ICICI Bank 2014 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

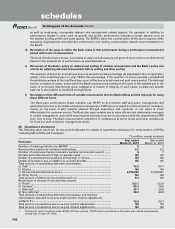

F48

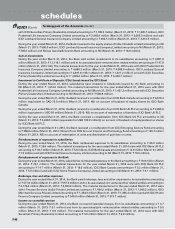

Insurance Company Limited amounting to ` 2.2 million (March 31, 2013: ` 0.1 million), ICICI Securities Limited amounting

to Nil (March 31, 2013: ` 1.9 million) and with K. Ramkumar amounting to Nil (March 31, 2013: ` 0.7 million).

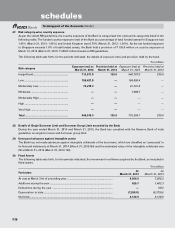

Purchase of fixed assets

During the year ended March 31, 2014, the Bank purchased fixed assets from its subsidiaries amounting to ` 4.2 million

(March 31, 2013: ` 2.6 million). The material transactions for the year ended March 31, 2014 were with ICICI Prudential Life

Insurance Company Limited amounting to ` 4.2 million (March 31, 2013: Nil), ICICI Venture Funds Management Company

Limited amounting to Nil (March 31, 2013: ` 1.8 million) and with ICICI Prudential Asset Management Company Limited

amounting to Nil (March 31, 2013: ` 0.8 million).

Sale of gold coins

During the year ended March 31, 2014, the Bank sold gold coins to ICICI Prudential Life Insurance Company Limited

amounting to Nil (March 31, 2013: ` 1.7 million).

Donation

During the year ended March 31, 2014, the Bank has given donation to ICICI Foundation for Inclusive Growth amounting

to ` 125.0 million (March 31, 2013: ` 80.0 million).

Purchase of loan

During the year ended March 31, 2014, the Bank purchased loans from ICICI Bank UK PLC amounting to ` 3,820.4 million

(March 31, 2013: Nil).

Sale of loan

During the year ended March 31, 2014, the Bank sold loan (including undisbursed loan commitment) to ICICI Bank UK

PLC amounting to ` 2,696.2 million (March 31, 2013: ` 1,357.1 million).

Purchase of bank guarantees

Bank guarantees issued by ICICI Bank UK Plc on behalf of its clients amounting to Nil were transferred to the bank during

the year ended March 31, 2014 (March 31, 2013: ` 12,221.2 million).

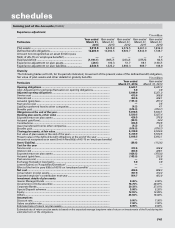

Letters of Comfort

The Bank has issued letters of comfort on behalf of its banking subsidiaries. The details of the letters are given below.

On behalf of To Purpose

ICICI Bank UK Plc Financial Services

Authority, UK (‘FSA’)

Financially support ICICI Bank UK Plc to ensure that it

meets all of its obligations as they fall due.

ICICI Bank Canada Canada Deposit

Insurance Corporation

(‘CDIC’)

To comply with the Bank Act and the CDIC regulations

or by-laws thereunder and to indemnify CDIC against

all losses, damages, reasonable costs and expenses

arising from failure of ICICI Bank Canada in performing

the same.

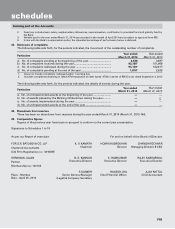

The Bank has issued an undertaking on behalf of ICICI Securities Inc. for Singapore dollar 10.0 million (currently equivalent

to ` 475.8 million) to the Monetary Authority of Singapore (MAS) and has executed indemnity agreement on behalf of

ICICI Bank Canada to its independent directors for a sum not exceeding Canadian dollar 2.5 million (currently equivalent

to ` 135.7 million) each, aggregating to Canadian dollar 17.5 million (currently equivalent to ` 949.8 million). The Bank has

furnished an undertaking on behalf of ICICI Bank Eurasia Limited Liability Company, for an amount of USD 19.0 million

(currently equivalent to ` 1,138.4 million) in relation to its borrowing. The aggregate amount of ` 2,564.0 million at March

31, 2014 (March 31, 2013: ` 2,270.2 million) is included in the contingent liabilities.

During the year, the Bank has issued an indemnity letter to one independent director on behalf of ICICI Bank Canada.

In addition to the above, the Bank has also issued letters of comfort in the nature of letters of awareness on behalf of its

subsidiaries in respect of their borrowings made or proposed to be made and for other incidental business purposes. As

they are in the nature of factual statements or confirmation of facts, they do not create any financial impact on the Bank.

The letters of comfort in the nature of letters of awareness that are outstanding at March 31, 2014 issued by the Bank

on behalf of its subsidiaries, aggregate to ` 14,530.2 million (March 31, 2013: ` 18,640.5 million). During the year ended

March 31, 2014, borrowings pertaining to letters of comfort aggregating ` 4,110.3 million were repaid.

forming part of the Accounts (Contd.)

schedules