, Rural Infrastructure Development

Fund deposits and other related investments) ................................................... 533,636,254 447,127,306

TOTAL INVESTMENTS IN INDIA ...................................................................................... 1,696,161,122 1,636,199,010

II. Investments outside India [net of provisions]

i) Government securities ........................................................................................ 7,095,945 6,574,742

ii) Subsidiaries and/or joint ventures abroad

(includes equity and preference shares) ............................................................ 59,553,372 62,475,493

iii) Others (equity shares, bonds and certificate of deposits) ................................. 7,407,725 8,686,748

TOTAL INVESTMENTS OUTSIDE INDIA .......................................................................... 74,057,042 77,736,983

TOTAL INVESTMENTS ...................................................................................................... 1,770,218,164 1,713,935,993

A. Investments in India

Gross value of investments ....................................................................................... 1,719,617,326 1,663,577,178

Less: Aggregate of provision/depreciation/(appreciation) ....................................... 23,456,204 27,378,168

Net investments.......................................................................................................... 1,696,161,122 1,636,199,010

B. Investments outside India

Gross value of investments ....................................................................................... 74,375,855 77,981,759

Less: Aggregate of provision/depreciation/(appreciation) ....................................... 318,813 244,776

Net investments.......................................................................................................... 74,057,042 77,736,983

TOTAL INVESTMENTS ...................................................................................................... 1,770,218,164 1,713,935,993

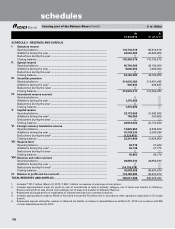

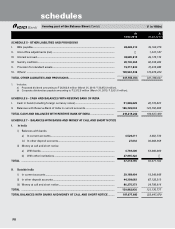

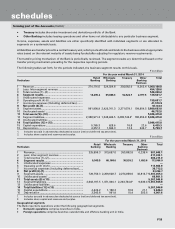

SCHEDULE 9 - ADVANCES [net of provisions]

A. i) Bills purchased and discounted .......................................................................... 83,655,926 61,532,333

ii) Cash credits, overdrafts and loans repayable on demand ................................ 552,132,982 451,092,674

iii) Term loans ............................................................................................................ 2,751,237,584 2,389,869,344

TOTAL ADVANCES ............................................................................................................ 3,387,026,492 2,902,494,351

B. i) Secured by tangible assets (includes advances against book debts) ............... 2,858,197,549 2,471,296,382

ii) Covered by bank/government guarantees ......................................................... 41,650,261 22,221,201

iii) Unsecured ............................................................................................................ 487,178,682 408,976,768

TOTAL ADVANCES ............................................................................................................ 3,387,026,492 2,902,494,351

C. I. Advances in India

i) Priority sector ................................................................................................ 645,517,532 597,940,480

ii) Public sector .................................................................................................. 27,754,783 13,438,496

iii) Banks ............................................................................................................. 287,641 187,857

iv) Others ............................................................................................................ 1,816,506,450 1,557,357,190

TOTAL ADVANCES IN INDIA ............................................................................................ 2,490,066,406 2,168,924,023

II. Advances outside India

i) Due from banks ............................................................................................ 5,935,596 18,107,068

ii) Due from others

a) Bills purchased and discounted ............................................................. 33,737,778 17,437,061

b) Syndicated and term loans ..................................................................... 752,854,831 680,864,553

c) Others ...................................................................................................... 104,431,881 17,161,646

TOTAL ADVANCES OUTSIDE INDIA ................................................................................ 896,960,086 733,570,328

TOTAL ADVANCES ............................................................................................................ 3,387,026,492 2,902,494,351

(` in ‘000s)

forming part of the Balance Sheet (Contd.)

schedules