ICICI Bank 2014 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2014 ICICI Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

F33

forming part of the Accounts (Contd.)

schedules

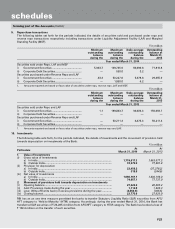

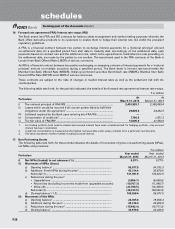

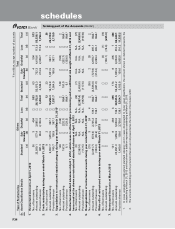

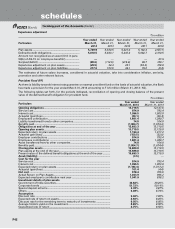

The following tables set forth, for the year ended March 31, 2013 details of loan assets subjected to restructuring.

` in million, except number of accounts

Type of Restructuring Under CDR Mechanism Under SME Debt Restructuring Mechanism

Sr.

no.

Asset Classification Details Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

Standard

(a)

Sub-

Standard

(b)

Doubtful

(c)

Loss

(d)

Total

(e)

1. Restructured Accounts at April 1, 2012

No. of borrowers 24 1 6 1 32 3—4 1 8

Amount outstanding 27,452.1 154.9 1,209.3 17.0 28,833.3 112.1 —323.8 96.9 532.8

Provision thereon 3,547.6 128.3 705.1 17.0 4,398.0 — — 94.7 96.9 191.6

2. Fresh restructuring during the year ended March 31, 2013

No. of borrowers 14 — — — 14 — — — — —

Amount outstanding 10,082.1 — — — 10,082.1 — — — — —

Provision thereon 819.2 — — — 819.2 — — — — —

3. Upgradations to restructured standard category during the year ended March 31, 20131

No. of borrowers — — — — — — — — — —

Amount outstanding — — — — — — — — — —

Provision thereon — — — — — — — — — —

4. Restructured standard advances at April 1, 2012, which cease to attract higher provisioning and/or additional risk weight at March 31, 2013 and

hence need not be shown as restructured standard advances at April 1, 2013

No. of borrowers —N.A. N.A. N.A. —(1) N.A. N.A. N.A. (1)

Amount outstanding —N.A. N.A. N.A. —(61.2) N.A. N.A. N.A. (61.2)

Provision thereon —N.A. N.A. N.A. —(0.1) N.A. N.A. N.A. (0.1)

5. Downgradations of restructured accounts during the year ended March 31, 20131

No. of borrowers (5) (1) 5 1 — — — (1) 1 —

Amount outstanding (2,054.3) (154.9) 2,191.5 99.0 N.A.2— — (58.0) 58.0 N.A.2

Provision thereon (177.6) (128.3) 1,186.0 99.0 N.A.2— — (14.5) 58.0 N.A.2

6. Write-offs of restructured accounts during the year ended March 31, 2013

No. of borrowers — — (2) —(2) — — — (1) (1)

Amount outstanding — — (158.1) —(158.1) — — — (76.9) (76.9)

7. Restructured Accounts at March 31 2013

No. of borrowers 32 —9 2 43 1—3 1 5

Amount outstanding 35,357.1 —3,201.2 120.1 38,678.4 4.1 —153.0 58.0 215.1

Provision thereon 3,634.8 —2,064.6 120.1 5,819.5 — — 153.0 58.0 211.0

1. In cases upgraded to restructured standard category and in cases downgraded to lower asset classification, the amount shown as deleted represents the

outstanding at March 31, 2012 and that shown in addition represents outstanding at March 31, 2013.

2. The amounts outstanding and the provision thereon are not presented as the number of borrowers is Nil.